New York (AFP) – Wall Street rebounded on Thursday as shares in US tech titans rose after a selloff that was sparked by the US Federal Reserve dousing hopes of an imminent interest-rate cut.

Shares in Amazon, Apple and Facebook owner Meta all climbed during Thursday’s session.All three companies were due to report results after the market closed.

Microsoft and Google parent Alphabet were also higher following disappointing results the previous day.

Adam Sarhan of 50 Park Investments said the market is recovering from the “knee-jerk” selloff after Wednesday’s Fed meeting.

“The market knows that it’s a matter of when, not if, the Fed’s going to cut rates,” he said.

Wall Street’s main indices — the Dow, the tech-heavy Nasdaq and the broad-based S&P 500 — had tumbled on Wednesday after the Fed’s disappointing rate signal.

The central bank kept its rate unchanged at a 23-year high, as expected, but chairman Jerome Powell then warned that a cut was unlikely in March.

But on Thursday’s investors were eager to step in, lifting all three major Wall Street indices by one percent or more.

“Today shows how eager traders are to buy every dip,” said Steve Sosnick of Interactive Brokers.”People are more fearful about missing out than they are about the potential that a stock might sell off.”

The Fed, the European Central Bank and the Bank of England raised their interest rates multiple times to combat inflation, but all have kept them on hold now that consumer prices have started to cool.

The BoE froze its key interest rate Thursday for a fourth meeting in a row.

Its governor Andrew Bailey warned there was a “need to see more evidence that inflation is set to fall” to the bank’s two-percent target, “and stay there, before we can lower interest rates”.

– Europe slides –

The eurozone’s main markets were down Thursday, even as data showed inflation slowed in January to 2.8 percent.

London’s benchmark FTSE 100 index closed down.

Shares in British energy major Shell closed up 2.4 percent as dealers shrugged off slumping annual net profit to focus on better-than-expected adjusted earnings and share buybacks.

Shell said Thursday that its net profit more than halved to $19.4 billion last year as oil and gas prices weakened.

Shares in French banking giant BNP Paribas slumped by nearly 10 percent, while Dutch lender ING tumbled around 6.4 percent, as disappointing fourth-quarter results took the shine off bumper annual profits.

Deutsche Bank rallied as much as five percent in the day’s trading, after it revealed plans to slash 3,500 jobs following a decline in annual profits, before closing nearly three percent up.

– Key figures around 2130 GMT –

New York – Dow: UP 1.0 percent at 38,519.84 (close)

New York – S&P 500: UP 1.3 percent at 4,906.19 (close)

New York – Nasdaq: UP 1.3 percent at 15,361.64 (close)

London – FTSE 100: DOWN 0.1 percent at 7,622.16 (close)

Paris – CAC 40: DOWN 0.9 percent at 7,588.75 (close)

Frankfurt – DAX: DOWN 0.3 percent at 16,859.04 (close)

EURO STOXX 50: DOWN 0.2 percent at 4,638.60 (close)

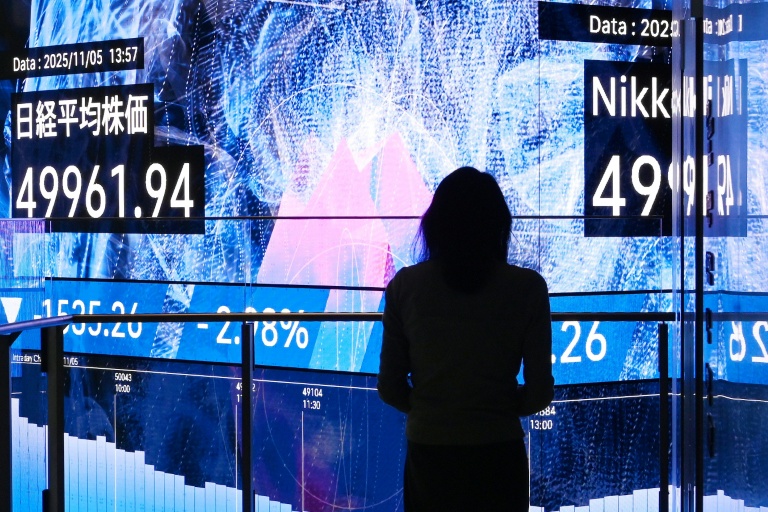

Tokyo – Nikkei 225: DOWN 0.8 percent at 36,011.46 (close)

Hong Kong – Hang Seng Index: UP 0.5 percent at 15,566.21 (close)

Shanghai – Composite: DOWN 0.6 percent at 2,770.74 (close)

Euro/dollar: UP at $1.0874 from $1.0818 on Wednesday

Dollar/yen: DOWN at 146.42 yen from 146.92 yen

Pound/dollar: UP at $1.2746 from $1.2688

Euro/pound: UP at 0.8529 from 0.8526 pence

West Texas Intermediate: DOWN 2.7 percent at $73.82 per barrel

Brent North Sea Crude: DOWN 2.3 percent at $78.70 per barrel

burs-jmb/mdl