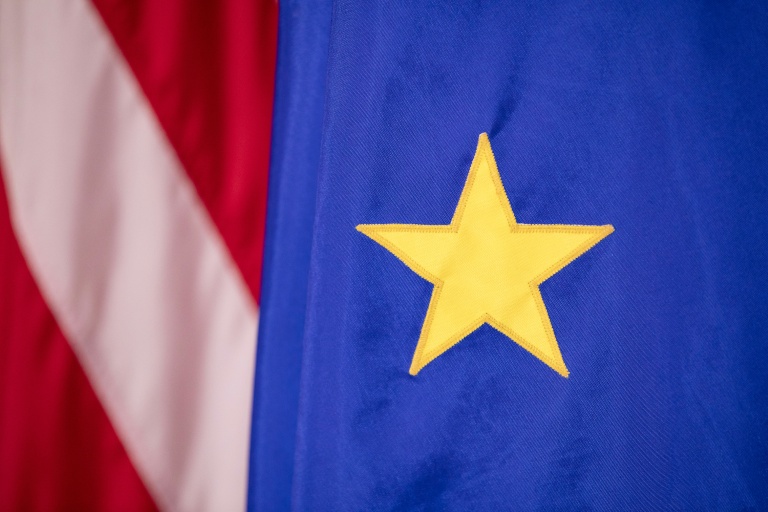

Hong Kong (AFP) – Gold and silver hit record highs on Monday while equity markets fell after Donald Trump revived trade war fears by threatening several European nations with tariffs over their opposition to the United States buying Greenland. The US president has fanned already-rising geopolitical tensions this month by insisting that Washington would take control of the North Atlantic island, citing national security needs.

And on Saturday, after talks failed to resolve “fundamental disagreement” over the Danish autonomous territory, he announced he would hit eight countries with fresh levies over their refusal to submit. He said he would impose 10 percent tariffs on Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland from February 1 — rising to 25 percent from June 1 — if they did not agree to the takeover.

The announcement drew an immediate response, with a joint statement from the countries saying: “Tariff threats undermine transatlantic relations and risk a dangerous downward spiral.” The move also threatened a trade deal signed between the United States and the European Union last year, with German Foreign Minister Johann Wadephul telling ARD television: “I don’t believe that this agreement is possible in the current situation.”

Aides to French President Emmanuel Macron said he would ask the EU to activate a never-before-used “anti-coercion instrument” against Washington if Trump makes good on his threat. The measure allows for curbing imports of goods and services into the EU, a market of 27 countries with a combined population of 450 million. Bloomberg reported that member states were discussing the possibility of retaliatory levies on €93 billion ($108 billion) of US goods.

The prospect of a trade war between the global economic heavyweights shook markets, with safe-haven assets extending gains that had come on the back of Trump’s threats against Iran last week and the US ouster of Venezuelan president Nicolas Maduro. Gold, a key go-to in times of turmoil, hit a peak of $4,690.59, while silver struck $94.12. On equity markets, Paris and Frankfurt opened more than one percent lower, while London was also deep in the red. Tokyo, Hong Kong, Sydney, Singapore, Manila, Mumbai and Wellington retreated, though there were gains in Shanghai, Seoul, Taipei, and Bangkok. US futures sank.

The dollar also retreated against its peers, with the euro, sterling, and yen all higher. “The next signpost is whether this moves from rhetoric to policy, and that is why the concrete dates matter,” wrote Charu Chanana, chief investment strategist at Saxo Markets. “On the European side, the decision path matters as much as the headline, because there is a difference between merely mentioning the anti-coercion instrument as a signal and formally pursuing it as action.”

Even if the immediate tariff threat gets negotiated down, the structural risk is that fragmentation keeps rising, with more politicised trade, more conditional supply chains, and higher policy risk for companies and investors. There was little major reaction to data showing China’s economy expanded five percent last year, in line with its target, but one of the slowest rates in decades. Growth in the final three months slowed sharply from the previous quarter. The figures showed that exports continued to provide the main basis of growth as domestic consumption remained subdued, putting pressure on officials to provide more stimulus.

Sarah Tan, an economist at Moody’s Analytics, wrote: “China enters 2026 with confidence still fragile, the property downturn unresolved, and the external environment turning more hostile. The property slump is set to extend into the year, which will weigh on households and manufacturers alike. Meanwhile, the (trade) truce with the US is time-limited and set to expire before the end of 2026, putting both talks and friction on the horizon.”

As a result, China begins 2026 with as much uncertainty as it faced at the start of 2025. Investors in Seoul and Taipei brushed off a warning from US Commerce Secretary Howard Lutnick that South Korean chipmakers and Taiwan firms not investing in the United States could be hit with 100 percent tariffs unless they boost output in the country.

– Key figures at around 0815 GMT –

Frankfurt – DAX: DOWN 1.5 percent at 24,927.07

Paris – CAC 40: DOWN 1.7 percent at 8,121.61

London – FTSE 100: DOWN 0.4 percent at 10,191.20

Tokyo – Nikkei 225: DOWN 0.7 percent at 53,583.57 (close)

Hong Kong – Hang Seng Index: DOWN 1.1 percent at 26,563.90 (close)

Shanghai – Composite: UP 0.3 percent at 4,114.00 (close)

Euro/dollar: UP at $1.1628 from $1.1604 on Friday

Pound/dollar: UP at $1.3390 from $1.3382

Dollar/yen: DOWN at 158.02 yen from 158.07 yen

Euro/pound: UP at 86.83 pence from 86.69 pence

West Texas Intermediate: DOWN 0.6 percent at $59.07 per barrel

Brent North Sea Crude: DOWN 0.7 percent at $63.69 per barrel

New York – Dow: DOWN 0.2 percent at 49,359.33 (close)

© 2024 AFP