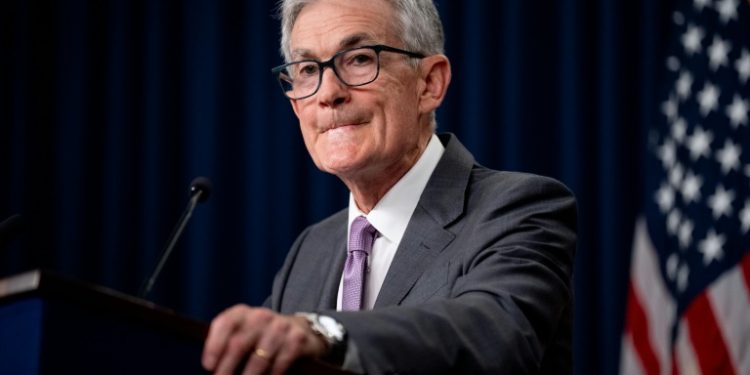

New York (AFP) – Wall Street stocks rose Wednesday after the US Federal Reserve signaled it could cut interest rates as soon as September, while strong results from a key chip maker lifted semiconductor shares. Major US indices spent almost the entire day in positive territory, hitting peaks during Fed Chair Jerome Powell’s press conference before edging down a bit. “The Fed delivered what the markets anticipated in terms of opening the door to a rate cut in September without overcommitting,” said LBBW’s Karl Haeling. The tech-rich Nasdaq Composite Index led major indices, gaining 2.6 percent.

Meanwhile, the yen rallied after the Bank of Japan hiked interest rates for just the second time in 17 years, while oil prices rose on renewed tensions in the Middle East. Shares closed higher in Paris and Frankfurt, as well as London. After two days of deliberations, Fed policymakers voted unanimously to maintain interest rates at a 23-year high. But Powell told reporters at a news conference that the first interest rate cut could come “as soon as” the Fed’s next rate meeting in September. “The Fed is beginning to feel more comfortable that inflation is beginning to come down,” said Adam Sarhan of 50 Park Investments. “The Fed feels that it can finally get control of inflation; there is a light at the end of the tunnel.”

Chipmaker AMD reported positive earnings after the bell Tuesday, resulting in a 4.4 percent jump in shares on Wednesday. Artificial intelligence player Nvidia rocketed up 12.8 percent while Broadcom and Micron also advanced. In Tokyo, the Bank of Japan further unwound its massive monetary easing program by hiking interest rates for only the second time in 17 years, lifting the yen. The Nikkei 225 bounced back from morning losses after the announcement and finished more than one percent higher.

Oil prices jumped as Hamas vowed retribution after political leader Ismail Haniyeh was killed in a strike in Iran that was blamed on Israel. The incident came a day after an Israeli strike on Beirut killed Hezbollah commander Fuad Shukr. But Trade Nation’s Morrison said oil’s gains could be short-lived because while unsettling, the killings do not directly endanger petroleum supplies.

– Key figures around 2030 GMT –

New York – Dow: UP 0.2 percent at 40,842.79 (close)

New York – S&P 500: UP 1.6 percent at 5,522.30 (close)

New York – Nasdaq Composite: UP 2.6 percent at 17,599.40 (close)

London – FTSE 100: UP 1.1 percent at 8,367.98 points (close)

Paris – CAC 40: UP 0.8 percent at 7,531.49 (close)

Frankfurt – DAX: UP 0.5 percent at 18,508.65 (close)

Euro STOXX 50: UP 0.7 percent at 4,872.94 (close)

Tokyo – Nikkei 225: UP 1.5 percent at 39,101.82 (close)

Hong Kong – Hang Seng Index: UP 2.0 percent at 17,344.60 (close)

Shanghai – Composite: UP 2.1 percent at 2,983.75 (close)

Dollar/yen: DOWN at 149.88 yen from 152.77 yen on Tuesday

Pound/dollar: UP at $1.2858 from $1.2836

Euro/dollar: UP at $1.0828 from $1.0815

Euro/pound: DOWN at 84.19 pence from 84.26 pence

West Texas Intermediate: UP 4.3 percent at $77.91 per barrel

Brent North Sea Crude: UP 2.7 percent at $80.72 per barrel

© 2024 AFP