Hong Kong (AFP) – Hong Kong stocks resumed their China-fuelled rally Friday on a broadly positive day for Asian markets while oil prices stabilised after soaring on fears about the Middle East crisis as investors await Israel’s response to Iran’s missile attack. Buyers were back in the driving seat in Hong Kong after retreating for the first time Thursday since Beijing last week unveiled a raft of economy-boosting measures that has seen investors flooding back to the market. The stimulus — mainly targeting the property sector — has seen stocks in the city and mainland China enjoy a blistering run of more than 20 percent on hopes that Beijing can finally reignite growth.

The Hang Seng Index climbed around two percent Friday, with tech firms leading the charge, while developers — who have seen eye-watering gains over the past week — fluctuated as investors await cues from China. Mainland markets are closed for the Golden Week holiday. There were also gains in Tokyo at the end of a rollercoaster week dictated by a volatile yen after the election of Shigeru Ishiba as prime minister. The yen initially surged to less than 142 per dollar on the news owing to Ishiba’s previous support for Bank of Japan interest rate hikes. But it sank later in the week to more than 147 after he said the country was not yet ready for a third increase this year. It was around 146.50 on Friday.

“Investors are likely to remain on edge as they weigh the evolving monetary policy signals from Japan against shifting geopolitical developments,” said ACY Securities currency analyst Luca Santos. Singapore, Seoul, Wellington, Mumbai, Bangkok, and Manila rose, though Sydney, Taipei, and Jakarta edged down along with London, Frankfurt, and Paris.

Investors are now awaiting the release of key US jobs data later in the day, which they hope could provide an idea about the Federal Reserve’s thinking on whether or not to cut rates again this month, and if so by how much. Speculation about Israel’s response to the scores of missiles fired at it on Tuesday has stoked concern that the region could erupt into a wider conflict that incorporates Iran. Crude has risen around 10 percent since that attack on supply fears, while China’s drive to reignite its vast economy has the potential to cause a demand surge.

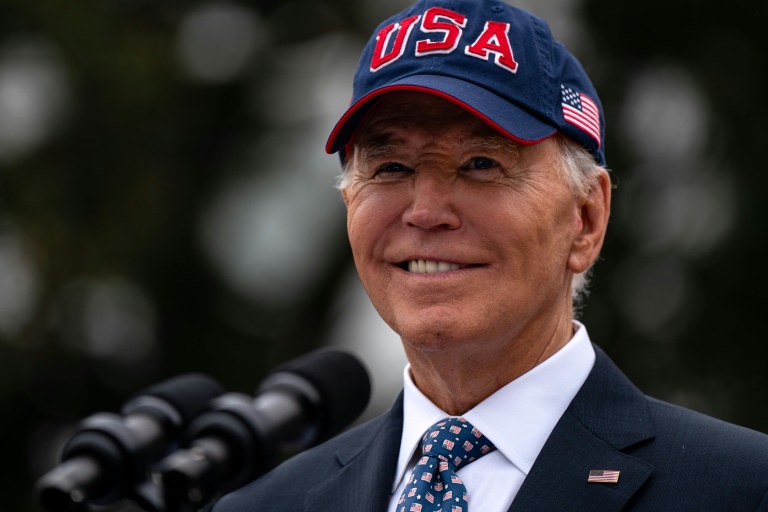

Both main contracts rocketed around five percent Thursday when US President Joe Biden said he was “discussing” possible Israeli strikes on Iranian oil sites in retaliation for Tehran’s barrage. However, they were essentially flat in Asian trade. As Israel continues air and ground attacks on Hezbollah in Lebanon, Iran — which arms and funds the militants — said it would step up its response in the event of a retaliation. Still, IG market analyst Tony Sycamore said it was unlikely Iran’s oil would be targeted owing to the fact it could rekindle inflation just as global central banks fight to bring it down.

“Instead, Israel is more likely to target critical weapons factories and military installations, similar to actions taken in April,” he wrote. “In the aftermath, there is hope for a return to the shadow conflict that has been ongoing between Israel and Iran’s regional proxies since the 7 October Hamas attack.” He added that if the crisis did escalate into a direct confrontation, “there’s a risk that Iranian oil (four percent of global supply) could be cut off by embargoes or military actions.” “The potential loss of Iranian supply might be offset by the return of Libyan oil and increased Saudi production, as voluntary supply cuts are set to expire on 1 December,” he said.

– Key figures around 0710 GMT –

West Texas Intermediate: FLAT at $73.69 per barrel

Brent North Sea Crude: FLAT at $77.60 per barrel

Tokyo – Nikkei 225: UP 0.2 percent at 38,635.62 (close)

Hong Kong – Hang Seng Index: UP 2.1 percent at 22,573.41

London – FTSE 100: DOWN 0.3 percent at 8,261.77

Shanghai – Composite: Closed for a holiday

Pound/dollar: UP at $1.3151 from $1.3124 on Thursday

Euro/dollar: UP at $1.1031 from $1.1029

Euro/pound: DOWN at 83.90 pence from 84.03 pence

Dollar/yen: DOWN at 146.20 from 146.92 yen

New York – Dow: DOWN 0.4 percent at 42,011.59 (close)

© 2024 AFP