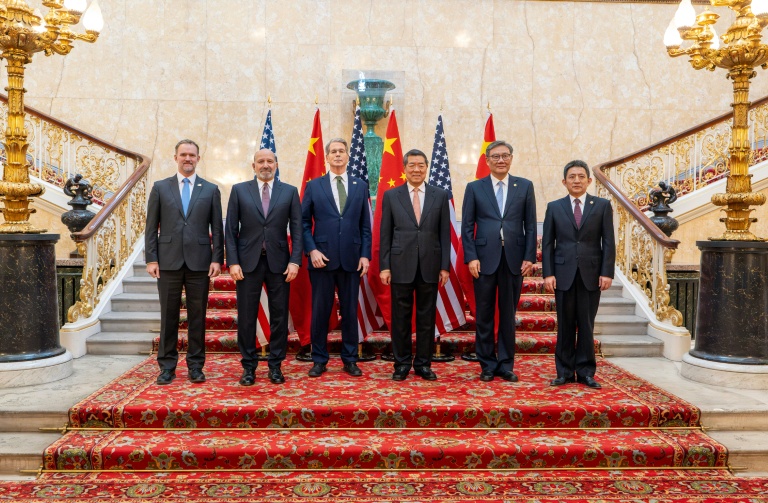

New York (AFP) – Global stocks were mixed Monday as markets monitored high-stakes US-China trade talks and awaited key inflation data later in the week. Trade representatives for the world’s two biggest economies plan a second day of talks on Tuesday in London following an opening round on Monday. Although there were no breakthroughs, the market has welcomed the negotiations.

“There’s hopes that they’re inching closer to some sort of a deal,” said Peter Cardillo of Spartan Capital Securities. New York’s blue-chip Dow index finished flat while the broader S&P 500 and tech-heavy Nasdaq rose modestly. Asian shares closed up on hopes of a deal and catching up with Wall Street from Friday, when US jobs data suggested the American economy was doing well, for now. The dollar, however, dipped amid fears of higher US inflation in the pipeline from Trump’s generalized tariffs weighing on it. London, Paris, and Frankfurt indices all closed lower.

While the US economy has been showing resilience, official data on Monday showed China’s exports to the United States last month grew at a slower pace than expected, even as they picked up to the EU and Asia. The US-China talks took place following a call between US President Donald Trump and Chinese President Xi Jinping last Thursday. They sought a de-escalation after each had accused the other of violating terms of a tariffs reprieve struck in Geneva in mid-May.

“Some kind of accord would be welcome, but they might even be happy if the two sides merely agree to keep talking,” said Chris Beauchamp, chief market analyst at the online trading platform IG. Easing China’s export controls on rare-earths was key for Washington, while China wants the US to rethink immigration curbs on students, restrictions on access to advanced technology including microchips, and to make it easier for Chinese tech providers to access US consumers, said Kathleen Brooks, research director at XTB. “The outcome of these discussions will be crucial for market sentiment,” she said.

The dollar’s weakness came as economists warned that Trump’s tariffs on most of the world could reignite inflation, and as the US Federal Reserve weighs whether to lower interest rates. In corporate news, entertainment giant Warner Bros. Discovery announced plans to split into two publicly traded companies. One would be a streaming and studios company covering film and TV production and catalogues, while the other would be a global network company with television brands including CNN and Discovery, and free-to-air channels in Europe.

US semiconductor maker Qualcomm also announced it was buying a UK firm, Alphawave, for $2.4 billion as demand for database infrastructure heated up from demand in the AI sector. Alphawave shares in London jumped almost 19 percent. Qualcomm’s shares rose 4.1 percent in New York. This week’s agenda includes releases on US consumer and producer prices, key benchmarks on inflation.

Key figures at around 2040 GMT:

– New York – Dow: FLAT at 42,761.76 (close)

– New York – S&P 500: UP 0.1 percent at 6,00 (close)

– New York – Nasdaq Composite: UP 0.3 percent at 19,591.24 (close)

– London – FTSE 100: DOWN 0.1 percent at 8,832.28 (close)

– Paris – CAC 40: DOWN 0.2 percent at 7,791.47 (close)

– Frankfurt – DAX: DOWN 0.5 percent at 24,174.32 (close)

– Tokyo – Nikkei 225: UP 0.9 percent at 38,088.57 (close)

– Hong Kong – Hang Seng Index: UP 1.6 percent at 24,181.43 (close)

– Shanghai – Composite: UP 0.4 percent at 3,399.77 (close)

Euro/dollar: UP $1.1420 from $1.1397 on Friday

Pound/dollar: UP at $1.3552 from $1.3528

Dollar/yen: DOWN at 144.60 yen from 144.85 yen

Euro/pound: UP 84.27 from 84.23 pence

Brent North Sea Crude: UP 0.9 percent at $67.04 per barrel

West Texas Intermediate: UP 1.1 percent at $65.29 per barrel

© 2024 AFP