London (AFP) – European equities mostly rose Friday but US shares slipped as dealers mulled data that dampened hopes for several interest rate cuts from the Federal Reserve this year.

While Paris and Frankfurt were higher Friday, they were below peaks they’d hit Thursday.

Profit-taking weighed on oil and the cryptocurrency bitcoin, which slid from its historic pinnacle hit the day before on a wave of investor enthusiasm.

Wall Street slipped Thursday following news of a sharper-than-expected jump in US wholesale prices, and the signs of continued sticky inflation were again weighing on prices Friday.

All three main Wall Street indexes opened lower Friday. “US equities are well overdue a pullback given the rally since October and the number of fresh highs recorded by the major indices.” said David Morrison, analyst at Trade Nation.

“A note of uncertainty has suddenly entered the market.” Eyes next week turn to the Fed’s latest monetary policy meeting.

Thursday’s surprisingly large bump in February’s US producer price index followed a forecast-beating read on consumer prices earlier in the week and overshadowed separate figures pointing to a slowdown in retail sales.

The data “cooled investors’ appetite for risk after it confirmed the rising price acceleration for February”, said ActivTrades analyst Pierre Veyret.

“This does not support the case of a quick dovish move from the Fed.”

– Fed outlook –

While Fed officials are not expected to move on rates next week, their post-meeting statement will be pored over for an idea of their thinking, with many — including boss Jerome Powell — having warned they will only cut when confident inflation is under control.

The cental bank’s dot plot estimates for rates through the rest of the year will also be closely examined.

Markets have been pricing in three cuts — in line with policymakers’ most recent forecasts — but analysts have warned that forecast might have to be re-considered if inflation data keeps coming in higher than expectations.

Analysts said the latest figures suggest the personal consumption expenditures (PCE) price index, the Fed’s preferred gauge of inflation, could come in higher than hoped.

Europe, however, was outpacing Wall Street on expectations the European Central Bank could cut still start cutting interest rates this summer, even if the Fed doesn’t. “The ECB doesn’t need to wait for the Fed,” said Jack Allen-Reynolds, deputy chief eurozone economist at Capital Economics, adding that the Norwegian and Swiss central banks could cut rates in the coming weeks.

Even if neither country uses the euro, their moves would underscore that European monetary policy doesn’t necessarily have to take its cue from the Fed.

Vodafone shares were up 6 percent after the UK-based telecoms company sold its Italian unit to Swisscom for 8 billion euros ($8.7 billion)

In cryptocurrency trading Friday, bitcoin was at $67,699, after spiking on Thursday to an all-time high of $73,797.

“After bitcoin was hitting all-time highs almost on an hourly basis in recent days, investors have been profit-taking,” said Nigel Green, head of financial advisory firm deVere Group.

The unit has rocketed about 50 percent higher since the middle of February as rate-cut hopes weighed on the dollar.

Bitcoin has also benefitted from surging interest caused by US authorities’ decision to allow greater trading accessibility.

Oil rose to its highest since November Thursday on reports of coming tightness in the market, but fell back Friday.

– Key figures around 1340 GMT –

London – FTSE 100: DOWN less than 0.1 percent at 7,742.76 points

Paris – CAC 40: UP 0.5 percent at 8,201.72

Frankfurt – DAX: UP 0.3 percent at 17,990.82

EURO STOXX 50: UP 0.3 percent at 5,007.60

New York – Dow: DOWN 0.2 percent at 38,827.08

New York – S&P 500: DOWN 0.6 percent at 5,119.75

New York – Nasdaq Composite: DOWN 0.8 percent at 15,999.40

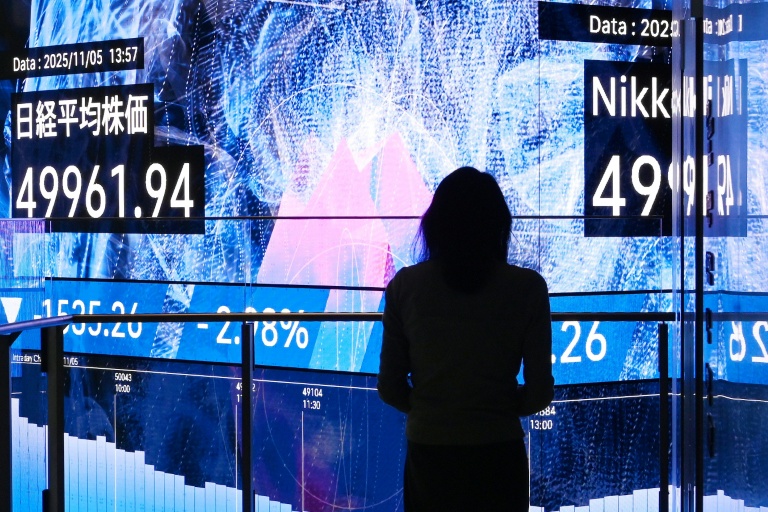

Tokyo – Nikkei 225: DOWN 0.3 percent at 38,707.64 (close)

Hong Kong – Hang Seng Index: DOWN 1.4 percent at 16,720.89 (close)

Shanghai – Composite: UP 0.5 percent at 3,054.64 (close)

Euro/dollar: UP at $1.0890 from $1.0889 on Thursday

Dollar/yen: UP at 148.89 yen from 148.28 yen

Pound/dollar: UNCHANGED at $1.2752

Euro/pound: UP at 85.42 pence from 85.36 pence

West Texas Intermediate: DOWN 0.6 percent at $80.74 per barrel

Brent North Sea Crude: DOWN 0.6 percent at $84.93 per barrel

© 2024 AFP