London (AFP) – World stock markets mostly rose Thursday after the latest batch of US data reinforced expectations that the Federal Reserve will cut interest rates next week and in 2026. Eyeing a third straight session in the green, Wall Street endured a mixed start as the Dow slid just into the red after a modestly positive start. But the tech-heavy Nasdaq was 0.1 percent up after initially having slipped back amid lingering concerns over high tech valuations.

Shares in Meta were up sharply after a report that the Facebook parent company is significantly cutting back on virtual-reality investments in a pivot toward artificial intelligence. According to Bloomberg, Meta plans to cut metaverse costs by 30 percent — news that drove its share price up as much as four percent in Thursday trading on Wall Street. The broader S&P was little changed, while major European markets were higher, London ending 0.2 percent ahead as Frankfurt added 0.8 percent.

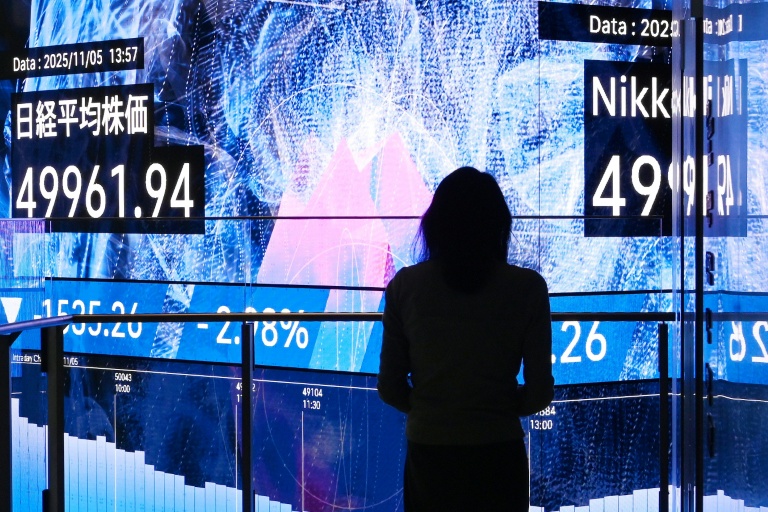

Tokyo earlier rallied more than two percent in a positive Asian session which also saw Hong Kong, Sydney, Taipei, and Bangkok finish higher. Bets on a December reduction for US interest rates have surged after several Fed officials said supporting jobs was more important than keeping a lid on elevated inflation. The need for more action was further stoked by Wednesday’s data from payrolls firm ADP showing 32,000 posts were lost in November, compared with an expected rise of 10,000. The drop was the most since early 2023 and is the latest indication of a stuttering American labour market.

“Right now, the data argues for additional Fed funds rate cuts,” noted Elias Haddad, markets analyst at Brown Brothers Harriman & Co. “US labor demand is weak, consumer spending is showing early signs of cracking, and upside risks to inflation are fading.” Kathleen Brooks, research director at XTB, noted that “there seems to be one main driver for stocks this year: an increase in expectations of a Fed rate cut next week. The Fed Fund Futures market is now pricing in a 98-percent chance of a cut next week.”

Oil prices were up around one percent. On currency markets, the dollar traded mixed and the Indian rupee wallowed at record lows of more than 90 against the greenback as investors grew increasingly worried about a lack of progress in India-US trade talks.

**Key figures at around 1645 GMT**

New York – Dow: DOWN 0.1 percent at 47,852.97 points

New York – S&P 500: UP 0.1 percent at 6,853.15

New York – Nasdaq Composite: UP 0.1 percent at 23,484.03

London – FTSE 100: UP 0.2 percent at 9,710.87 (close)

Paris – CAC 40: UP 0.5 percent at 8,122.03 (close)

Frankfurt – DAX: UP 0.8 percent at 23,882.03 (close)

Tokyo – Nikkei 225: UP 2.3 percent at 51,028.42 (close)

Hong Kong – Hang Seng Index: UP 0.7 percent at 25,935.90 (close)

Shanghai – Composite: DOWN 0.1 percent at 3,875.79 (close)

Euro/dollar: DOWN at $1.1655 from $1.1667 on Wednesday

Pound/dollar: UP at $1.3353 from $1.3352

Dollar/yen: DOWN at 154.86 yen from 155.23 yen

Euro/pound: DOWN at 87.29 pence from 87.39 pence

Brent North Sea Crude: UP 0.9 percent at $63.24 per barrel

West Texas Intermediate: UP 1.1 percent at $59.61 per barrel

© 2024 AFP