London (AFP) – Oil prices rose further Friday as tensions mount in the Middle East, while Hong Kong’s stock markets resumed a rally caused by China’s recently-announced measures to stimulate its economy. Europe’s main equity indices diverged nearing the half-way stage, with London weighed down by a rebounding pound alongside gains for Paris and Frankfurt. The dollar was mixed against its main rivals as traders awaited key US jobs data due Friday that could give a clearer idea of the pace of planned interest-rate cuts from the Federal Reserve.

“Oil prices continued their ascent,” noted Russ Mould, investment director at trading group AJ Bell, as Brent North Sea crude and the main US contract each gained about one percent. “This is good news for oil producers but bad news for millions of companies and consumers as they face higher energy and transport costs,” he added.

Buyers of company shares were back in the driving seat in Hong Kong, after a pause Thursday to the rally that started last week thanks to Beijing unveiling a raft of economy-boosting measures. The stimulus — mainly targeting the property sector — has seen stocks in the city and mainland China enjoy a blistering run of more than 20 percent on hopes that Beijing can finally reignite growth. Hong Kong’s Hang Seng Index closed up almost three percent Friday, with tech firms leading the charge, while developers — who have seen eye-watering gains over the past week — fluctuated as investors awaited cues from China. Mainland Chinese markets were closed for the Golden Week holiday.

There were also gains in Tokyo at the end of a rollercoaster week dictated by a volatile yen after the election of Shigeru Ishiba as prime minister. “Investors are likely to remain on edge as they weigh the evolving monetary policy signals from Japan against shifting geopolitical developments,” said ACY Securities currency analyst Luca Santos.

Attention was firmly on the oil market as tensions escalate in the crude-rich Middle East. Israel bombarded south Beirut at least 10 times late Thursday, Lebanese sources said, after it launched its deadliest strike on the occupied West Bank in decades. The escalating assaults by Israel come as it weighs retaliation for Iran’s barrage of missiles fired at the country, with the United States saying Israel hitting Iranian oil facilities is on the table. Iran said the attack was its response to the killing of Hassan Nasrallah, chief of its ally Hezbollah, and other top figures.

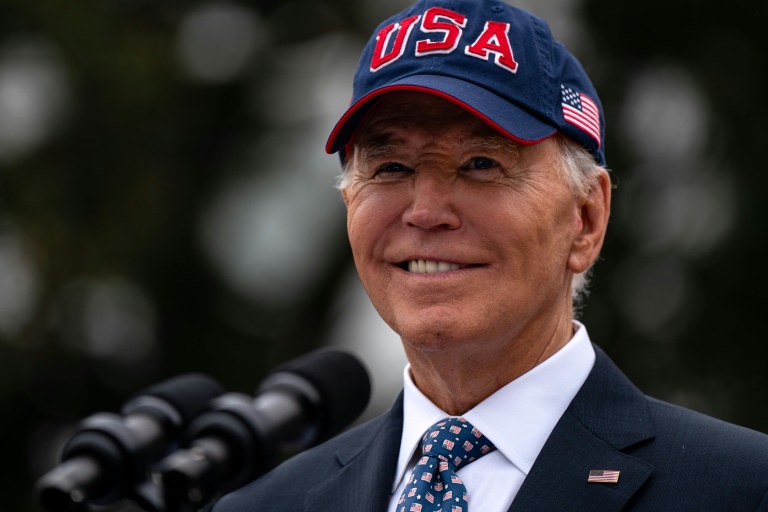

Crude prices rocketed around five percent Thursday when US President Joe Biden said he was “discussing” possible Israeli strikes on Iranian oil sites in retaliation for Tehran’s barrage. Meanwhile, China’s drive to reignite its vast economy has the potential to cause a surge in demand for oil, according to analysts.

– Key figures around 1000 GMT –

Brent North Sea Crude: UP 1.0 percent at $78.37 per barrel

West Texas Intermediate: UP 1.1 percent at $74.50 per barrel

London – FTSE 100: DOWN 0.4 percent at 8,246.53 points

Paris – CAC 40: UP 0.4 percent at 7,510.60

Frankfurt – DAX: UP 0.2 percent at 19,045.58

Hong Kong – Hang Seng Index: UP 2.8 percent at 22,736.87 (close)

Tokyo – Nikkei 225: UP 0.2 percent at 38,635.62 (close)

Shanghai – Composite: Closed for a holiday

New York – Dow: DOWN 0.4 percent at 42,011.59 (close)

Pound/dollar: UP at $1.3167 from $1.3124 on Thursday

Euro/dollar: DOWN at $1.1027 from $1.1029

Euro/pound: DOWN at 83.73 pence from 84.03 pence

Dollar/yen: DOWN at 146.44 from 146.92 yen

© 2024 AFP