Hong Kong (AFP) – The dollar tumbled with most stocks while gold hit a fresh record high as panic gripped markets again on Friday, while China retaliated against Donald Trump’s latest tariff blitz against the world’s number two economy. The US president’s decision to delay crippling duties for 90 days sparked a frenzied scramble for equities that had been beaten down since his “Liberation Day” announcement unleashed a global panic.

However, the realisation that nothing had been resolved, coupled with Trump’s decision to double down on his battle with economic superpower China, fuelled another bout of selling of US assets. The dollar tanked against the yen, euro, pound and Swiss franc — investors dropping what is usually considered a key safe haven currency as they look to unload US risk assets. Gold-standard Treasuries were also under pressure amid speculation that China was offloading some of its vast holdings in retaliation for Trump’s measures.

The weaker dollar and the rush for safety has also sent bullion to a fresh record high above $3,220. Chinese President Xi Jinping urged the European Union on Friday to join Beijing in resisting “unilateral bullying” by Washington, state media said as he met Spanish Prime Minister Pedro Sanchez. Shortly after, Beijing said it would ramp up levies against the United States to 125 percent, compared with the 145 percent China faces. It added that Washington’s moves defied “basic economic laws and common sense” and “seriously violates international trade rules” but said it would “ignore” future US hikes.

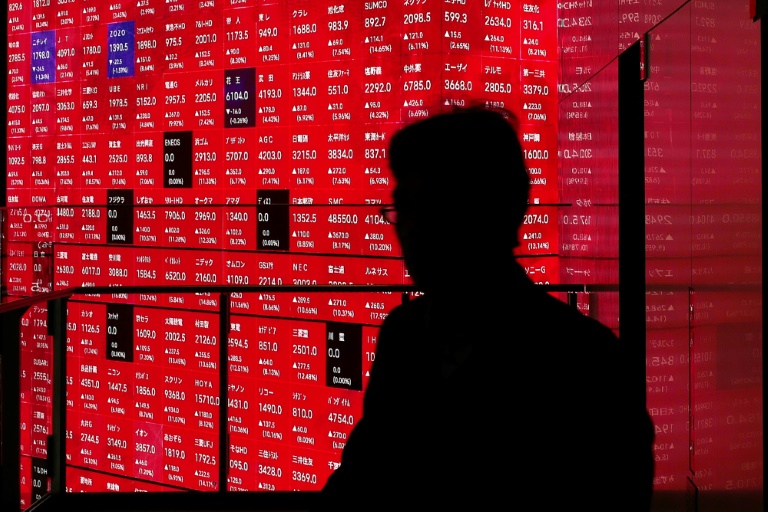

After blockbuster rallies on Thursday in response to the 90-day tariff pause, markets across the region were back deep in negative territory at the end of a highly volatile week. Tokyo shed three percent — a day after surging more than nine percent — while Sydney, Seoul, Singapore, Wellington and Bangkok were also in the red. However, Hong Kong and Shanghai rose as traders focused on possible Chinese stimulus measures. Beijing said earlier Friday it would implement a moderately loose monetary policy in a bid to reassure investors.

London and Paris rose in the morning but Frankfurt reversed early gains. There were gains in Taipei and Ho Chi Minh City stocks as the leaders of Taiwan and Vietnam said they would hold talks with Trump. Manila, Mumbai and Jakarta also rose. The generally downbeat mood came after losses on Wall Street, where the S&P 500 lost 3.5 percent, the Dow 2.5 percent and the Nasdaq 4.3 percent. That ate into the previous day’s gains of 9.5 percent, 7.9 percent and 12.2 percent respectively.

“There has been a pronounced ‘sell US’ vibe flowing through broad markets and into the classic safe-haven assets, with the dollar losing the safe-haven bid put in over the past week,” said Pepperstone group’s Chris Weston. He added that the moves had “the feel of repatriation flows by foreign entities, with many re-focused on the idea that Trump’s reluctant pause on tariffs was due to increased system risk and migrating capital away from Ground Zero.”

With Treasuries being sold off, sending their yields higher and making US debt more expensive, there is a fear of a bigger calamity down the line. Michael Krautzberger at Allianz Global Investors wrote: “A fall in the dollar could be a sign that markets are questioning its status as a global reserve currency.” Looking forward, the big fear is that the response to the additional US tariff threats in recent days, especially on Chinese goods, is the opening salvo from the big foreign holders of US Treasuries in tariff-hit countries, as they sell their US Treasury holdings. “A trade war morphing into a capital war would represent a significant escalation in recent tensions.”

Trump says he wants to use tariffs to reorder the world economy by forcing manufacturers to base themselves in the United States and for other countries to decrease barriers to US goods. While he acknowledged on Thursday there would be “a transition cost and transition problems,” the Republican dismissed the global market turmoil and insisted that “in the end it’s going to be a beautiful thing.” Commerce Secretary Howard Lutnick also posted on social media that “the Golden Age is coming. We are committed to protecting our interests, engaging in global negotiations and exploding our economy.”

Trump also warned that the huge tariffs delayed on Wednesday would be reintroduced if no agreements had been made between Washington and other countries. “If we can’t make the deal we want to make… then we’d go back to where we were,” he said.

– Key figures around 0810 GMT –

Tokyo – Nikkei 225: DOWN 3.0 percent at 33,585.58 (close)

Hong Kong – Hang Seng Index: UP 1.1 percent at 20,914.69 (close)

Shanghai – Composite: UP 0.5 percent at 3,238.23 (close)

London – FTSE 100: UP 0.2 percent at 7,931.01

Dollar/yen: DOWN at 142.90 yen from 144.79 yen on Thursday

Euro/dollar: UP at $1.1404 from $1.1183

Pound/dollar: UP at $1.3081 from $1.2954

Euro/pound: UP at 87.10 pence from 86.33 pence

West Texas Intermediate: UP 1.3 percent at $60.86 per barrel

Brent North Sea Crude: UP 1.2 percent at $64.10 per barrel

New York – Dow: DOWN 2.5 percent at 39,593.66 (close)

© 2024 AFP