Hong Kong (AFP) – Asian stocks gained on Monday after China posted stronger-than-expected industrial production data in an uneven recovery for the world’s second-largest economy.

Investors also have their eyes on a Bank of Japan decision on Tuesday, with policymakers expected to finally ditch the bank’s negative interest rate.

Shanghai closed up 1.0 percent and Hong Kong added 0.1 percent after Beijing released industrial production and fixed-asset investment figures that were “surprisingly spritely”, said Harry Murphy Cruise of Moody’s Analytics.

“China’s economy had a stronger start to the year than expected,” he told AFP, but warned that “we should take the latest data with a grain of salt”.

“Today’s prints are inflated by this year’s bigger Lunar New Year celebrations compared to those last year marred by rapidly rising Covid-19 cases,” Cruise said.

China’s industrial production was up 7.0 percent year-on-year in January and February, beating the 6.8 percent rise in December and the 5.2 percent predicted for the period by Bloomberg.

Household consumption was sluggish, reflecting a fragile recovery for the Chinese economy.

“Headwinds still remain: real estate investment continues to be a drag, deflation’s reversal is likely only fleeting and export’s outlook is clouded by geopolitical tensions and still-high global interest rates,” Cruise said.

– Eyes on Bank of Japan –

Taipei rose 1.0 percent, Seoul gained 0.7 percent and Manila added 0.4 percent.

Bangkok and Sydney were up but Wellington fell 0.3 percent and Singapore slid 0.1 percent.

Europe’s major stock markets also opened higher ahead of key eurozone inflation data and a slew of central bank decisions this week.

The US Federal Reserve, the Reserve Bank of Australia, the Bank of England and the Swiss National Bank are among the institutions holding policy meetings.

But only one is expected to make a major move — the Bank of Japan, which wraps up its two-day policy meeting on Tuesday.

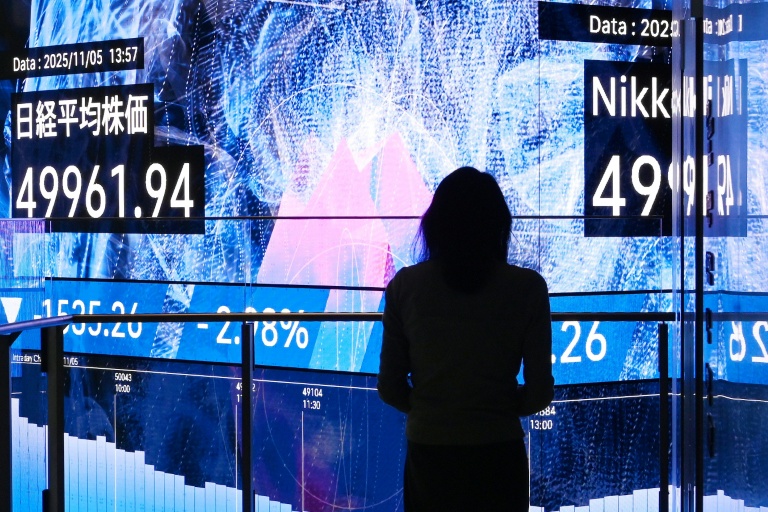

Tokyo closed 2.7 percent higher on Monday after the influential Nikkei business daily reported that the BoJ plans to raise interest rates for the first time since 2007.

Strong wins for workers in annual pay negotiations have also pointed to the bank ending its outlier negative rate policy designed to boost the flagging economy.

Tom Kenny, senior international economist at ANZ, said that even if it does raise rates, guidance from the BoJ’s governor Kazuo Ueda “is likely to be dovish”.

“He has previously said that policy will remain accommodative after the removal of the (negative interest rate policy) and has ruled out the possibility of successive rate hikes,” Kenny said.

Dampened hopes for Federal Reserve rate cuts led Wall Street to close lower on Friday, and now “all eyes are on whether the Fed will adjust its rate hike outlook for 2024”, said Stephen Innes of SPI Asset Management.

“Uncertainty around this pivotal event may temper market activity in the coming days,” he said.

– Key figures around 0830 GMT –

Tokyo – Nikkei 225: UP 2.7 percent at 39,740.44 (close)

Hong Kong – Hang Seng Index: UP 0.1 percent at 16,737.12 (close)

Shanghai – Composite: UP 1.0 percent at 3,084.93 (close)

London – FTSE 100: UP 0.1 percent at 7,732.97

Dollar/yen: UP at 149.12 yen from 149.08 yen on Friday

Euro/dollar: UP at $1.0892 from $1.0891

Pound/dollar: UP at $1.2743 from $1.2737

Euro/pound: FLAT at 85.48 pence

West Texas Intermediate: UP 0.8 percent at $81.69 per barrel

Brent North Sea Crude: UP 0.7 percent at $85.91 per barrel

New York – Dow: DOWN 0.5 percent at 38,714.77 points (close)

© 2024 AFP