Washington (AFP) – Global markets were mixed on Monday as traders largely treaded water after a busy period that saw a post-election “explosion” in enthusiasm in the United States, followed by a pullback last week. Focus also turned to chip behemoth Nvidia ahead of its quarterly earnings on Wednesday, which could indicate prospects for the entire tech sector. Wall Street’s three major indices finished mixed, with the Dow edging lower, and the S&P and the Nasdaq closing slightly higher, as few investors were willing to take new positions ahead of Nvidia’s results.

It was “a relatively unremarkable day, in terms of magnitude of move,” Art Hogan from B. Riley Wealth Management told AFP. This was “not surprising,” he added, pointing to the post-election market “explosion,” and the subsequent drawback last week. “We kind of entered the new week at a midpoint with very little economic data,” he said. European markets tracked their losses on Monday, while Asian markets were mixed.

– Rising trade tensions –

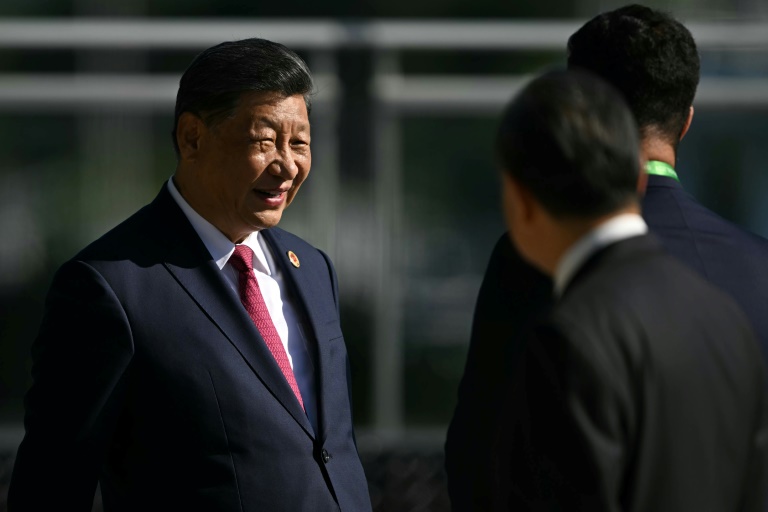

Expectations that a second Trump administration will impose painful fresh tariffs on Chinese goods have added to the unease and ramped up fears of another trade war between the economic powerhouses. “It is likely that if Trump does proceed with tariffs on Chinese goods, they will respond aggressively,” said Kathleen Brooks, research director at traders XTB. In Europe, the vice president of the European Central Bank said Monday that Trump’s spending plans risked inflating the US government’s budgetary deficit and spreading worries on markets. “Trade tensions could rise further,” with resulting risks for economic activity, Luis de Guindos noted.

Investor focus this week will also be on the release of purchasing managers’ index data for signals about the health of business activity in the eurozone, Britain and the United States. Friday’s PMI data “may capture some of the initial sentiment impact from around the world regarding Trump’s victory,” said Jim Reid, economist at Deutsche Bank. “Europe will be especially interesting on this front as the continent awaits their trade fate,” he added.

In Asia on Monday, Tokyo and Shanghai stock markets closed lower while Hong Kong rose, helped by hopes of more Chinese stimulus after a recent raft of measures. Bitcoin sat at around $91,000, having hit another record high of $93,462 last week on hopes Trump will push for more deregulation of the crypto market. And crude oil prices jumped after production stopped at a key Norwegian field in the North Sea, Sverdrup, due to an electrical supply disruption.

– Key figures around 2130 GMT –

New York – Dow: DOWN 0.1 percent at 43,389 points (close)

New York – S&P 500: UP 0.4 percent at 5,893.62 (close)

New York – Nasdaq: UP 0.6 percent at 18,791.81 (close)

London – FTSE 100: UP 0.6 percent at 8,109.32 (close)

Paris – CAC 40: UP 0.1 percent at 7,278.23 (close)

Frankfurt – DAX: DOWN 0.1 percent at 19,189.19 (close)

Tokyo – Nikkei 225: DOWN 1.1 percent at 38,220.85 (close)

Hong Kong – Hang Seng Index: UP 0.8 percent at 19,576.61 (close)

Shanghai – Composite: DOWN 0.2 percent at 3,323.85 (close)

Euro/dollar: UP at $1.0600 from $1.0536 on Friday

Pound/dollar: UP at $1.2678 from $1.2611

Dollar/yen: UP at 155.04 yen from 154.32 yen

Euro/pound: UP at 83.57 pence from 83.52 pence

Brent North Sea Crude: UP 3.2 percent at $73.30 per barrel

West Texas Intermediate: UP 3.2 percent at $69.16 per barrel

© 2024 AFP