Hong Kong (AFP) – Shares in Hong Kong and Shanghai sank Monday on a mixed day for equity markets after data showing Chinese consumer prices slipped back into deflation stoked fresh concerns over the world’s number two economy. The reading compounded uncertainty on trading floors as investors struggle to keep up with Donald Trump’s trade policy tinkering, while his refusal to rule out a US recession this year further rattled confidence.

The president’s on-again, off-again tariff threats against Canada, Mexico, China, and others have left financial markets in turmoil and consumers unsure what the year might bring. Traders are also keeping tabs on Beijing as Chinese leaders wrap up their annual rubber stamp parliament gathering where they set a 2025 annual growth target of around five percent, vowed to make domestic demand its main economic driver, and unveiled a rare hike in fiscal funding.

The need for more measures to boost the faltering economy was highlighted at the weekend by figures showing consumer prices fell 0.7 percent in February, the first drop in 13 months. “The data only reinforces what’s been clear for months — deflationary pressures remain firmly entrenched in the world’s second-largest economy,” said Stephen Innes at SPI Asset Management. “The property sector remains stuck in the mud, domestic demand is weak, and despite a bounce in tech stocks, the broader wealth effect just isn’t filtering through to consumers.”

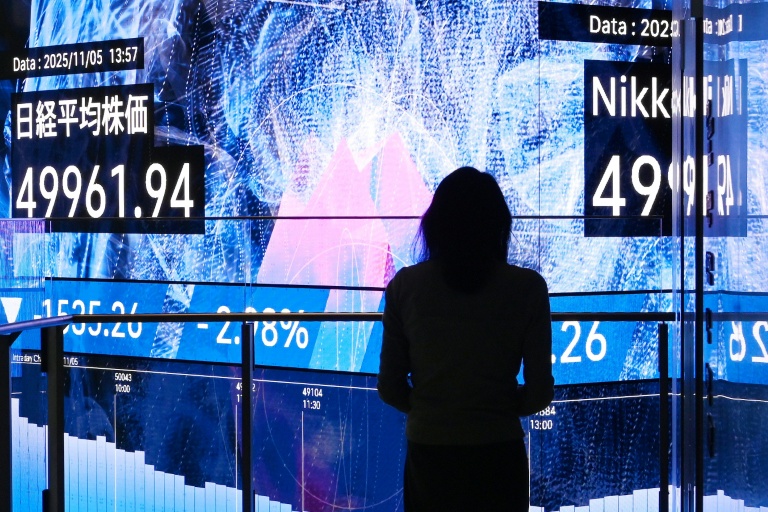

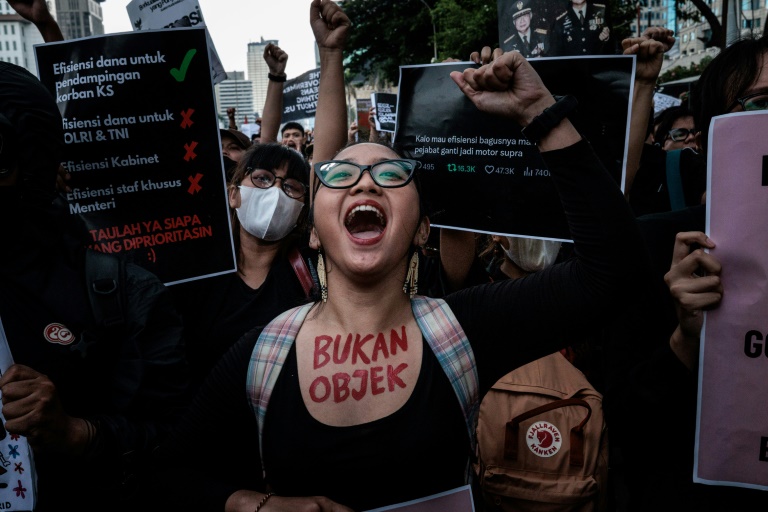

Chinese retail investors might be riding the market rally, but the fact that household spending remains subdued suggests most are either tapped out or too cautious to dive into equities. A stock market pop doesn’t fix a sluggish economy overnight. Hong Kong stocks, which have surged 20 percent this year to a three-year high, lost almost two percent and Shanghai ended off 0.2 percent. There were also losses in Singapore, Taipei, Bangkok, and Jakarta, though Tokyo, Sydney, Seoul, Wellington, Mumbai, and Manila rose. London, Paris, and Frankfurt rose in early trade.

The mixed start to the week followed a positive day on Wall Street where investors welcomed soothing comments on the economy from Federal Reserve boss Jerome Powell, which offset a slightly below-par jobs data. However, there is a growing worry about the growth outlook owing to Trump’s tariffs, federal job cuts, and still-high inflation. Analysts described the jobs report as unspectacular, but good enough to suggest the labour market is not weakening precipitously.

The reading “shows private-sector demand for labour stayed strong just prior to the spike in economic policy uncertainty which has produced a sharp fall in business and consumer confidence,” said Ray Attrill at National Australia Bank. “As Pantheon Economics notes, it is the government sector, which added just 11,000 to payrolls last month compared to a prior six-month average of 35,000 that accounts for the modestly below-trend overall February result.” “The hit to payrolls from layoffs of federal employees instigated by DOGE lies in the near future,” he added, referring to the Department of Government Efficiency run by Trump’s billionaire ally Elon Musk.

Trump raised worries about a recession Sunday when asked by Fox News if a downturn was possible this year by replying, “I hate to predict things like that.” He added, “There is a period of transition because what we’re doing is very big — we’re bringing wealth back to America,” he said, adding, “It takes a little time.”

– Key figures around 0800 GMT –

Tokyo – Nikkei 225: UP 0.4 percent at 37,028.27 (close)

Hong Kong – Hang Seng Index: DOWN 1.9 percent at 23,783.49 (close)

Shanghai – Composite: DOWN 0.2 percent at 3,366.16 (close)

London – FTSE 100: UP 0.1 percent at 8,686.98

Euro/dollar: DOWN at $1.0823 from $1.0844 on Friday

Pound/dollar: DOWN at $1.2895 from $1.2925

Dollar/yen: DOWN 147.57 yen from 147.97 yen

Euro/pound: UP at 83.92 pence from 83.87 pence

West Texas Intermediate: FLAT at $67.05 per barrel

Brent North Sea Crude: FLAT at $70.39 per barrel

New York – Dow: UP 0.5 percent at 42,801.72 (close)

© 2024 AFP