Tokyo (AFP) – Shares in the Japanese owner of 7-Eleven plunged as much as 12 percent on Thursday after the convenience store giant said its founding family failed to put together a white-knight buyout. Last year, Seven & i rejected an offer worth nearly $40 billion from Canadian rival Alimentation Couche-Tard (ACT), which would have been the biggest foreign buyout of a Japanese firm.

Even as ACT reportedly sweetened its bid, Seven & i said in November it was studying a counter-offer from its founding Ito family, reportedly worth around eight trillion yen ($54 billion). The family were reportedly negotiating financing from top Japanese banks as well as companies such as Itochu Corp, which owns the FamilyMart chain.

But Seven & i said Thursday it was “notified that it has become difficult to procure the necessary funds for an official proposal about the acquisition.” “We will continue to explore and scrutinise all strategic options including the proposal from ACT,” it said in a statement. Itochu said in its own statement it had “sincerely considered the matter” but that its “consideration on this matter has been terminated.”

With around 85,000 outlets, 7-Eleven is the world’s biggest convenience store brand. The franchise began in the United States, but it has been wholly owned by Seven & i since 2005. ACT, which began with one store in Quebec in 1980, now runs nearly 17,000 convenience store outlets worldwide, including the Circle K chain.

In September, when Seven & i rejected the initial takeover offer from ACT, the company said it had “grossly” undervalued its business and could face regulatory hurdles. Its 7-Eleven stores are a beloved institution in Japan, selling everything from concert tickets to pet food and fresh rice balls, although sales have been flagging. Japan’s minister for economic revitalization said in January that the country would study the “economic security” aspects of any foreign acquisition of 7-Eleven. Ryosei Akazawa highlighted the role Japan’s convenience stores can play in times of crisis, such as after major earthquakes and other disasters, particularly in remote regions.

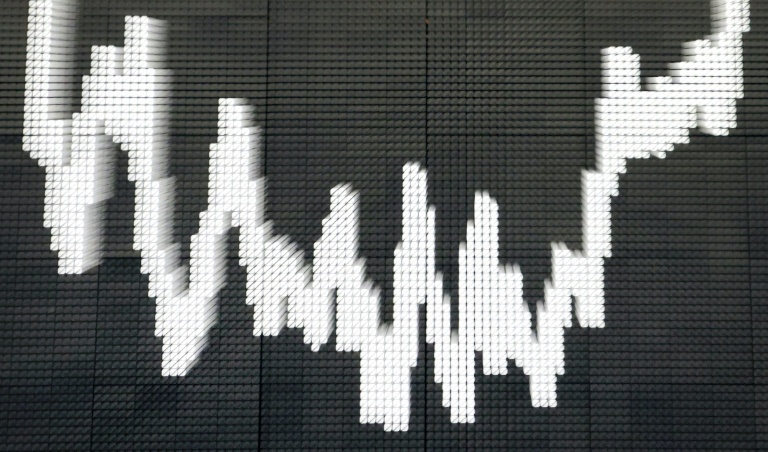

In 2021, ACT dropped a takeover bid worth 16 billion euros ($17 billion today) for French supermarket Carrefour after the French government said it would veto the deal over food security concerns. Late morning in Tokyo, Seven & i shares were down 11.2 percent.

© 2024 AFP