New York (AFP) – Global stock markets mostly rose on Monday, shrugging off concerns about a looming US government shutdown as markets eyed key budget talks set for Monday afternoon. Following a mostly positive round of trading in Europe and Asia, Wall Street’s main indices finished modestly higher.

US President Donald Trump was expected to meet with congressional leaders Monday afternoon. Unless US lawmakers agree to a temporary spending plan on Tuesday, many government operations will shut down on Wednesday, when the new fiscal year begins. “It is very much touch-and-go in terms of whether there will be a deal that averts a government shutdown,” said Briefing.com analyst Patrick O’Hare. “But for now the impact of a possible shutdown is concentrated more in the headlines than in the economy and the stock market,” he said.

Trade Nation market analyst David Morrison noted that Wall Street’s so-called fear gauge, the VIX index, was little changed and down from last week. “Even with risks such as the potential US government shutdown and key labor market data later in the week, the decline in volatility reflects a market that is comfortable holding steady near record highs,” he said.

A shutdown could, however, delay the release of statistics used by the Federal Reserve in helping decide interest rates. The Fed cut rates earlier this month — the first since December — and investors still see it as likely it will reduce them twice more this year. Data released last week showed the Fed’s preferred inflation measure rose in line with expectations in August, giving the bank room to cut rates again. Investors were looking to the monthly non-farm payroll report scheduled to come out on Friday to adjust their expectations on whether the Fed will cut at its next meeting at the end of October.

The dollar dropped against main rivals, while oil prices fell more than three percent on expectations that OPEC+ will increase output, fanning concerns of a glut. Gold’s price on Monday hit an all-time peak above $3,830 an ounce over concerns about the possible government shutdown and on expectations for more rate cuts, which make the precious metal more attractive as an investment. “Geopolitical risks — from Europe and the Middle East to US-China frictions — are reinforcing gold’s role as a strategic hedge,” said City Index and FOREX.com analyst Fawad Razaqzada.

On the corporate front, shares in video game giant Electronic Arts jumped 4.5 percent after it announced it would be acquired by a consortium led by Saudi Arabia’s Public Investment Fund for $55 billion. Shares in GSK climbed 2.2 percent in London afternoon trading after the British pharmaceutical giant unexpectedly announced that longtime chief executive Emma Walmsley will be replaced by its chief commercial officer in January. Lufthansa shares edged higher after it said it will cut 4,000 jobs, nearly four percent of the German airline giant’s workforce, after profits slumped in the face of mounting headwinds.

– Key figures at around 2020 GMT –

New York – Dow: UP 0.2 percent at 46,316.07 (close)

New York – S&P 500: UP 0.3 percent at 6,661.21 (close)

New York – Nasdaq: UP 0.5 percent at 22,591.15 (close)

London – FTSE 100: UP 0.2 percent at 9,299.84 (close)

Paris – CAC 40: UP 0.1 percent at 7,880.87 (close)

Frankfurt – DAX: FLAT at 23,745.06 (close)

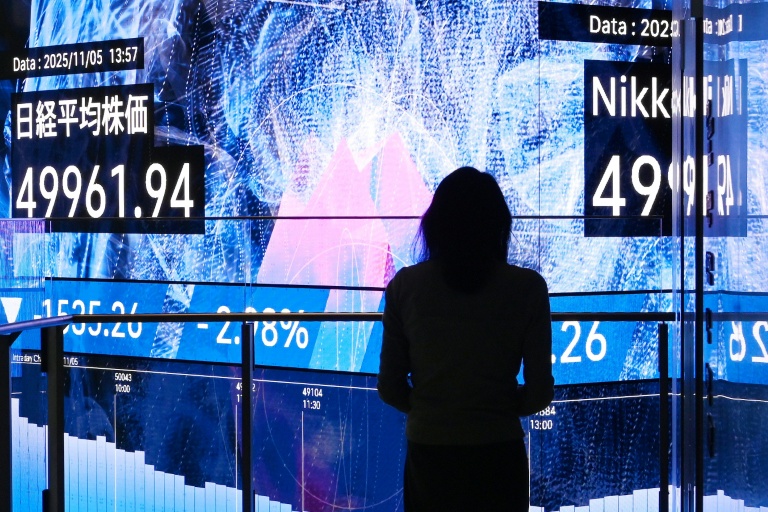

Tokyo – Nikkei 225: DOWN 0.7 percent at 45,043.75 (close)

Hong Kong – Hang Seng Index: UP 1.9 percent at 26,622.88 (close)

Shanghai – Composite: UP 0.9 percent at 3,862.53 (close)

Euro/dollar: UP at $1.1725 from $1.1703 on Friday

Pound/dollar: UP at $1.3434 from $1.3402

Dollar/yen: DOWN at 148.68 yen from 149.49 yen

Euro/pound: DOWN at 87.28 pence from 87.32 pence

Brent North Sea Crude: DOWN 3.1 percent at $67.97 per barrel

West Texas Intermediate: DOWN 3.5 percent at $63.45 per barrel

burs-jmb/sla

© 2024 AFP