London (AFP) – Wall Street and European stocks mostly fell on Tuesday as gains made in Asia after China’s central bank sprang a record cut to a benchmark lending rate to boost the nation’s struggling economy failed to carry over.

Wall Street’s main indices were mostly lower following a three-day holiday weekend as investors eyed major upcoming earnings reports, including from Silicon Valley chip titan Nvidia on Wednesday. They are also awaiting publication of policy meeting minutes from the Federal Reserve and European Central Bank, on Wednesday and Thursday respectively. That could offer insights about hoped-for interest rate cuts in the United States and the eurozone.

“Coming off the three-day weekend, the US equity market looks like it is having vacation-withdrawal symptoms,” said analyst Patrick O’Hare at Briefing.com. “There just isn’t much of a buying impulse at the moment in the broader market, as participants are in a wait-and-see mode, anxious to see if there will be a buy-the-dip effort today following Friday’s losses, and also anxious to see how the market responds to Nvidia’s earnings report,” he added.

Data released Friday showed a greater-than-expected rise in US wholesale prices, crushing hopes of an early interest-rate cut by the Fed, and sending stocks lower. But Vincent Juvyns, global market strategist for JPMorgan Asset Management, told Bloomberg Television that “markets have adjusted to the idea that rate cuts would come later and probably be less important than what was originally priced.” Equities on both sides of the Atlantic have repeatedly set record highs in recent months on expectations of interest rate cuts and blockbuster earnings by tech firms doped by enthusiasm for AI.

In Europe, the Paris stock market advanced, aided by solid results from industrial gas giant Air Liquide, but Frankfurt and London dipped. Chinese shares were buoyant after the Lunar New Year, leading gains in most Asian markets thanks to a holiday boost, although Tokyo stumbled on profit-taking.

– Another stimulus step –

“China provided a fresh boost to risk appetite…after the People’s Bank of China (PBoC) announced cuts in another step to the nation’s economic stimulus policy,” said ActivTrades analyst Pierre Veyret. The PBoC announced it was lowering the five-year loan prime rate (LPR), used to price mortgages, from 4.2 to 3.95 percent. Beijing’s measures are intended to rally dwindling growth and counter rate hikes in other major economies, as the world’s second-largest economy battles a prolonged property-sector crisis and a global slowdown. “This news…gave investors reasons to buy the dip while waiting for other crucial macro developments,” added Veyret. The Chinese central bank’s moves, aimed at pushing commercial banks to grant more credit at better rates, was the largest reduction since the key LPR was revamped in 2019, Bloomberg reported.

Oil prices fell as demand fears jostled with concern over potential disruption to supplies from the crude-rich Middle East. The dollar fell against the euro, pound and yen.

– Key figures around 1630 GMT –

New York – Dow: FLAT at 38,613.54 points

New York – S&P 500: DOWN 0.5 percent at 4,978.39

New York – Nasdaq Composite: DOWN 1.1 percent at 15,604.89

London – FTSE 100: DOWN 0.1 percent at 7,719.21 (close)

Paris – CAC 40: UP 0.3 percent at 7,795.22 (close)

Frankfurt – DAX: DOWN 0.1 percent at 17,068.43 (close)

EURO STOXX 50: DOWN less than 0.1 percent at 4,760.28 (close)

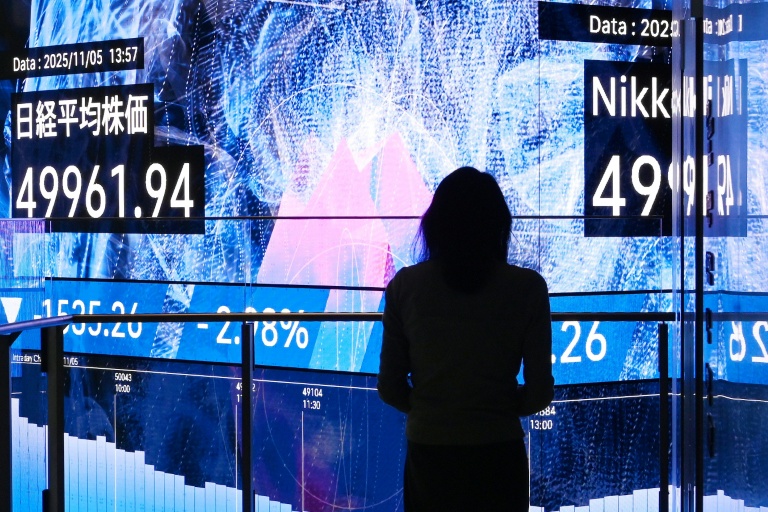

Tokyo – Nikkei 225: DOWN 0.3 percent at 38,363.61 (close)

Hong Kong – Hang Seng Index: UP 0.6 percent at 16,247.51 (close)

Shanghai – Composite: UP 0.4 percent at 2,922.73 (close)

Euro/dollar: UP at $1.0821 from $1.0769 on Monday

Dollar/yen: DOWN at 149.84 yen from 150.17 yen

Pound/dollar: UP at $1.2648 from $1.2584

Euro/pound: DOWN at 85.54 pence from 85.56 pence

Brent North Sea Crude: DOWN 1.5 percent at $82.34 per barrel

West Texas Intermediate: DOWN 0.8 percent at $78.59 per barrel

burs-rl/giv