Hong Kong (AFP) – Asian equities rallied Tuesday, tracking another tech-driven record on Wall Street, while investors awaited fresh US economic data to get a better handle on the outlook for inflation.

With few major catalysts to drive business, the thoughts of Federal Reserve officials this week will be parsed for an idea about their plans for interest rates after lowering their guidance for how many cuts they would make this year.

Traders are also keeping an eye on developments in France, with fears growing that a snap legislative election called by President Emmanuel Macron could see right-wing parties succeed and cause political turmoil in the European Union.

The mood on trading floors was generally upbeat after the S&P 500 and Nasdaq chalked more record closes thanks to continued buying of tech titans including Apple, Intel, and Microsoft owing to optimism over artificial intelligence.

And analysts were confident markets were well placed for more gains owing to the expected interest rate cuts and strong earnings.

Asian investors extended the buying, with Tokyo and Taipei up more than one percent, while there were also healthy gains in Shanghai, Sydney, Singapore, Mumbai, Bangkok, Seoul, and Wellington.

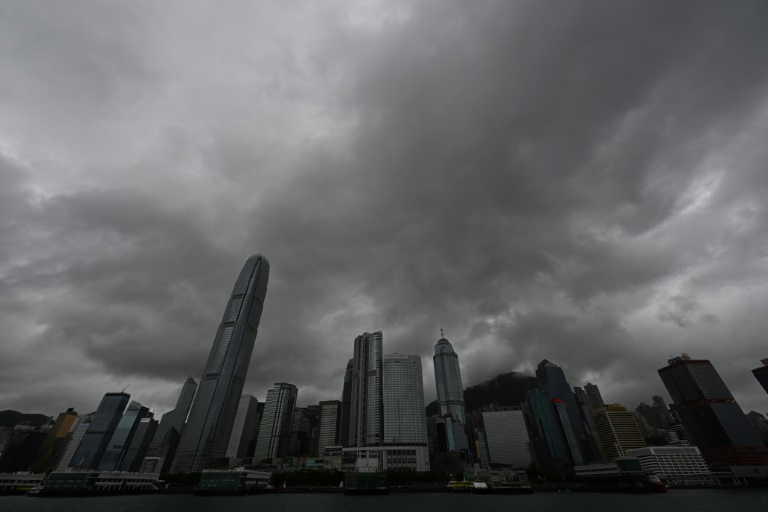

However, Hong Kong reversed early gains to fall into the red.

London, Frankfurt, and Paris all rose at the start of trade.

Investors will be keeping an eye on US retail sales, business inventories, and industrial production data Tuesday, which will provide the latest snapshot of the economy.

On Monday, Philadelphia Fed president Patrick Harker said he saw one rate cut this year but would make his decision based on incoming data.

“If all of it happens to be as forecasted, I think one rate cut would be appropriate by year’s end,” he said in comments prepared for an event in Philadelphia.

“Indeed, I see two cuts or none for this year as quite possible if the data break one way or another. So, again, we will remain data-dependent.”

He added that the current rate, which is at a two-decade high “will continue to serve us well for a bit longer, holding us in restrictive territory to bring inflation back to target and mitigate upside risks”.

His remarks came after Minneapolis Fed chief Neel Kashkari said at the weekend that officials need not rush to loosen policy, while his Cleveland counterpart Loretta Mester remained concerned that inflation could still pick back up.

Still, Main Street Research’s James Demmert said: “The Fed may not need to cut rates this year but if they do, it will be even more bullish for equities, particularly tech.”

– Key figures around 0715 GMT –

Tokyo – Nikkei 225: UP 1.0 percent at 38,482.11 (close)

Hong Kong – Hang Seng Index: DOWN 0.1 percent at 17,913.10

Shanghai – Composite: UP 0.5 percent at 3,030.25 (close)

London – FTSE 100: UP 0.3 percent at 8,162.22

Euro/dollar: DOWN at $1.0731 from $1.0738 on Monday

Euro/pound: UP at 84.52 pence from 84.49 pence

Dollar/yen: UP at 157.90 yen from 157.72 yen

Pound/dollar: DOWN at $1.2698 from $1.2706

West Texas Intermediate: DOWN 0.2 percent at $80.17 per barrel

Brent North Sea Crude: DOWN 0.2 percent at $84.09 per barrel

New York – Dow Jones: UP 0.5 percent at 38,778.10 (close)

© 2024 AFP