Washington (AFP) – Republican former president Donald Trump once dubbed himself a “Tariff Man” seeking to boost government coffers. As he makes another White House bid in 2024, tariff hikes — this time on all US imports — are again on the table.

But analysts estimate the new levies could bring added consumer costs of some $500 billion annually, while other proposals like tax cut extensions could further inflate the national deficit.

What are Trump’s key economic policies and their consequences?

– What are his proposals?

-Trump has advocated for at least a 10 percent tariff on imports from all trading partners, describing this as “a ring around the country.”

This would hit some $3 trillion in goods, at 2023 import levels.

On Chinese goods, Trump floated levies of 60 percent or higher, warning last month: “You screw us and we’ll screw you.”

The tariff revenues would in turn help to offset extensions to sweeping tax cuts approved in 2017 under his administration’s Tax Cuts and Jobs Act (TCJA), with some provisions due to expire after 2025.

While the act lowered income taxes for many Americans, they have also been criticized for being more beneficial to the wealthy.

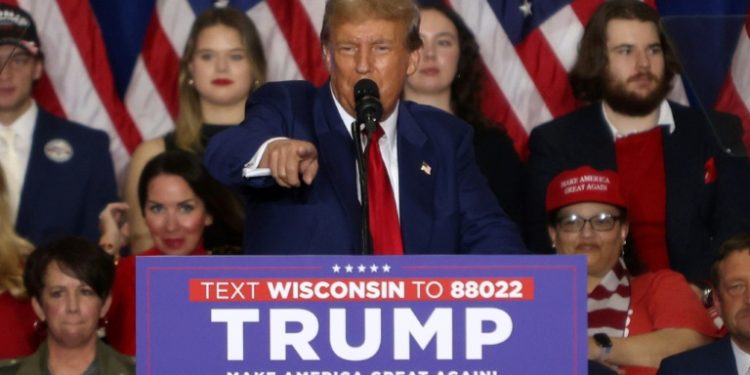

At a rally this month, Trump pledged a “middle class, upper class, lower class, business class, big tax cut.”

He has vowed to reverse President Joe Biden’s electric vehicle subsidies as well, among other moves.

– What is the consumer impact?

-A 10 percent across-the-board tariff and more on China would cost an average American household at least $1,700 in increased taxes each year, according to a report this week from the Peterson Institute for International Economics (PIIE).

The toll “will be nearly five times those caused by the Trump tariff shocks through late 2019, generating additional costs to consumers from this channel alone of about $500 billion per year,” it said. Those new consumer costs translate to at least 1.8 percent of GDP, the nonpartisan Washington-based institute said, also noting the potential negative effects of foreign retaliation and lost competitiveness.

– What is the fiscal hit?

-Extending Trump’s tax cuts for the next decade would add $4.6 trillion to the deficit, according to a report this month by the Congressional Budget Office (CBO), a nonpartisan federal agency.

CBO’s earlier cost estimate for an extension was $3.5 trillion through 2033.

This means policymakers might have to find ways to offset the hit to the deficit, such as by lowering spending.

Renewed trade wars will also “more than offset the benefit from lower taxes,” said Oxford Economics in an April analysis.

– How are different groups affected?

-Trump’s proposals shift tax burdens “away from the well-off and toward lower-income members of society,” said PIIE senior fellows Kimberly Clausing and Mary Lovely, who wrote the report.

Fully extending TCJA provisions would “entail about one percent of GDP in tax cuts, accruing disproportionately to the top end of the income distribution,” PIIE estimates.

Tariffs also act as a tax on consumption, and lower-income households spend a much larger share of their income while wealthier households can save more.

“As fiscal policy, the Trump agenda amounts to regressive tax cuts, only partially paid for by regressive tax increases,” said the PIIE report.

Consumers could also see inflation rise as much as 0.6 percentage points, said Oxford Economics, if Republicans double down on tax cuts and tariffs, and repeal the clean energy provisions of Biden’s landmark Inflation Reduction Act.

The weight of earlier Trump tariffs was borne almost entirely by US importers, according to the International Trade Commission.

– Are there external risks?

-Broad tariff hikes risk retaliation and distrust from US trading partners, experts say.

Those partners could hit back with tariffs of a similar magnitude although China, consistent with its past approach, might retaliate in a “less-than-proportional manner,” said Oxford Economics.

Taken together, this would still have a significant hit on trade and US GDP.

Higher import costs are likely to hit incomes and consumption, while retaliatory tariffs will make US industries less competitive, Oxford Economics added.

“At a time when international conflicts are manifold and international collective action problems are substantial, the United States cannot afford to alienate its partners and allies,” the PIIE report said.

“In short, the proposed policies come with serious national security risks.”

© 2024 AFP