Hong Kong (AFP) – The yen rallied Friday after forecast-busting inflation data out of Tokyo boosted talk of another Japanese interest rate hike next month, while equity markets were mixed as traders weigh the economic outlook during a second Trump administration.

With Wall Street closed for the Thanksgiving break, there were few catalysts to drive business heading into the weekend and at the end of a rollercoaster month dominated by uncertainty in the wake of Donald Trump’s election victory. Traders are tracking developments surrounding the tycoon as he builds a hawkish cabinet and outlines his plans, including a threat to hammer China, Canada, and Mexico with hefty tariffs on his first day.

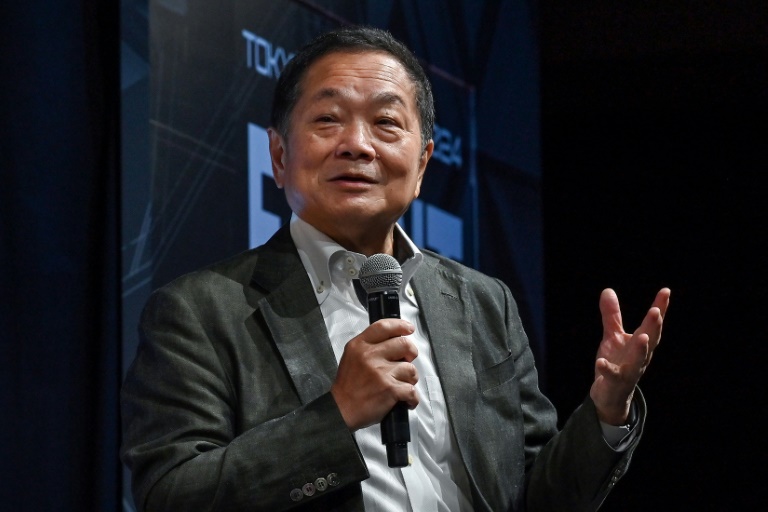

Eyes were also on Japan, where figures showed consumer prices in Tokyo — seen as a bellwether for the country — jumped to 2.6 percent in November, well up from October and much more than expected. The news ignited speculation that the central bank will hike rates for a third time this year. Expectations for an increase in borrowing costs have picked up pace in recent weeks after Bank of Japan governor Kazuo Ueda said officials would have to tighten policy if the economy continued to perform in line with forecasts.

Friday’s price data came as separate figures showed the jobs market remained tight. Bets on a rate increase have risen to more than 60 percent, according to Bloomberg News. The yen rallied Friday, hitting less than 150 per dollar for the first time in a month. The currency was also supported by forecasts that the Federal Reserve will lower US rates at its December meeting — narrowing the yield differential and making the Japanese unit more attractive to investors.

The report “will probably strengthen the BoJ’s conviction that inflation momentum is building, with its two percent target looking (increasingly) secure,” said Taro Kimura, an economist with Bloomberg Economics. The BoJ hiked rates in March for the first time in 17 years as it looked to move away from a long-running ultra-loose monetary policy. However, a second surprise lift at the end of July sparked turmoil on markets and led to a major unwind of the so-called “yen carry trade” in which investors used the cheaper currency to purchase higher-yielding assets.

The stronger yen weighed on Japanese exporters and pushed Tokyo stocks lower on Friday. Other Asian markets fluctuated, with Sydney, Seoul, Singapore, Manila, Jakarta, and Taipei in the red, while Wellington, Mumbai, and Bangkok were slightly higher. Hong Kong and Shanghai gained after Chinese authorities held a meeting to discuss plans to boost stunted consumption, a key goal for Beijing as they look to kickstart the world’s number two economy.

London was barely moved at the open while Frankfurt and Paris retreated. The euro edged up but remained under pressure owing to uncertainty over budget cuts to reduce France’s huge deficit, and as Prime Minister Michel Barnier’s government struggles amid tough opposition from the right and left. Economic weakness in Germany in particular has also dampened enthusiasm in Europe.

Oil prices slipped after the OPEC+ alliance postponed a weekend meeting to December 5, with analysts saying there were signs of disagreement among the group over plans to increase output. Bitcoin was sitting at about $96,500, having suffered a big drop at the start of the week following its worst run since Trump’s electoral success. Still, it is widely tipped to top $100,000 on expectations the new president will ease restrictions on the digital currency market.

– Key figures around 0810 GMT –

Tokyo – Nikkei 225: DOWN 0.4 percent at 38,208.03 (close)

Hong Kong – Hang Seng Index: UP 0.3 percent at 19,423.61 (close)

Shanghai – Composite: UP 0.9 percent at 3,326.46 (close)

London – FTSE 100: FLAT at 8,280.84

Dollar/yen: DOWN at around 150 yen from 151.51 yen on Thursday

Euro/dollar: UP at $1.0577 from $1.0552

Pound/dollar: UP at $1.2724 from $1.2687

Euro/pound: DOWN at 83.13 pence from 83.18 pence

West Texas Intermediate: DOWN 0.3 percent at $68.52 per barrel

Brent North Sea Crude: DOWN 0.7 percent at $72.75 per barrel

© 2024 AFP