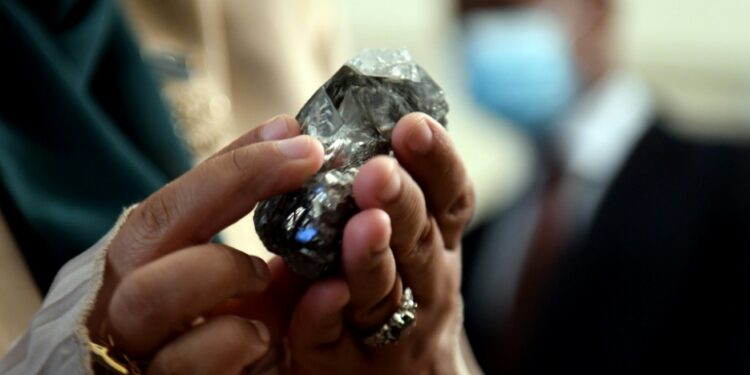

Johannesburg (AFP) – Even with its legendary image of glitz and glamour, diamond icon De Beers has struggled to attract a buyer after nearly two years on a market dulled by falling prices and the allure of lab-grown gems. The seller, mining titan Anglo American, even warned Thursday it may take a third writedown in as many years on the company that was born in South Africa 130 years ago and went on to dominate the global diamond market. This is after a $2.9 billion drop last year and a $1.6 billion charge the year before, bringing its estimated value to about $5 billion, according to company records.

Anglo’s bid to offload its loss-making company is not only being thwarted by the depressed market for mined diamonds, particularly in China, according to analysts. It is also complicated by a crowded field of suitors circling the sale, including at least three sub-Saharan governments and various private bidders, which makes any deal as political as it is financial, they added. Botswana has perhaps been the most ardent in its ambition to acquire a controlling stake in the company that oversees the world trade in the stones on which its economy depends.

Botswana and its president, Duma Boko, De Beers’ biggest producer partner with a 15-percent holding, led a determined push to finalize a deal by last year but to no avail. Other diamond-rich governments such as Angola and Namibia have also signaled interest, as have various sovereign wealth funds and a consortium led by former De Beers chief executive Gareth Penny.

– ‘For better or worse’ –

It is a complicated sale that — if it goes through — would mark one of the most significant shifts in the diamond industry in a quarter of a century, said independent analyst Paul Zimnisky. “The new owner will be in a position to fundamentally pave the future of the entire industry, for better or worse,” the diamond industry analyst told AFP. Botswana’s bid underscores its belief that it must manage the resource, which contributes about a third of its GDP, in order to capture more of the value chain and secure its economic future.

But the International Monetary Fund has cautioned the mostly desert nation that concentrating more of its state resources in the diamond sector could heighten fiscal risks and leave it more exposed to swings in global demand. Zimnisky was also wary of what could amount to the “nationalization” of De Beers. “In general, I think that a more private or capitalistic business model works better than a more government-run or social one,” he told AFP. “It is pertinent to have some private money involved as well as executives with relevant experience,” said the US-based analyst.

– Patience –

Anglo American has kept details of the sale negotiations under wraps, with chief executive Duncan Wanblad saying on Thursday only that the separation is “progressing.” The mining giant announced in 2024 — after fending off a hostile takeover bid from Australian rival BHP — that it would sell off De Beers and its coal and nickel operations in order to focus on iron ore and copper.

“De Beers isn’t a single, clean asset; it spans mining, marketing, and retail, and it includes a government partner,” leading diamond industry analyst Edahn Golan told AFP. “From a buyer’s perspective, this is actually an attractive moment to step in. From a seller’s perspective, there’s a compelling argument for waiting until the market improves and capturing more of the upside,” he said.

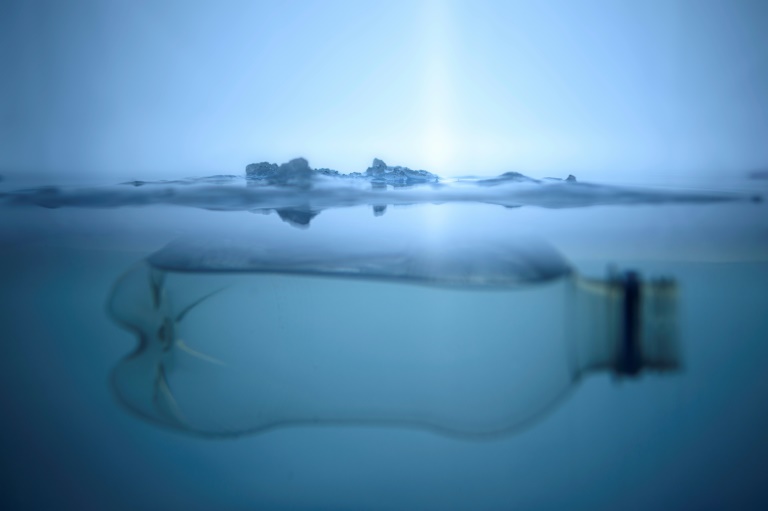

Demand for natural diamonds has weakened as younger buyers spend less on traditional jewellery and are drawn to cheaper lab-grown gems. US tariffs and shifting trade routes are meanwhile disrupting flows through key cutting and polishing hubs. As the sector weathers a period of unprecedented uncertainty, retailers and manufacturers are sitting on their biggest polished-stone stockpiles in years.

Despite the gloomy market, Anglo would not be “interested in fire-selling” De Beers, Zimnisky said. “They can be patient,” he added. Golan agreed. “My hope is that the outcome is a company that both brings prosperity to the communities in which it operates and succeeds in rebuilding consumer interest in diamonds,” he said.

© 2024 AFP