Hong Kong (AFP) – Markets fell in Asia and Europe on Friday, tracking a sell-off on Wall Street sparked by a string of better-than-expected US data that added to worries the Federal Reserve will hold off on cutting interest rates this year.

A weeks-long rally in equities has petered out in the past few days on profit-taking and as central bank officials pushed back against bets on an early reduction. Confidence was dealt a further blow Thursday as a closely watched gauge of the services sector showed activity rose at its fastest pace in a year, while the factory sector also beat forecasts. Meanwhile, fewer people than estimated made unemployment claims, suggesting the labour market remains tight.

The readings indicated the world’s top economy was still in rude health, quelling the excitement sparked by last week’s news that the consumer price index slowed in April after three months of topping forecasts.

“The data erase some of the cooling signals in recent outcomes and contrast the month-long run of broader US data tending to surprise on the soft side,” said Taylor Nugent of National Australia Bank.

The figures came after minutes from the Fed’s May policy decision showed decision-makers wanted to keep borrowing costs elevated until they are confident prices are under control, while some even said they were willing to hike again.

FHN Financial’s Chris Low said: “The minutes are a reminder that while the Fed does not see another rate hike as likely — and certainly does not see it as a base-case — it will not rule out hikes if inflation does not behave.”

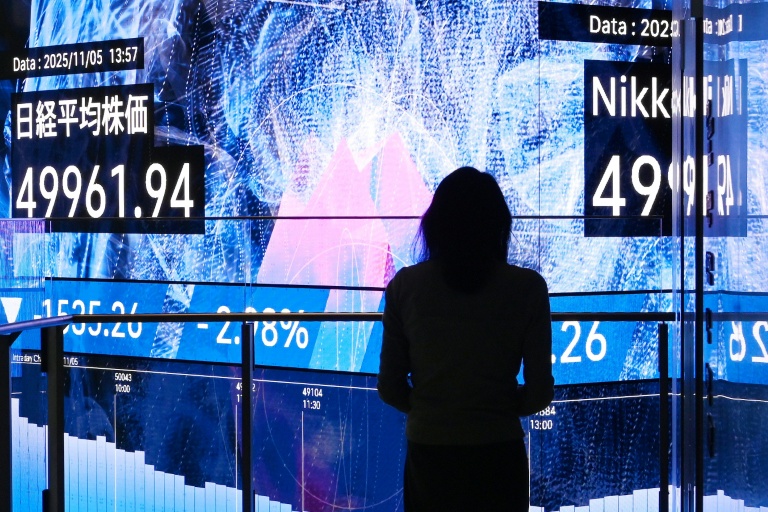

All three main indexes in New York ended in the red, and Asia followed suit. Hong Kong fell for a fourth straight day, having hit a nine-month high this week, while there were also losses in Tokyo, Shanghai, Seoul, Singapore, Sydney, Bangkok, Wellington, Taipei and Manila. London, Paris and Frankfurt also fell.

“It appears that markets are in the ‘good (economic) news is bad market news’ mode as they fret (over a) ‘higher for longer’ Fed,” said Vishnu Varathan, of Mizuho Bank.

The prospect of interest rates remaining at two-decade highs through most of the year put upward pressure on the dollar. Investors are paying particular attention to the yen after Japanese officials recently stepped into forex markets when it hit a 34-year low against the greenback.

The Japanese unit was also weighed by data showing inflation eased last month, leading to speculation about when the country’s central bank will lift interest rates again, having hiked in March for the first time in 17 years. The slowdown in prices will not “deter financial markets from speculating on further Bank of Japan policy tightening”, said Kristina Clifton, at Commonwealth Bank of Australia. But she added that “at this stage, we expect the BoJ to wait until around October before increasing interest rates again”.

– Key figures around 0810 GMT –

Tokyo – Nikkei 225: DOWN 1.2 percent at 38,646.11 (close)

Hong Kong – Hang Seng Index: DOWN 1.4 percent at 18,608.94 (close)

Shanghai – Composite: DOWN 0.9 percent at 3,088.87 (close)

London – FTSE 100: DOWN 0.6 percent at 8,288.32

Dollar/yen: UP at 157.04 yen from 156.93 yen on Thursday

Euro/dollar: DOWN at $1.0813 from $1.0815

Pound/dollar: DOWN at $1.2695 from $1.2696

Euro/pound: UP at 85.22 from 85.16 pence

West Texas Intermediate: DOWN 0.3 percent at $76.68 per barrel

Brent North Sea Crude: DOWN 0.2 percent at $81.22 per barrel

New York – Dow: DOWN 1.5 percent at 39,065.26 (close)

© 2024 AFP