New York (AFP) – Wall Street’s top indices fell on Thursday as a rebound in tech shares tumbled, adding to losses triggered by fears of new trade tensions. After a mixed day on European equity markets, losses on Wall Street were broad-based, with energy the only one of 11 industrial sectors to advance in the S&P 500. The Dow, which had notched records the last three days, led major indices lower with a 1.3 percent drop.

“It doesn’t take much of an excuse for markets to take some profits when they’ve had such a good run,” said Art Hogan, chief market strategist at B. Riley Wealth.

Market watchers have for days fixated on the “overbought” state of tech shares after outsized gains by artificial intelligence stocks so far in 2024. The “VIX” volatility index rose about 10 percent in a move that some tied to political pressure building on US President Joe Biden to exit the 2024 campaign. Spartan Capital’s Peter Cardillo said speculation about Biden “could create some short-term election anxiety” after more investors expected a win by Donald Trump following the June presidential debate.

Europe’s major stock markets ended the day mixed, with London getting a boost by the previous day’s oil price surge. Oil prices had vaulted two percent higher Wednesday after signs of strengthening crude demand in top consumer the United States, though the market stabilized Thursday. The dollar firmed following losses caused by growing expectations the US Federal Reserve would cut interest rates at least once this year. As expected, the European Central Bank on Thursday kept its key interest rates steady as it waits for firm indications that consumer price rises are stable before reducing borrowing costs again. The bank kept the key deposit rate at 3.75 percent, after the first cut in June ended an unprecedented streak of hikes to tame runaway inflation. But ECB chief Christine Lagarde said there was no predetermined rate path and that the decision at September’s meeting was “wide open” and would depend upon the data.

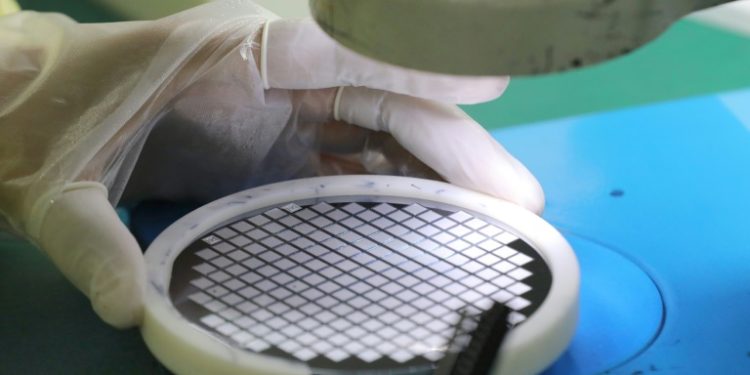

On Wednesday, tech firms took a hit after a report said US President Joe Biden would target companies supplying China with key semiconductor technology. Biden is reportedly looking at imposing strict curbs on companies including Tokyo Electron and Dutch firm ASML if they continue allowing Beijing access to their chip tech. Sentiment was also dented by Trump’s comments that crucial chip supplier Taiwan — home to TSMC and other major producers — should pay the United States for helping the island defend itself militarily against China.

– Key figures around 2030 GMT –

New York – Dow: DOWN 1.3 percent at 40,665.02 (close)

New York – S&P 500: DOWN 0.8 percent at 5,544.59 (close)

New York – Nasdaq Composite: DOWN 0.7 percent at 17,871.22 (close)

London – FTSE 100: UP 0.2 percent at 8,204.89 (close)

Paris – CAC 40: UP 0.2 percent at 7,586.55 (close)

Frankfurt – DAX: DOWN 0.5 percent at 18,354.76 (close)

EURO STOXX 50: DOWN 0.4 percent at 4,870.12 (close)

Tokyo – Nikkei 225: DOWN 2.4 percent at 40,126.35 (close)

Hong Kong – Hang Seng Index: UP 0.2 percent at 17,778.41 (close)

Shanghai – Composite: UP 0.5 percent at 2,977.13 (close)

Euro/dollar: DOWN at $1.0900 from $1.0939 on Wednesday

Pound/dollar: DOWN at $1.2946 from $1.3009

Dollar/yen: UP at 157.36 yen from 156.20 yen

Euro/pound: UP at 84.17 pence at 84.08 pence

West Texas Intermediate: DOWN less than 0.1 percent at $82.82 per barrel

Brent North Sea Crude: UP 0.1 percent at $85.11 per barrel

© 2024 AFP