New York (AFP) – Wall Street stocks finished little changed Tuesday as investors weighed how better than expected retail sales data would affect a Federal Reserve decision. After closing at a record Monday, the Dow edged lower, while both the S&P 500 and Nasdaq ended with modest gains.

“I think investors are beginning to recalibrate their expectations,” Jack Ablin of Cresset Capital said of the outlook on whether the Fed will opt for a bigger or smaller interest rate cut. “I just think it was a little too much optimism for a bigger rate cut,” Ablin added. The Fed began its two-day meeting, with Fed boss Jerome Powell having already signalled that slowing inflation will allow the central bank to cut rates for the first time in four years when it reports its decision on Wednesday.

Debate has focused on whether officials will go for 25 basis points or 50, with some warning that the bigger option could signal there is some concern about the economy. Earlier Tuesday, the Commerce Department reported that consumer spending cooled in August, but not as much as analysts had expected, indicating the economy remains healthy. Retail sales were up 0.1 percent in the month, while expectations had been for a 0.2 percent drop.

Bets on the US central bank opting for a super-sized cut have jumped in recent days, with observers suggesting officials want to go big before a series of smaller reductions. “It is extremely rare to go into a Fed meeting with such a high level of uncertainty,” said David Morrison, analyst at Trade Nation. “This means there is likely to be considerable volatility after the announcement.”

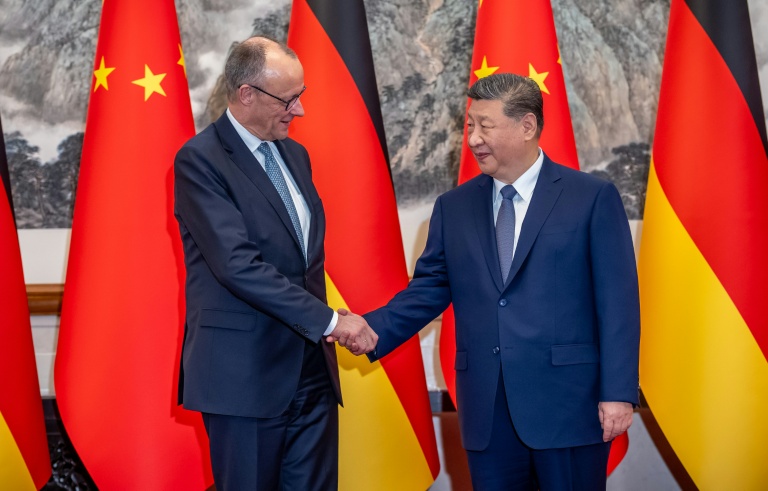

The expectations of lower interest rates have hurt the dollar in recent days, but it steadied Tuesday. There are concerns too over Europe’s biggest economy Germany as a survey Tuesday showed investor confidence fell significantly more than expected this month. The ZEW institute’s closely-watched economic expectations index fell to 3.6 points, down sharply from 19.2 points in August. But the Frankfurt stock market ended higher, along with the bourse in Paris.

Support has come from the European Central Bank’s decision last week to cut rates for the second time this year, according to analysts. The Bank of England will also hold a policy meeting on Thursday but is widely expected to maintain its key interest rate at 5.0 percent. Earlier, Tokyo closed down one percent as a strong yen weighed on Japanese exporters.

– Key figures around 1235 GMT –

New York – Dow: DOWN less than 0.1 percent at 41,606.18 (close)

New York – S&P 500: UP less than 0.1 percent at 5,634.58 (close)

New York – Nasdaq Composite: UP 0.2 percent at 17,628.06 (close)

London – FTSE 100: UP 0.4 percent at 8,309.86 (close)

Paris – CAC 40: UP 0.5 percent at 7,487.42 (close)

Frankfurt – DAX: UP 0.5 percent at 18,726.08 (close)

Tokyo – Nikkei 225: DOWN 1.0 percent at 36,203.22 (close)

Hong Kong – Hang Seng Index: UP 1.4 percent at 17,660.02 (close)

Shanghai – Composite: Closed for a holiday

Euro/dollar: DOWN at $1.1116 from $1.1133 on Monday

Pound/dollar: DOWN at $1.3162 from $1.3226

Dollar/yen: UP at 141.22 yen from 140.62 yen

Euro/pound: UP at 84.46 pence from 84.17 pence

West Texas Intermediate: UP 1.6 percent at $71.19 per barrel

Brent North Sea Crude: UP 1.3 percent at $73.30 per barrel

© 2024 AFP