New York (AFP) – Wall Street stocks rocketed higher Wednesday following President Trump’s shock move to pause many new tariffs, lifting an equity market beaten down by days of losses amid rising recession worries. The catalyst came around 1720 GMT when Trump announced a 90-day pause on the most onerous new tariffs for every country except China, which was targeted with a whopping 125 percent levy.

Within moments of Trump’s social media announcement, the Dow index surged ahead around 2,500 points along the way to a nearly eight-percent gain on the session. The tech-rich Nasdaq won 12.2 percent to notch its best day in 24 years. Oil prices jumped more than four percent while the dollar also strengthened. The reversals followed another down day on European bourses reflecting worsening fears of a US recession and global slowdown, in part due to expectations that widespread trade wars would reignite inflation.

Instead of the onerous tariff levels unveiled last week during Trump’s “Liberation Day” event, affected US trading partners excluding China would face a 10 percent tariff rate, temporarily reverting to a level that took effect over the weekend. That move had already roiled markets. Trump singled out the world’s second-biggest economy, however, saying its tariff rate would be raised to a prohibitive 125 percent “based on the lack of respect that China has shown to the world’s markets.”

Trump denied that he had backtracked on the tariffs, telling reporters that “you have to be flexible.” “People were jumping a little bit out of line, they were getting yippy, a little bit afraid,” Trump said. “Yippy” is a term in sports to describe a loss of nerves. “When markets are pricing in worst-case scenarios, it doesn’t take much good news to turn that opinion around,” said Art Hogan of B. Riley Wealth Management. Hogan added that investors were waiting for any sense of a more reasonable trade process, saying this situation might “be less of a drag on economic activity and earnings.”

Sam Stovall, chief investment strategist at CFRA Research, said most of the equity purchases Wednesday likely came from short-term investors looking for quick gains or traders eager to cover positions purchased prior to the shift in fortune. Investment advisors typically advise clients to avoid trading during periods of great upheaval when even major losses can be reversed if a stockholder’s approach is that of a long-term investor. Retail investors “will want to see whether this story has legs,” Stovall said. “Investors and clients have been whipsawed and they don’t like it.”

– Bond market volatility – A secondary factor in Wednesday’s positive US session was the successful auction of $38 billion in US Treasury notes, said Briefing.com. Volatility in the US bond market, including a jump in yields over the last week, has rattled investors, prompting talk that US Treasuries could be losing their status as a safe haven asset. Trump’s reversal lifted the entire Dow index with Nvidia the biggest gainer at 18.7 percent. Both Apple and Boeing piled on more than 15 percent, while Disney, Goldman Sachs, and Nike were among the names winning more than 10 percent.

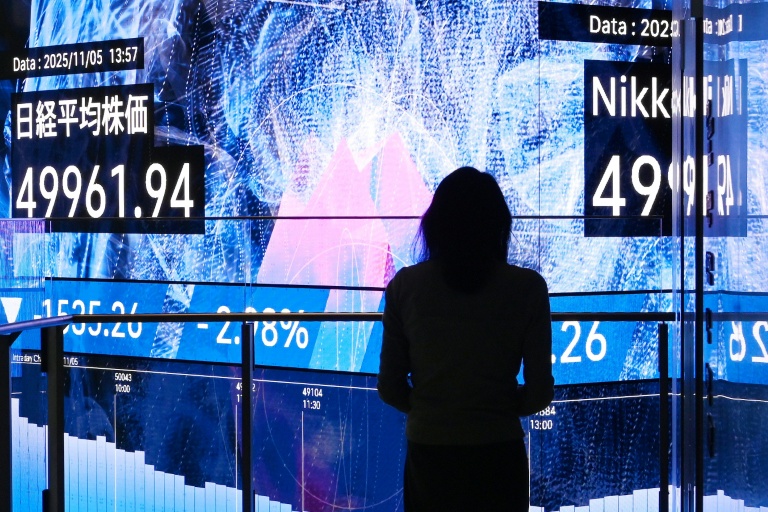

Earlier, European bourses suffered another down day as the European Union announced reprisals for steel and aluminum tariffs that entered force last month, targeting more than 20 billion euros ($22 billion) of US products including soybeans, motorcycles, and beauty products. Most Asian equities markets fell back into the red. Tokyo closed down 3.9 percent.

– Key figures around 2030 GMT –

New York – Dow: UP 7.9 percent at 40,608.45 (close)

New York – S&P 500: UP 9.5 percent at 55,456.90 (close)

New York – Nasdaq Composite: UP 12.2 percent at 17,124.97 (close)

London – FTSE 100: DOWN 2.9 percent at 7,679.48 (close)

Paris – CAC 40: DOWN 3.3 percent at 6,863.02 (close)

Frankfurt – DAX: DOWN 3.0 percent at 19,670.88 (close)

Tokyo – Nikkei 225: DOWN 3.9 percent at 31,714.03 (close)

Hong Kong – Hang Seng Index: UP 0.7 percent at 20,264.49 (close)

Shanghai – Composite: UP 1.3 percent at 3,186.81 (close)

Euro/dollar: DOWN at $1.0948 from $1.0958

Pound/dollar: UP at $1.2810 from $1.2765

Dollar/yen: DOWN at 147.82 yen from 146.27 yen on Tuesday

Euro/pound: DOWN at 85.45 pence from 85.84 pence

West Texas Intermediate: UP 4.7 percent at $62.35 per barrel

Brent North Sea Crude: UP 4.2 percent at $65.48 per barrel

burs-jmb/aha

© 2024 AFP