New York (AFP) – Major stock markets mostly rose and the dollar remained under pressure Tuesday as Americans cast votes in a knife-edge presidential election. Wall Street’s main indexes, which had fallen the previous day, rebounded after voting began in the world’s biggest economy. In Europe, London dipped 0.1 percent as investors awaited an interest-rate decision by the Bank of England on Thursday, while Paris and Frankfurt ended the day with modest gains. Equities in Shanghai and Hong Kong won strong support from hopes over China’s economy. The dollar weakened against the euro, the British pound, and the yen.

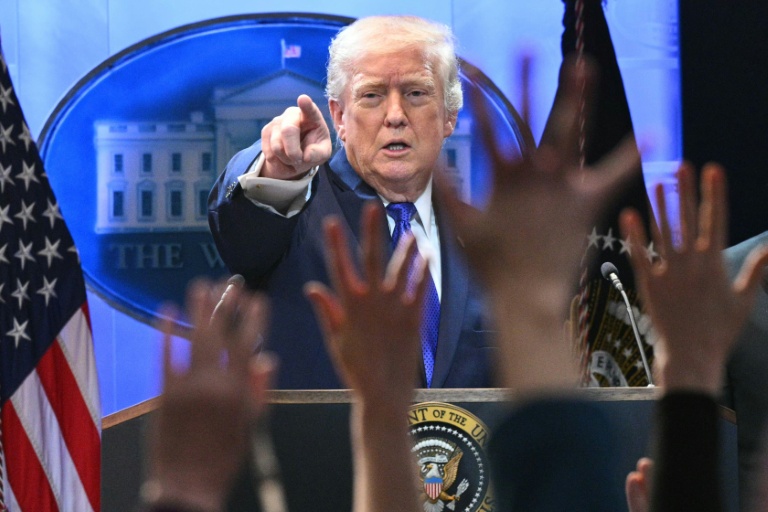

Forecasters have for weeks pointed to a neck-and-neck contest between Vice President Kamala Harris and former President Donald Trump. A win for Trump is expected to stoke inflation and send Treasury yields higher owing to his pledges to slash taxes and impose tariffs on imports, which could push up the dollar. Analysts see less upheaval from a win by Democratic Vice President Harris.

“A pro-tariff Trump presidency could see the dollar strengthen amid concerns higher inflation will prompt the Fed to keep interest rates higher,” predicted Matt Britzman, senior equity analyst at Hargreaves Lansdown. “There is likely to be a period of volatility particularly if the result is contested, but investors should keep their eyes on long-term horizons as historically financial markets have risen over the course of both Democratic and Republican presidencies,” he added.

Fawad Razaqzada, analyst at City Index and Forex.com, said that “traders are not committing to any particular direction across financial markets, and you can’t really blame them.” Given that the race appears to be a toss-up, “this makes it extremely difficult to make a strong case for the direction of the dollar or stocks this week,” he added. Investors are also awaiting another US Federal Reserve rate cut on Thursday as inflation cools.

– Asia up –

Hong Kong and Shanghai each closed up by more than two percent Tuesday after data showed China’s services sector expanded last month at its fastest pace since July. The news came as traders awaited the end of a Chinese government meeting this week to hammer out an economic stimulus. Officials are expected to give the go-ahead to about $140 billion in extra budget spending, mostly for indebted local governments, and a similar one-off payment for banks. Chinese Premier Li Qiang, meanwhile, said he was “fully confident” that China’s economy would hit its growth targets this year and indicated that there was room to do more.

Oil prices rose, but less sharply, having surged almost three percent Monday on worries about the Middle East crisis and as top producers agreed to extend output cuts through to the end of December.

– Key figures around 2130 GMT –

New York – Dow: UP 1.0 percent at 42,221.88 (close)

New York – S&P 500: UP 1.2 percent at 5,782.76 (close)

New York – Nasdaq: UP 1.4 percent at 18,439.17 (close)

London – FTSE 100: DOWN 0.1 percent at 8,172.39 (close)

Paris – CAC 40: UP 0.5 percent at 7,407.15 (close)

Frankfurt – DAX: UP 0.6 percent at 19,256.27 (close)

Tokyo – Nikkei 225: UP 1.1 percent at 38,474.90 (close)

Hong Kong – Hang Seng Index: UP 2.1 percent at 21,006.97 (close)

Shanghai – Composite: UP 2.3 percent at 3,386.99 (close)

Euro/dollar: UP at $1.0930 from $1.0878 on Monday

Pound/dollar: UP at $1.3035 from $1.2957

Dollar/yen: DOWN at 151.60 yen from 152.13 yen

Euro/pound: DOWN at 83.82 from 83.96 pence

Brent North Sea Crude: UP 0.6 percent at $75.53 per barrel

West Texas Intermediate: UP 0.7 percent at $71.99 per barrel

burs-jmb/des

© 2024 AFP