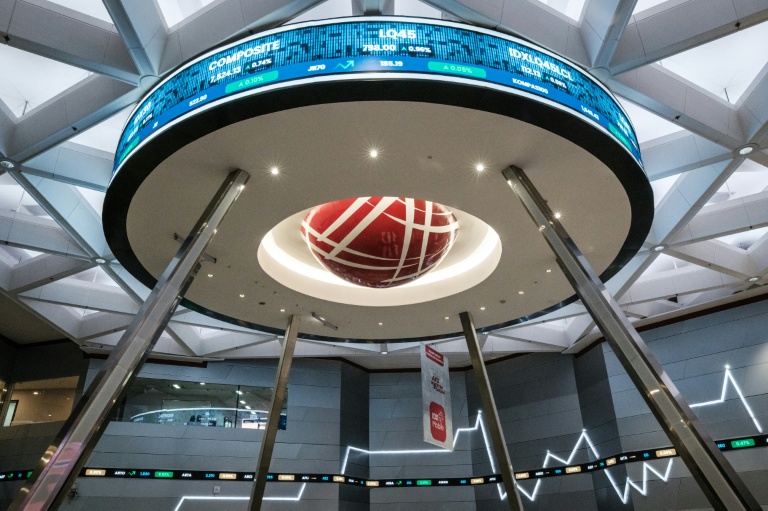

Hong Kong (AFP) – Asian markets mostly fell Monday following a dour end to last week for Wall Street, fueled by disappointing economic data. However, Frankfurt and the euro rose after conservatives won Germany’s closely watched election.

After a healthy performance on Friday, Asian investors struggled to maintain momentum following big losses in New York, where the Nasdaq lost more than two percent. The selling came after a report showed activity in the key services sector hit a 25-month low in February, while separate data indicated consumer sentiment dived almost 10 percent from January. Meanwhile, another study revealed that expectations for inflation hit a three-decade high.

These readings follow a recent run of figures pointing to a softening of the labor market and prices continuing to rise faster than the Federal Reserve’s target rate. There have been increasing fears since Donald Trump regained the U.S. presidency that his plans to impose import tariffs, slash taxes, and reduce regulations would reignite inflation. This has prompted investors to scale back their expectations for how many interest rate cuts the Fed will make this year.

Hong Kong retreated after Friday’s blockbuster rally fueled by tech firms, particularly an eye-watering rise of more than 14 percent in e-commerce titan Alibaba. Shanghai, Seoul, Mumbai, Taipei, Manila, Jakarta, Bangkok, and Wellington were also in the red, while Sydney and Singapore edged up but the rest of the region struggled. London edged up at the open, but Paris slipped.

Frankfurt’s DAX index and the euro were boosted by news that conservatives won a closely watched election in Germany, with leader Friedrich Merz urging the speedy formation of a new coalition government. Merz’s CDU/CSU alliance won more than 28 percent, according to projections, crushing the Social Democrats (SPD) of outgoing Chancellor Olaf Scholz, which came in third. However, there was some nervousness after the far-right Alternative for Germany (AfD) came in second, almost doubling its score to more than 20 percent.

Merz stated he wanted to quickly form a government, warning that as Trump is driving rapid and disruptive changes, “the world isn’t waiting for us.” “Markets will like that, presuming it is achieved,” said National Australia Bank’s senior forex analyst Rodrigo Catril. Nevertheless, SPI Asset Management’s Stephen Innes remarked, “With these results, the next government’s first priority won’t be fixing Germany’s stagnating economy — it’ll be damage control.” He added to expect a hard pivot toward stricter immigration policies, not because of economic necessity, but because mainstream parties are now in full-blown panic mode over the AfD’s rise.

Oil prices extended losses after dropping as much as three percent on Friday as weak U.S. data sparked demand fears. Additionally, there are growing expectations that Trump will ease the sanctions that have limited Russian oil exports.

– Key figures around 0815 GMT –

Hong Kong – Hang Seng Index: DOWN 0.6 percent at 23,341.61 (close)

Shanghai – Composite: DOWN 0.2 percent at 3,373.03 (close)

London – FTSE 100: UP 0.1 percent at 8,665.27

Tokyo – Nikkei 225: Closed for a holiday

Euro/dollar: UP at $1.0500 from $1.0462 on Friday

Pound/dollar: UP at $1.2643 from $1.2628

Dollar/yen: UP at 149.45 from 149.32 yen

Euro/pound: UP at 82.96 pence from 82.81 pence

West Texas Intermediate: DOWN 0.3 percent at $70.16 per barrel

Brent North Sea Crude: DOWN 0.2 percent at $73.88 per barrel

New York – Dow: DOWN 1.7 percent at 43,428.02 (close)

© 2024 AFP