London (AFP) – Major stock markets mostly advanced Monday as investors looked ahead to key interest-rate decisions this week in the United States and elsewhere. Leading Asian and European indices largely gained following last week’s volatility caused by mixed earnings and big selling of technology stocks.

The US Federal Reserve, Bank of England, and Japan’s central bank are due this week to update on their monetary policies, with US jobs data and more results from multinationals also set to come out. “While no change is expected at the Federal Reserve meeting this week, the odds are now strongly in favour of a cut in September,” noted Richard Hunter, head of markets at Interactive Investor.

On Thursday, a day after the Fed’s latest decision, the Bank of England may cut borrowing costs for the first time since the Covid pandemic after a sizeable fall to British inflation this year, analysts said. They added that the decision is on a knife-edge, similar to what is expected over the Bank of Japan’s decision.

Expectations for a rise, either this week or at the BoJ’s next meeting, along with bets on a Fed cut, have helped push the yen higher against the dollar after it hit a four-decade low near the start of July. Moody’s Analytics believes the BoJ will leave rates on hold despite a pickup in Japanese inflation.

Wall Street reopens Monday after its main indices jumped more than one percent Friday. This followed the publication of the Fed’s preferred gauge of inflation, the personal consumption expenditures (PCE) index, which slowed to 2.5 percent last month. The reading, which was just above the US central bank’s two percent target, was the latest to boost bets on a rate cut in September and pushed up expectations for two more before January.

– Key figures around 1115 GMT –

London – FTSE 100: UP 0.7 percent at 8,343.70 points

Paris – CAC 40: DOWN 0.4 percent at 7,489.12

Frankfurt – DAX: UP 0.3 percent at 18,470.44

Euro STOXX 50: UP 1.0 percent at 4,859.83

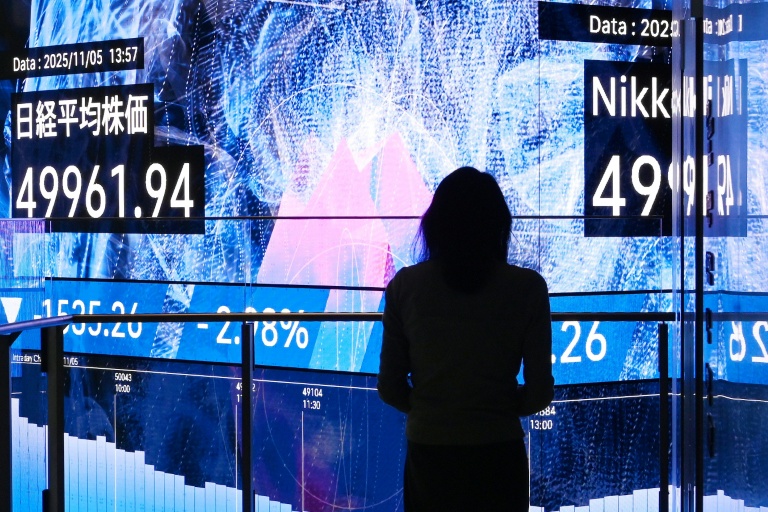

Tokyo – Nikkei 225: UP 2.1 percent at 38,468.63 (close)

Hong Kong – Hang Seng Index: UP 1.3 percent at 17,238.34 (close)

Shanghai – Composite: FLAT at 2,891.85 (close)

New York – Dow: UP 1.6 percent at 40,589.34 (close)

Dollar/yen: DOWN at 153.63 yen from 153.75 yen on Friday

Euro/dollar: DOWN at $1.0836 from $1.0859

Pound/dollar: DOWN at $1.2840 from $1.2875

Euro/pound: UP at 84.36 pence at 84.32 pence

West Texas Intermediate: DOWN 0.6 percent at $76.71 per barrel

Brent North Sea Crude: DOWN 0.5 percent at $80.72 per barrel

© 2024 AFP