London (AFP) – A solid opening for New York equities underpinned European stocks Tuesday as the tech sector extended a strong run and a US rate cut next month was seen as a near-certainty. Investors in tech stocks have moved past fears that AI enthusiasm may have created a bubble that is waiting to burst, analysts said.

Expectations that the US Federal Reserve will cut interest rates next month added further support to equities but weighed on the dollar. Fed governor Christopher Waller said Monday that inflation was not his main worry and that his “concern is mainly the labour market, in terms of our dual mandate” to support jobs and keep a cap on prices. “So I’m advocating for a rate cut at the next meeting,” he added.

Before Wall Street’s opening, data pointing to labour market softness in the US and weaker-than-expected retail sales numbers further fuelled rate cut expectations. Traders now see about a 90 percent chance of a reduction, against around 35 percent only last week—but not everyone saw this as a good thing. “The last time we saw Fed rate expectations change that fast — September 2024 — the last-minute 50 bp cut turned out to be a mistake, and the Fed had to pause for a year before moving again,” said Ipek Ozkardeskaya, an analyst at Swissquote, an investment firm. “Did it prevent the bulls from buying? Not really,” she added.

Shares in Alphabet extended gains on reports Meta will use its AI chips, putting Google on course to take market share from sector star Nvidia, whose stock dropped. “AI remains one of the most powerful forces reshaping markets, but the tone is changing,” wrote Saxo Markets’ Charu Chanana. “Strong earnings from leading chipmakers (led by Nvidia)… reassure investors that demand is real, yet the sharp swings in market reaction show that enthusiasm now sits alongside questions around sustainability, profitability, and execution.”

Oil prices fell amid reports that a deal to end the war in Ukraine may be close, which, if confirmed, would allow Russia to export vastly more oil.

– Key figures at around 1332 GMT –

New York – Dow: UP 0.6 percent at 46,715.03 points

London – FTSE 100: UP 0.4 percent at 9,575.05

Paris – CAC 40: UP 0.6 percent at 7,806.41

Frankfurt – DAX: UP 0.7 percent at 23,404.91

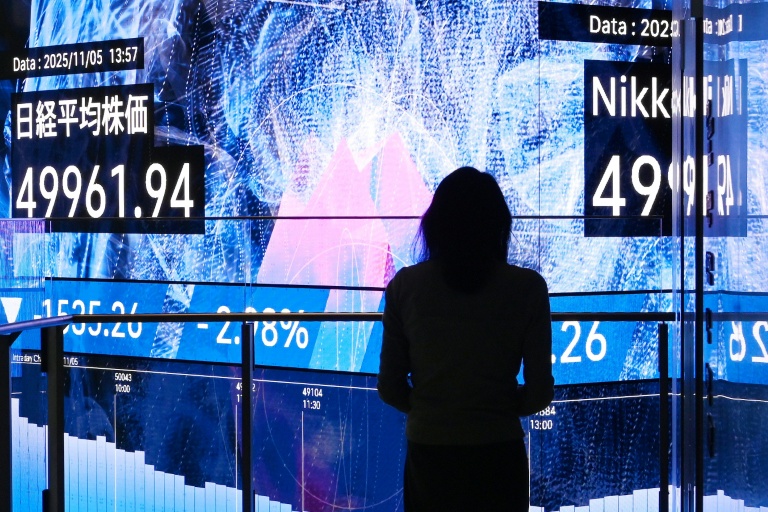

Tokyo – Nikkei 225: UP 0.1 percent at 48,659.52 (close)

Hong Kong – Hang Seng Index: UP 0.7 percent at 25,894.55 (close)

Shanghai – Composite: UP 0.9 percent at 3,870.02 (close)

Euro/dollar: UP at $1.1564 from $1.1523 on Monday

Pound/dollar: UP at $1.3166 from $1.3110

Dollar/yen: DOWN at 156.07 yen from 156.81 yen

Euro/pound: DOWN at 87.85 pence from 87.91 pence

Brent North Sea Crude: DOWN 1.8 percent at $61.62 per barrel

West Texas Intermediate: DOWN 1.8 percent at $57.79 per barrel

burs-jh/cw

© 2024 AFP