New York (AFP) – Global stock markets rallied Thursday, with major US indices surging to all-time highs after the Federal Reserve delivered a bumper interest-rate cut and pledged further reductions. Following an up day in Europe and Asia that also lifted Frankfurt to a record, Wall Street stocks shrugged off Wednesday’s lackluster trading and opened higher, never looking back after that.

US indices spent the entire day in positive territory, with the Dow finishing above 42,000 for the first time and the S&P 500 jumping 1.7 percent to also close at a record. “The rate cut seen and heard around the world yesterday has fostered quite the response today — even though it was initially met with some stifled enthusiasm yesterday,” said Patrick O’Hare, market analyst at stock analysis firm Briefing.com.

The Fed on Wednesday cut its key lending rate by half a percentage point, opting for the larger reduction after also weighing a quarter-point move. The aggressive cut split opinion among analysts, with some warning it could reignite inflation, while others said it showed the bank was keeping ahead of the curve in supporting the economy.

Among other markets, Frankfurt closed with a 1.6 percent gain and a record close of 19,002.38 points after setting a record session high of 19,044.96. Paris ended up 2.3 percent after its strongest session since January. London’s FTSE 100 index closed up 0.9 percent, paring back some gains after the Bank of England held its own rate steady at five percent. The decision was expected, avoiding a second reduction in a row after the Bank of England delivered its first cut in August. BoE governor Andrew Bailey said the central bank needed “to be careful not to cut too fast or by too much,” as UK inflation stays above its target.

The pound hit a more than two-year high against the dollar before easing back. Tokyo and Hong Kong closed around two percent higher. Fawad Razaqzada, market analyst at City Index and FOREX.com, said the half-point US cut was being “seen as a bold but necessary step to ease economic concerns without sending panic signals reminiscent of the 2008 financial crisis.” Norway’s central bank also opted to keep its policy rate unchanged, holding it at a 16-year high and warning that the first cut would only come in the first quarter of 2025.

– Key figures around 2030 GMT –

New York – Dow: UP 1.3 percent at 42,025.19 (close)

New York – S&P 500: UP 1.7 percent at 5,713.64 (close)

New York – Nasdaq Composite: UP 2.5 percent at 18,013.98 (close)

London – FTSE 100: UP 0.9 percent at 8,328.72 (close)

Paris – CAC 40: UP 2.3 percent at 7,615.41 (close)

Frankfurt – DAX: UP 1.6 percent at 19,002.38 (close)

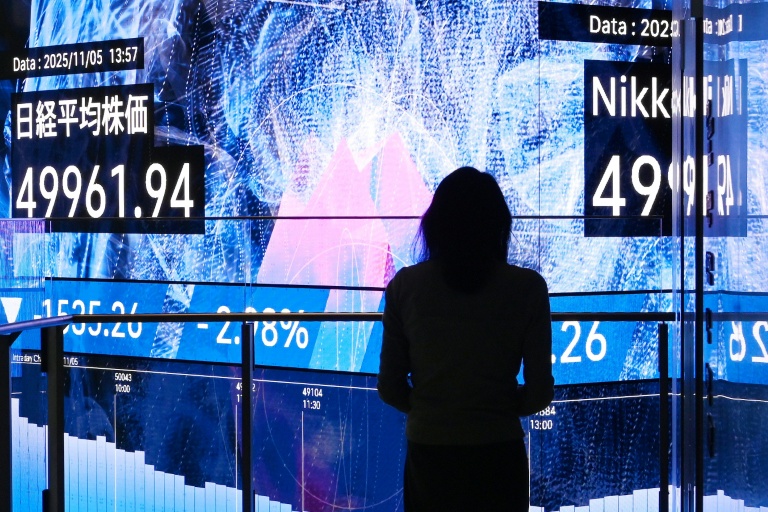

Tokyo – Nikkei 225: UP 2.1 percent at 37,155.33 (close)

Hong Kong – Hang Seng Index: UP 2.0 percent at 18,013.16 (close)

Shanghai – Composite: UP 0.7 percent at 2,736.02 (close)

Pound/dollar: UP at $1.3281 from $1.3214 on Wednesday

Euro/dollar: UP at $1.1161 from $1.1119

Dollar/yen: UP at 142.57 yen from 142.29 yen

Euro/pound: DOWN at 84.03 pence from 84.14 pence

Brent North Sea Crude: UP 1.7 percent at $74.88 per barrel

West Texas Intermediate: UP 1.5 percent at $71.95 per barrel

© 2024 AFP