New York (AFP) – The recent bankruptcies of US companies First Brands and Tricolor have focused attention on risks associated with the growth in the private credit market, or lending outside traditional banks. Bank of England Governor Andrew Bailey told a parliamentary panel this week that it was too soon to know whether the problem was isolated to those two firms or the “canary in the coal mine” to a 2008-scale financial crisis. JPMorgan Chase Chief Executive picked a different metaphor when discussing Tricolor, which cost the giant US lender $170 million. “When you see one cockroach, there are probably more,” Jamie Dimon said earlier this month, adding that his firm was scouring its loan book for other potential problems.

– What is the private credit market and why has it grown? – Estimating the exact size of the private credit market is difficult because of opacity in the financial system and differences in what is included in the category. But broadly speaking, nonbank finance has grown rapidly as conventional banks have backed off from some lending in response to regulations designed to limit risk.

Banks have something of a symbiotic relationship with nonbank financial institutions (NBFIs), which are also competitors. Bank lending to NBFIs has more than doubled since 2019 to more than $1 trillion at the end of 2024, according to an S&P Global report from February that described the trend as a source of “risks and rewards.” As the system has evolved, “you have the non-bank that lends to the consumer and the bank that lends to the non-bank,” said Brendan Browne, a credit analyst at S&P Global. This structure means banks don’t have to hold as much emergency capital but leaves them more in the dark about the ultimate recipient of the funds.

– Why are markets suddenly worried? – The rising importance of NBFIs has been on the radar of policymakers, including the Federal Reserve, which included a scenario of “rapid deterioration” in NBFI asset quality in the most recent stress tests. Total bank loan losses would be around $490 billion, according to the Fed, which concluded in June that large banks were “well-positioned to withstand significant” NBFI stresses. However, anxiety about the sector rose following bank losses from First Brands, a US auto supply company, and Tricolor, a subprime auto lender. Both cases involve alleged fraud.

The worry is that an economic downturn could bring to the surface more widespread problems with ill-advised lending made in recent years, especially after pandemic-era central bank policies flushed financial markets with liquidity.

– Will this blow up into a full-blown financial crisis? – It’s too early to say, but the reaction to recent bank earnings suggests markets view the issue as an item to watch, rather than an area of impending doom. A group of midsized banks saw their share prices tumble on October 16 after Zions Bancorp disclosed that it was pursuing litigation with a borrower over alleged fraud and would take a $50 million hit. But bank shares recovered the next day after multiple regional banks reported clean results.

So far, the problem appears to be “some one-off bad apples,” said Stuart Plesser, an analyst at S&P Global, adding that in general bank credit quality was “good” in the most recent batch of results. But Plesser said the recent cases point to the need to tighten terms, given instances where the same collateral was promised to multiple lenders. Another key wildcard is the extent that credit quality deteriorates if the job market slows significantly.

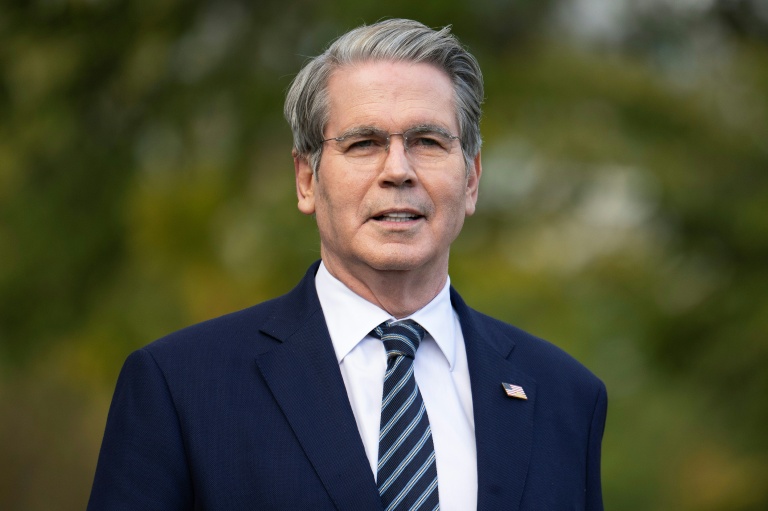

Given the rapid growth in lending to NBFIs, “there is likely to be a wobble at some point,” Lazard Chief Executive Peter Orszag said this week on CNBC. “I just don’t think that’s what we’re experiencing today.”

© 2024 AFP