London (AFP) – Stock markets diverged Wednesday as they digested a mixed bag of economic data and corporate reports, while bitcoin traded close to its record high with eyes on the upcoming US presidential election. The three main US stock indexes vacillated throughout the morning, but were all slightly higher in midday trading. Major European markets all closed sharply lower.

Google-parent Alphabet was up almost six percent in New York after reporting positive results after Tuesday’s close, but that was outweighed by disappointing results and guidance from tech company AMD, down more than nine percent, and drugmaker Eli Lilly, down more than seven percent. Microsoft and Facebook-parent Meta report later Wednesday.

On the economic front, the US economy grew at a healthy 2.8 percent annual rate in the third quarter, even if it undershot analyst expectations and slowed slightly from the previous quarter. “While the initial Q3 GDP report missed economists’ expectations, the miss was minor and reaffirms that the US economy remains on solid footing,” according to eToro analyst Bret Kenwell. On Thursday, the Federal Reserve’s favorite inflation measure will be released, while the monthly labor jobs report comes Friday.

In the eurozone, Paris and Frankfurt closed down more than one percent. “Investors are in no mood to increase their exposure to equity markets, given the lack of a clear lead from the US where consolidation seems to be the order of the day,” said David Morrison, analyst at Trade Nation. The eurozone economy grew a better-than-expected 0.4 percent in the third quarter, the bloc reported Wednesday. But the spurt was largely due to one-off factors such as the Olympics, and next quarter’s report may not be so rosy, said Fawad Razaqzada, analyst at City Index. “Recent forward-looking surveys have been far from great, suggesting that the eurozone economy remained sluggish at the start of Q4,” he said.

Outside the eurozone, London’s stock market dropped, though less than Paris and Frankfurt, as the UK’s new Labour government said it would raise taxes by 40 billion pounds and that the deficit will shrink next year. UBS shares slumped more than 4 percent after the Swiss bank highlighted a gloomy economic outlook despite making healthy profits in the third quarter.

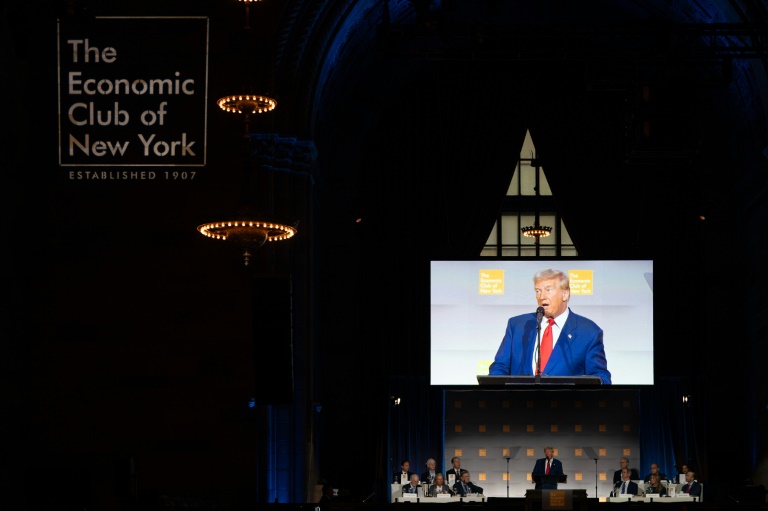

Asia’s top indices closed mostly down, while in foreign exchange the dollar was mixed against main rivals. Bitcoin steadied, a day after striking just shy of its all-time peak of $73,797.98 achieved in March. A recent surge in the price of bitcoin is seen as a bet on a Republican victory in next week’s US vote, as Donald Trump has emerged as the pro-crypto candidate. The outcome at the polls remains uncertain for many analysts, however, helping haven investment gold to a fresh record high of $2,789.86 an ounce Wednesday. The economic programs of both candidates are expected to add greatly to the US debt load.

Oil prices rebounded after a surprise decline in US petroleum reserves, even though concerns persist about whether there will be enough takers for an expected increase in global crude production next year. “It seems as if oil prices are ignoring improving economic data in the US and stimulus efforts from China to revive its struggling economy,” said Daniela Sabin Hathorn, senior market analyst at Capital.com.

– Key figures around 1640 GMT –

New York – Dow: UP 0.3 percent at 42,387.77 points

New York – S&P 500: UP 0.2 percent at 5,842.54

New York – Nasdaq Composite: UP 0.1 percent at 18,734.64

London – FTSE 100: DOWN 0.7 percent at 8,159.63 (close)

Paris – CAC 40: DOWN 1.1 percent at 7,428.36 (close)

Frankfurt – DAX: DOWN 1.1 at 19,257.34 (close)

Tokyo – Nikkei 225: UP 1.0 percent at 39,277.39 (close)

Hong Kong – Hang Seng Index: DOWN 1.6 percent at 20,380.64 (close)

Shanghai – Composite: DOWN 0.6 percent at 3,266.24 (close)

Euro/dollar: UP at $1.0863 from $1.0816 on Tuesday

Pound/dollar: DOWN at $1.3006 from $1.3010

Dollar/yen: DOWN at 153.08 yen from 153.57 yen

Euro/pound: UP at 83.53 pence from 83.13 pence

Brent North Sea Crude: UP 2.3 percent at $72.77 per barrel

West Texas Intermediate: UP 2.5 percent at $68.90 per barrel

© 2024 AFP