Frankfurt (Germany) (AFP) – Massive German spending pledges and uncertainty caused by US trade policy are fuelling expectations the European Central Bank could on Thursday signal that a pause in interest rate cuts is in sight, analysts said. The ECB is widely expected to make its sixth cut since June last year, with its focus having shifted recently from tackling inflation to boosting the beleaguered eurozone. The expected quarter percentage point reduction would bring the bank’s benchmark deposit rate to 2.5 percent. The rate reached a record of four percent in late 2023 after the ECB launched a furious hiking cycle to tame energy and food costs that surged in the wake of Russia’s invasion of Ukraine.

But investors will be keeping an eye out for signals from ECB President Christine Lagarde that a pause might be on the horizon, after some officials said it was time to start discussing the matter. Uncertainty about the fallout from potential US tariffs — President Donald Trump has threatened a 25-percent duty on all EU goods — was already clouding the outlook and potentially pushing rate-setters towards hitting pause.

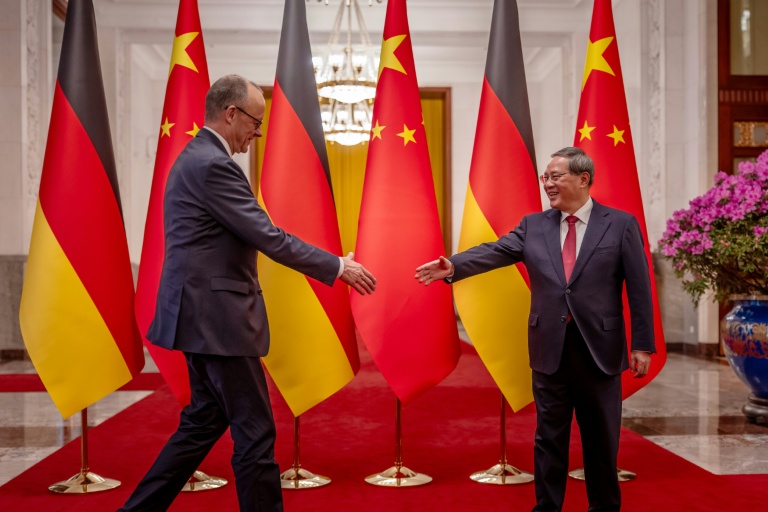

Now plans announced Tuesday by Germany’s likely next chancellor Friedrich Merz to spend several hundred billion euros more on defence and infrastructure in the coming years could impact policymakers’ considerations, analysts said. The dramatic move was driven by fears that long-standing US security guarantees for Europe will be weakened under President Donald Trump amid a rush to end the war in Ukraine. The spending surge has the potential to stoke inflation that would discourage further cuts to borrowing costs, while also supporting eurozone growth.

Investors had already lowered their expectations of a cut at the ECB’s next meeting in April following Merz’s announcement, said Kathleen Brooks, research director at trading platform XTB. If bank officials “think that higher spending on German infrastructure and defence will be inflationary, then we could see expectations of ECB rate cuts get scaled back,” she said.

– Growing uncertainty –

Even before the German announcement, policymakers at the central bank for the 20 countries that use the euro were already asking how much further it should continue on the path to lower interest rates. Isabel Schnabel, an influential member of the ECB’s board, told The Financial Times last month that policymakers were getting “closer to the point where we may have to pause or halt our rate cuts.”

“We can no longer say with confidence that our monetary policy is still restrictive,” she said. Eurozone inflation has also proved stickier than some had hoped. It edged down slightly in February to 2.4 percent after several months of increases, but remains above the ECB’s two-percent target. Officials have nevertheless remained confident it will settle around the benchmark later this year.

In the United States, where the economy is in more robust health than in the eurozone, the Federal Reserve paused rate cuts recently after inflation rose and amid uncertainty about the future direction of Trump’s policy. Lagarde has so far sought to avoid tipping the ECB’s hand and could stick with her mantra of making decisions “meeting-by-meeting” in her remarks after the rates announcement, observers said.

“Global uncertainties have increased significantly in recent weeks,” said Felix Schmidt, an economist from Berenberg bank, pointing to Trump’s tariff threats. Given this, “Lagarde will refrain from giving any clear forward guidance and will try to maintain maximum flexibility,” he added. The ECB will also publish updated economic forecasts on Thursday. While inflation predictions are expected to remain stable, the central bank might further lower its growth projections for the coming years, according to economists.

The eurozone has eked out meagre growth in the past two years amid a poor performance in its biggest economies, Germany and France, leaving the single currency area lagging behind the United States and China.

© 2024 AFP