London (AFP) – European and Asian stock markets started the week on the front foot on Monday as investors welcomed China’s plans to kickstart consumption in the world’s number two economy amid US tariff fears. The gains followed a pre-weekend rally on Wall Street, stoked by optimism that US lawmakers would pass a spending bill to avert a painful government shutdown.

“Hopes that a new consumer life raft in China will buoy up the country’s prospects of recovery have helped lift sentiment slightly, but caution remains,” said Susannah Streeter, head of money and markets at Hargreaves Lansdown. Eyes were on Beijing as officials were set to outline their plans to kickstart spending by the country’s army of consumers after years of post-Covid weakness that has been a major drag on economic growth. The plan looks to boost income with property reforms, stabilise the stock market and encourage lenders to provide more consumption loans with reasonable limits, terms, and interest rates.

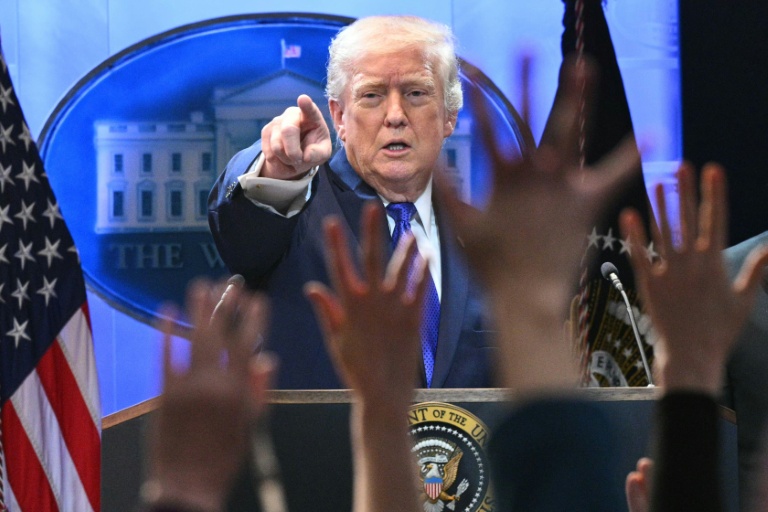

Officials were also looking at raising pension benefits, establishing a childcare subsidy system, and ensuring workers’ rights to rest and holidays are legally protected. The move comes after data showed consumer prices dropped into deflation in February for the first time in a year, while producer prices continued to fall. Observers have warned that leaders had a tough job ahead of them amid US President Donald Trump’s trade war. “With China firmly in US President Donald Trump’s sights, deflation concerns in China will worsen,” said economists at Moody’s Analytics. “The chaos of tariffs and rising unemployment will keep consumer spending weak, denting inflation’s demand drivers.”

London, Paris, and Frankfurt all advanced nearing the half-way stage on Monday, tracking gains in Asia. Hong Kong built on a blockbuster start to the year fuelled by a chase into Chinese tech giants, while Shanghai and Tokyo also enjoyed healthy buying. Traders also looked ahead to policy decisions this week from the Federal Reserve, the Bank of Japan, and the Bank of England — all expected to keep interest rates on hold. Alongside its rate decision, the Fed will release its summary of economic projections and outlook for borrowing costs this year, which comes as policymakers try to navigate the potential inflationary impacts of Trump’s tariffs campaign.

Gold was trading around the $3,000 an ounce mark on Monday after it broke the symbolic threshold for the first time on Friday owing to a rush into safe havens as traders fret over Trump’s tariffs.

– Key figures around 1100 GMT –

London – FTSE 100: UP 0.2 percent at 8,646.43 points

Paris – CAC 40: UP 0.4 percent at 8,058.23

Frankfurt – DAX: UP 0.4 percent at 23,066.51

Tokyo – Nikkei 225: UP 0.9 percent at 37,396.52 (close)

Hong Kong – Hang Seng Index: UP 0.8 percent at 24,145.57 (close)

Shanghai – Composite: UP 0.2 percent at 3,426.13 (close)

New York – Dow: Up 1.7 percent at 41,488.19 (close)

Euro/dollar: UP at $1.0906 from $1.0884 on Friday

Pound/dollar: UP at $1.2973 from $1.2936

Dollar/yen: DOWN at 148.49 yen from 148.62 yen

Euro/pound: DOWN at 84.09 pence from 84.14 pence

Brent North Sea Crude: UP 1.2 percent at $71.41 per barrel

West Texas Intermediate: UP 1.3 percent at $68.01 per barrel

© 2024 AFP