London (AFP) – European equities wavered Monday as dealers paused with key US inflation data on the horizon, having smashed records last week on increasing hopes of interest rate reductions and after Britain emerged from recession.

London turned flat nearing midday while Frankfurt and Paris dipped in early afternoon eurozone deals. All three ended Friday at record peaks.

“European markets are treading water…as we cautiously enter a new week that will likely be dominated by Wednesday’s US inflation gauge,” said Scope Markets analyst Joshua Mahony.

“Markets will be actively shifting their focus more keenly back towards economic factors in the weeks ahead,” he added, noting that more than 90 percent of S&P 500 companies have already reported their first-quarter earnings.

Reports that the White House planned to ramp up tariffs on clean energy products from China, a sharp drop in US consumer confidence and a pick-up in inflation expectations weighed on sentiment.

The readings follow a recent rally across world markets fuelled by optimism that the US Federal Reserve, the European Central Bank and the Bank of England will soon cut borrowing costs.

Two sets of US inflation data — the producer price index (PPI) on Tuesday and the consumer price index (CPI) on Wednesday — will be pored over for fresh clues over the Fed’s monetary policy outlook. The figure comes after three straight months of forecast-beating readings that have seen a whittling away of rate cut expectations.

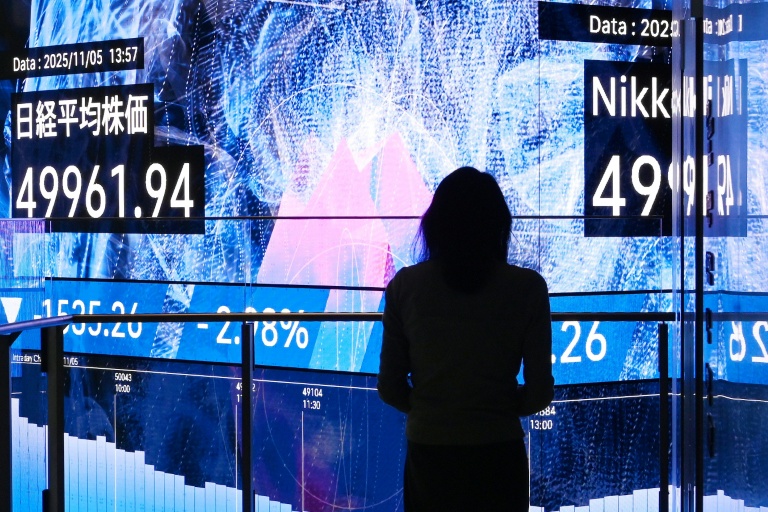

Asian indices also fluctuated as traders absorbed weak Chinese data and news that Beijing planned to start selling almost $140 billion of bonds to boost the stuttering economy.

The week began on a tepid note after figures showed a drop in a broad measure of credit in China that sparked worries of a further slackening in the world’s number two economy. That came as the Wall Street Journal reported that the White House is looking at almost quadrupling tariffs on Chinese electric vehicles as part of a plan that will also target batteries and solar cells. A decision, expected on Tuesday according to reports, would come as US President Joe Biden gears up for a rematch with Donald Trump in November’s presidential election. Last month, Biden urged for a tripling of tariffs on steel and aluminium as he courted blue-collar voters.

Investors did take some heart after it emerged that Chinese authorities were set to begin selling the first batch of almost $140 billion in sovereign bonds this week to raise cash to boost the economy. The sale comes after leaders announced plans in March, which fanned hopes for a huge spending spree aimed at re-energising growth.

The central government will begin issuing some 30-year bonds Friday as part of a planned sale of more than $138 billion of debt, according to a notice posted to the finance ministry’s website. Other bonds with tenors of 20 years and 50 years will go on sale on May 24 and June 14, respectively.

– Key figures around 1040 GMT –

London – FTSE 100: FLAT at 8,437.38 points

Paris – CAC 40: DOWN 0.2 percent at 8,205.88

Frankfurt – DAX: DOWN 0.2 percent at 18,736.22

EURO STOXX 50: DOWN 0.2 percent at 5,075.83

Tokyo – Nikkei 225: DOWN 0.1 percent at 38,179.46 (close)

Hong Kong – Hang Seng Index: UP 0.8 percent at 19,115.06 (close)

Shanghai – Composite: DOWN 0.2 percent at 3,148.02 (close)

New York – Dow: UP 0.3 percent at 39,512.84 (close)

Euro/dollar: UP at $1.0780 from $1.0772 on Friday

Dollar/yen: DOWN at 155.87 yen from 155.88 yen

Pound/dollar: UP at $1.2534 from $1.2525

Euro/pound: DOWN at 86.02 from 86.06 pence

Brent North Sea Crude: UP 0.4 percent at $83.14 per barrel

West Texas Intermediate: UP 0.3 percent at $78.52 per barrel

burs-rfj/lth

© 2024 AFP