London (AFP) – Major stock markets and the dollar diverged Wednesday before US inflation data that could help indicate the size of an expected interest-rate cut from the Federal Reserve next week. In Europe, London’s share-price gains were capped in midday deals by official data showing Britain’s economy stalled in July. Paris and Frankfurt grew by bigger amounts as investors in the eurozone geared up for the European Central Bank’s interest-rate decision Thursday.

Asia’s main equity indices closed lower with a strong yen weighing on Tokyo’s market, while Chinese stocks were knocked by concerns over China’s struggling economy, analysts said. The US consumer price index later in the day will be pored over for an insight into the Fed’s rate decision on September 18 and what it could mean for the global economy. “The die has been cast for a rate cut by the Fed next week,” Mark Zandi at Moody’s Analytics told AFP.

Wednesday’s inflation print “would have to be well above the current consensus…to dissuade the Fed not to ease” by 25 basis points. “While a 50 basis-points cut is possible, it is less than likely, regardless of the CPI print, as the Fed would cut that much only if something in the economy or financial system was going off the rails. That isn’t happening,” Zandi added. The Fed is expected to cut borrowing costs for the first time since inflation rocketed and then fell in the wake of Russia’s invasion of Ukraine. The European Central Bank is expected to reduce eurozone interest rates again on Thursday.

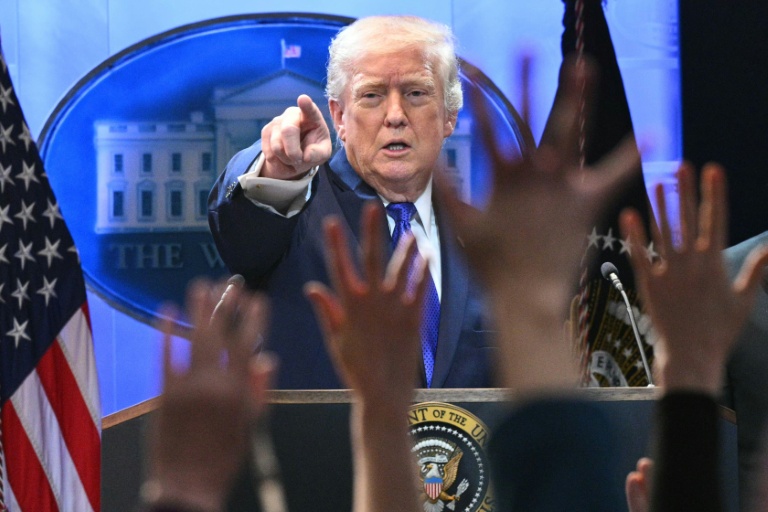

– Yen, oil higher – Elsewhere Wednesday, the yen hit a nine-month high after a Bank of Japan official hinted at more monetary tightening. The Japanese unit was boosted also by bets on a Kamala Harris presidency after she was considered to have come out on top in her US presidential debate with Donald Trump and following her endorsement by superstar Taylor Swift. The chances of Trump losing weighed on bitcoin after he had previously vowed to be a “pro-bitcoin president” if elected in November.

Another round of subpar US jobs data last week revived worries that the world’s top economy was slowing more than expected and could be on course for a recession. Investor uncertainty over the United States is compounded by the struggles of China’s economy, as leaders there try to kickstart growth in the face of a crisis in the huge property sector, tepid consumer activity, and soaring youth unemployment. Oil prices recovered in part after a hammering Tuesday, when Brent North Sea crude slid below $70 per barrel for the first time since December 2021 on concerns about the global outlook. Crude futures were hit also by the OPEC oil cartel revising down its demand estimates.

– Key figures around 1045 GMT –

London – FTSE 100: UP 0.1 percent at 8,211.69 points

Paris – CAC 40: UP 0.3 percent at 7,428.56

Frankfurt – DAX: UP 0.4 percent at 18,335.14

Tokyo – Nikkei 225: DOWN 1.5 percent at 35,619.77 (close)

Hong Kong – Hang Seng Index: DOWN 0.7 percent at 17,108.71 (close)

Shanghai – Composite: DOWN 0.8 percent at 2,721.80 (close)

New York – Dow: DOWN 0.2 percent at 40,736.96 points (close)

Dollar/yen: DOWN at 141.59 yen from 142.44 yen on Tuesday

Euro/dollar: UP at $1.1045 from $1.1023

Pound/dollar: DOWN at $1.3079 from $1.3083

Euro/pound: UP at 84.44 pence from 84.25 pence

Brent North Sea Crude: UP 2.1 percent at $70.62 per barrel

West Texas Intermediate: UP 2.3 percent at $67.23 per barrel

© 2024 AFP