New York (AFP) – Major stock markets mostly retreated Monday on profit-taking as oil prices jumped and traders weighed fresh interest-rate cuts from China’s central bank. Another record session Friday on Wall Street crowned a sixth weekly gain in a row, but failed to carry over into Monday and inspire a similar rally elsewhere. Both the Dow and S&P 500 pulled back as treasury bond yields rose in the first session of a heavy week of earnings reports.

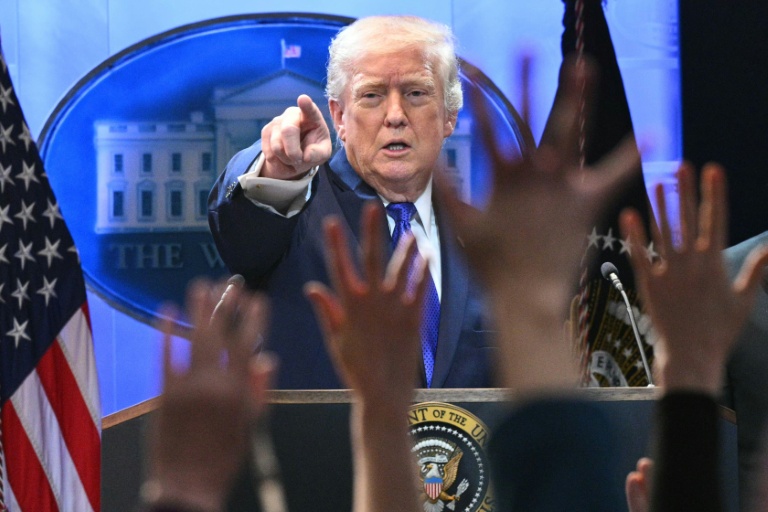

“Perhaps the market is reacting to higher bond yields and higher oil prices,” Jack Ablin, chief investment officer of Cresset Capital Management, said of the mostly down session. Ablin said many investors are “sitting tight” with the US presidential election now in its home stretch. “It just seems like an awkward time to be making big bets,” he said. “We’ll know a lot more in two weeks we hope.”

Investors are also biding time as they await the next batch of corporate earnings, with Google’s parent company Alphabet to report its third-quarter figures on Tuesday and IBM and Tesla to follow on Wednesday. Boeing, Coca-Cola, General Motors, and L’Oreal also report their earnings this week.

Haven investment gold reached a new all-time high on geopolitical concerns and uncertainty over the upcoming US election, analysts said. Oil prices, which tumbled more than eight percent last week, also drew support from Middle East unrest, as well as from hopes of increased demand from China — the world’s top importer of crude. “The idea is that the move (on Chinese rates) will encourage lending and spending and help mend the ailing property market,” said Susannah Streeter, head of money and markets at Hargreaves Lansdown. “But there are still expectations that further fiscal stimulus will be needed.”

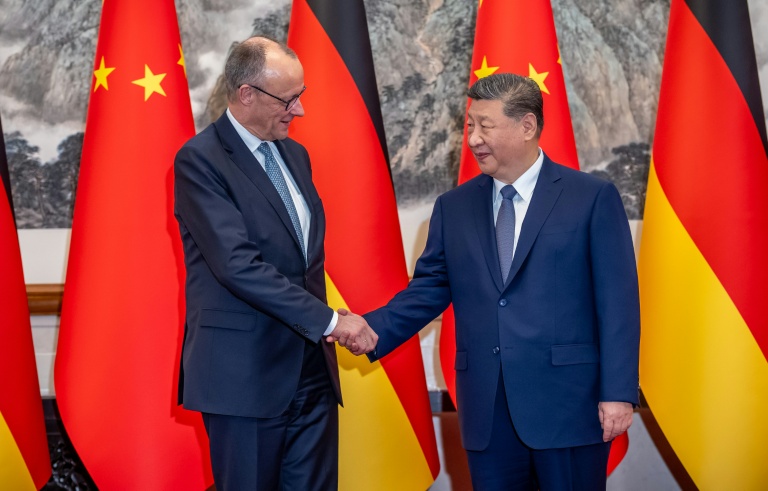

China’s central bank on Monday said it had slashed two key interest rates to all-time lows as part of an official drive to revive spending and achieve a five-percent annual economic growth target. The move comes after figures last week showed China’s economy expanded at its slowest quarterly pace since the start of 2023, but still better than forecast. Beijing has since last month unveiled economy-reviving measures, including rate cuts, an easing of home-buying rules, and pledges to support equity markets. The announcements inspired a blockbuster rally in mainland and Hong Kong stocks, but some gains have been erased after a series of disappointing news conferences that failed to provide any detail or meaningful measures.

“Officials are gradually ramping up support to kick-start the economy — but the will-they-won’t-they of announcements has made the process a rollercoaster for markets,” Moody’s Analytics said Monday. In foreign exchange, the dollar rose against other major currencies as markets bet the Federal Reserve will take a go-slow approach to cutting interest rates.

**Key figures around 2030 GMT -**

New York – Dow: DOWN 0.8 percent at 42,931.60 (close)

New York – S&P 500: DOWN 0.2 percent at 5,853.98 (close)

New York – Nasdaq Composite: UP 0.3 percent at 18,540.01 (close)

London – FTSE 100: DOWN 0.5 percent at 8,318.24 (close)

Paris – CAC 40: DOWN 1.0 percent at 7,536.23 (close)

Frankfurt – DAX: DOWN 1.0 percent at 19,461.19 (close)

Tokyo – Nikkei 225: DOWN 0.1 percent at 38,954.60 (close)

Hong Kong – Hang Seng Index: DOWN 1.6 percent at 20,478.46 (close)

Shanghai – Composite: UP 0.2 percent at 3,268.11 (close)

Euro/dollar: DOWN at $1.0818 from $1.0867 on Friday

Pound/dollar: DOWN at $1.2982 from $1.3029

Dollar/yen: UP at 150.82 yen from 149.53 yen

Euro/pound: DOWN at 83.30 pence from 83.40 pence

West Texas Intermediate: UP 1.9 percent at $70.56 per barrel

Brent North Sea Crude: UP 1.7 percent at $74.29 per barrel.

burs-jmb/jgc

© 2024 AFP