London (AFP) – European and Asian stock markets rose on Monday and bitcoin hit a fresh high as Donald Trump prepared to re-enter office as president of the world’s biggest economy. The dollar slid more than one percent versus the euro and lost similar ground against the pound after The Wall Street Journal reported that Trump would not immediately impose tariffs upon his inauguration.

“The dollar is incredibly sensitive to the tariff outlook right now, and the new administration is already setting a tone suggesting that the fast-moving, shock-and-awe trade policy that Trump had promised is likely to be more measured than the market had expected,” commented Kyle Chapman, FX Markets Analyst at Ballinger Group. Oil prices also fell more than 1 percent.

Kathleen Brooks, research director at XTB, suggested a second Trump term could prove to be less volatile than his first, noting that “Treasury Secretary Scott Bessant has spoken out against tariffs and is said to be a moderating influence on the President.” Noting forecasts of a flood of executive orders, Brooks said that there were signs that “a programme of tariffs is still under debate by Trump and his team.”

Trump’s declarations during his re-election campaign and during the transition that he will impose hefty tariffs on imports had fanned fears of another debilitating trade war between the US and China, the world’s second-largest economy. Pledges to slash taxes, regulations and immigration have also led to concerns that inflation could be reignited and force the Federal Reserve to hold off cutting interest rates further, with some observers even flagging possible hikes.

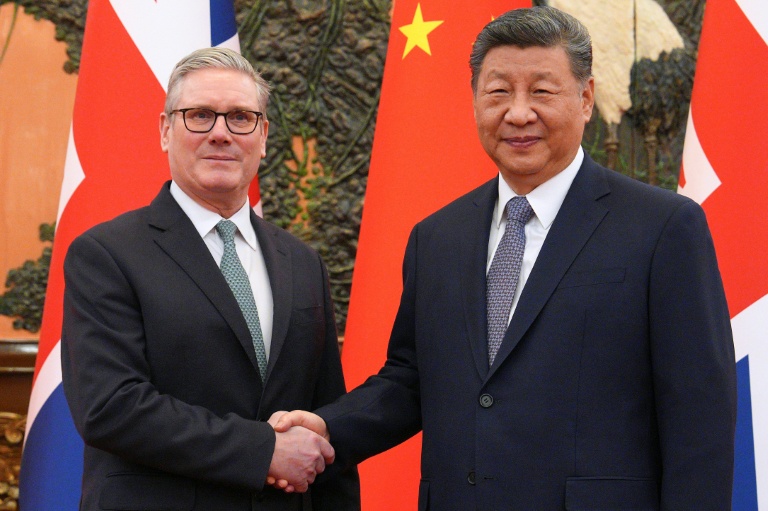

But sentiment was boosted by positive talks between Trump and Chinese President Xi Jinping last week that soothed worries about the incoming US leader’s second term. Bitcoin hit a record above $109,000 before easing as Trump, who has signalled plans to deregulate the cryptocurrency sector, prepares to be sworn in as US president. Over the weekend, Trump launched his own cryptocurrency, a so-called meme coin appropriately called $TRUMP, sparking feverish buying that sent its market capitalisation soaring to several billion dollars.

“Markets are beating to the drum of Donald Trump on the day of his return to the White House,” noted Russ Mould, investment director at AJ Bell. Frankfurt’s blue-chip DAX soared past 21,000 points for the first time, closing just north of the figure for a 0.4 percent session gain. “In the new year, the German leading index has been the secret star among global stock indices,” despite a gloomy German economic outlook, said Jochen Stanzl, Chief Market Analyst at CMC Markets. London’s benchmark FTSE 100 index also traded close to record highs, finishing 0.2 percent higher.

Wall Street was shut Monday for the Martin Luther King holiday, but US stock futures were solidly higher. “The start of a new presidency often brings fresh energy — and uncertainty — to the financial markets,” said Saxo Markets chief investment strategist Charu Chanana. “With Donald Trump’s inauguration, investors are bracing for significant policy shifts. This could mean changes in taxes, spending, and trade agreements.”

Hong Kong’s stock market led gains in Asia amid hopes that the feared trade war can be averted.

– Key figures around 1645 GMT –

London – FTSE 100: UP 0.2 percent at 8,522.41 points (close)

Paris – CAC 40: UP 0.3 percent at 7,731.94 (close)

Frankfurt – DAX: UP 0.4 percent at 21,004.92 (close)

Tokyo – Nikkei 225: UP 1.2 percent at 38,902.50 (close)

Hong Kong – Hang Seng Index: UP 1.8 percent at 19,925.81 (close)

Shanghai – Composite: UP 0.1 percent at 3,244.38 (close)

New York – Dow: Closed for public holiday

Euro/dollar: UP at $1.0404 from $1.0272 on Friday

Pound/dollar: UP at $1.2302 from $1.2168

Dollar/yen: DOWN at 155.67 yen from 156.20 yen

Euro/pound: UP at 84.56 pence from 84.41 pence

West Texas Intermediate: DOWN 1.7 percent at $76.57 per barrel

Brent North Sea Crude: DOWN 1.2 percent at $79.80 per barrel

© 2024 AFP