Taipei (AFP) – Taiwan’s economy soared last year on skyrocketing exports of AI hardware and semiconductors, but companies in more traditional manufacturing sectors could only look on with envy as they were clobbered by US tariffs and a strong local currency. The island’s growth has for decades been based on overseas shipments of a range of goods including machinery, metals, and chemicals, mostly small and medium-sized manufacturers employing thousands of workers.

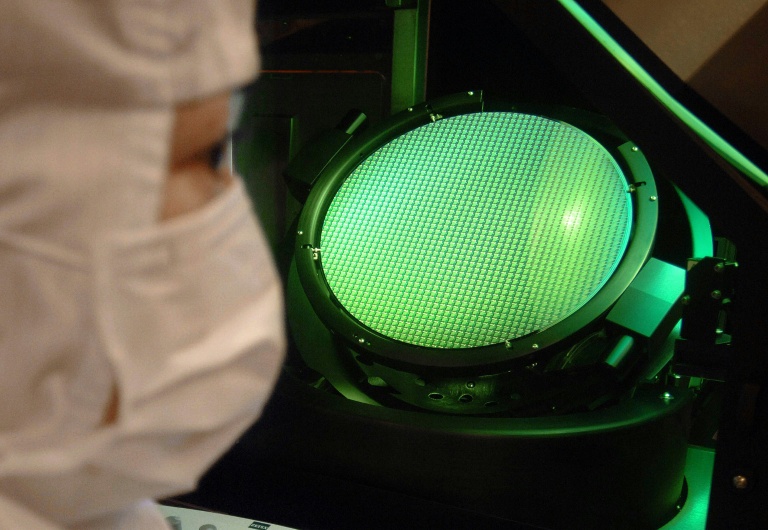

But the past 12 months saw companies in those sectors dealt a body blow as their goods sold into the United States were loaded with 20 percent levies as part of President Donald Trump’s global trade war, threatening people’s jobs. One area that was exempted, however, was semiconductor chips — a critical sector dominated by Taiwanese tech giant TSMC. That meant economic growth likely ballooned 7.4 percent last year, according to government estimates, which would be the fastest in 15 years.

“We don’t really feel that growth,” Chris Wu, the sales director of machine toolmaker Litz Hitech Corp in Taiwan’s manufacturing hub of Taichung, told AFP. “Overall the data looks strong, but for traditional industries, and for our company in particular, exports have declined — we’re down 30 percent.” Trump initially announced a 32 percent tariff on Taiwanese exports, which was later lowered to 20 percent, as part of his sweep of measures against dozens of trade partners last April. A trade deal announced last week cut that again to 15 percent, in line with key manufacturing rivals South Korea and Japan. While it was good news for traditional manufacturers, Wu said it was not a panacea.

Overseas demand for Litz Hitech’s precision tools and processing machines hasn’t recovered, and a 15 percent tariff is still nearly three times the company’s profit margin. On top of that, Wu said, the Taiwan dollar was stronger than the won, yen, and euro, meaning Taiwanese exports are more expensive. “I don’t think there is a single Taiwanese machine toolmaker that can negotiate to absorb (the tariff) in full — maybe two to three percent, but absorbing everything is impossible,” he said. “Our company can’t absorb even one percent.”

Taiwan’s information and communication technology (ICT) sector, which includes semiconductor chips, has become by far the biggest driver of the island’s export-dependent economy. Data for last year laid bare the stark difference in fortunes for tech and more traditional industries, with ICT exports soaring, while metals, plastics, and metal-cutting machine tools were all lower. “Last year’s situation was miserable, very miserable,” Jerry Liu, chairman of the Taichung Importers and Exporters Chamber of Commerce, told AFP. Taiwan’s reliance on AI has left some experts worried about the economic impact if the bubble of excitement around the technology were to burst. “That’s dangerous,” said Chen Been-lon, a research fellow and professor in the Institute of Economics at Academia Sinica. “But what can you do? You cannot force people not to invest in semiconductors.”

Taiwan hopes its semiconductor industry remains protected from Trump’s tariffs after the trade deal with Washington committed Taiwanese chip and tech businesses to invest up to $500 billion on US soil. However, a potential US Supreme Court ruling against Trump’s power to apply levies could upend the agreement. “If it’s unconstitutional…the current negotiated result may need to be redone,” said Wu Meng-tao, an economist at the Taiwan Institute of Economic Research, raising the risk of tariffs on the ICT sector.

Many in Taiwan’s traditional manufacturing sector, including Litz Hitech, have put employees on unpaid leave or reduced their working hours. Wu, the sales director, estimates thousands are affected. Conditions for small and medium-sized manufacturers could get tougher in 2026 if the US Federal Reserve cuts interest rates. The Taiwan dollar, which has pulled back from its highs last year, could come under renewed upward pressure. Liu said he was “gritting my teeth and holding on” — and hoping that the government helped to “stabilise the currency”.

But manufacturers also needed to move with the times by adopting AI and offering customers “comprehensive solutions,” said Patrick Chen, chairman of the Taiwan Machine Tools and Accessory Builders’ Association. “Simply selling standalone machines or individual pieces of equipment is a business model of the past.”

© 2024 AFP