New York (AFP) – A jump in US retail sales boosted world markets Thursday even as investors mulled the US rates outlook, US President Donald Trump’s tariffs, and the future of Federal Reserve boss Jerome Powell. Both the S&P 500 and Nasdaq finished at fresh records as investors focused on solid US economic data and earnings and shrugged off lingering worries about tariffs and Powell.

“Right now, as long as the markets don’t have a reason to sell off, they’re going to go up,” said Steve Sosnick of Interactive Brokers. “The news on the economy this week has been good enough.” Investors were wary heading into second-quarter earnings season, but “the data so far and the earnings are coming in better than expected,” said Jack Ablin of Cresset Capital Management.

Earlier, European markets also finished strongly in the green. Frankfurt and Paris closed almost 1.5 percent ahead, although London could only manage a 0.5 percent rise amid a higher official UK jobless count and slowing wages growth. Overall, US retail sales were up 0.6 percent in June to $720.1 billion, reversing a May 0.9 percent decline. The figures topped analyst expectations.

Besides retail sales, another week of modest weekly US jobless claims provided reassurance on the economy, said Art Hogan of B. Riley Wealth Management. “We’ve been worried about earnings and trade wars, but the economic data (…) remains resilient,” Hogan said. Thursday’s strong session on Wall Street followed a volatile round the day before. Stocks had briefly nose-dived on Wednesday following reports that Trump was planning to fire Powell, lambasting him for not cutting interest rates.

But the US president swiftly denied the story, sending markets higher again. Powell’s apparent security in the role also helped lift the dollar again Thursday, its latest rise in July after an historic retreat in the first six months of 2025. Trump’s unrelenting criticism of Powell has prompted foreign exchange traders to anticipate that “we are moving to a world where the US wants to have a more accommodative monetary policy,” said Kit Juckes, chief FX strategist at Societe Generale.

But the dollar’s resilience in the wake of the latest Powell-Trump dustup suggests markets still believe “monetary policy in the US is still credible,” Juckes said. Among individual companies, United Airlines climbed 3.1 percent as it offered an upbeat outlook on travel demand in the second half of 2025 despite reporting a drop in second-quarter profits. Tokyo-listed shares in the Japanese owner of convenience store giant 7-Eleven plunged after a Canadian rival, Alimentation Couche-Tard, pulled out of a $47 billion takeover bid.

– Key figures at around 2050 GMT –

New York – Dow: UP 0.5 percent at 44,484.49 (close)

New York – S&P 500: UP 0.5 percent at 6,297.36 (close)

New York – Nasdaq Composite: UP 0.7 percent at 20,885.65 (close)

London – FTSE 100: UP 0.5 percent at 8,972.64 points (close)

Paris – CAC 40: UP 1.3 percent at 7,822.00 (close)

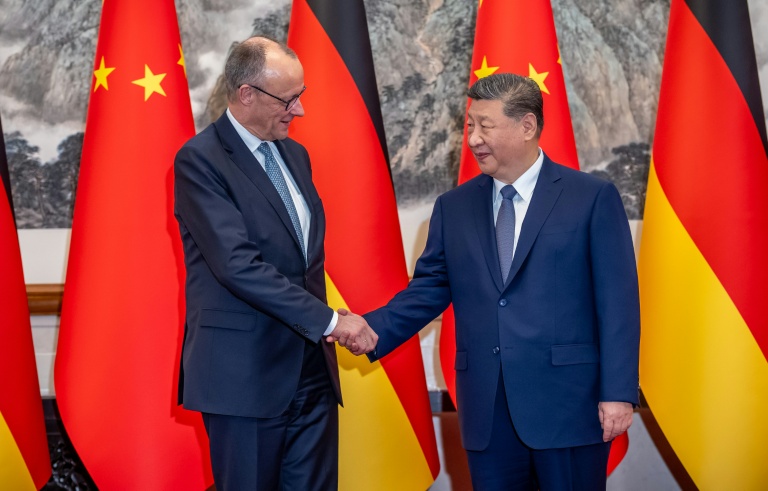

Frankfurt – DAX: UP 1.5 percent at 24,370.93 (close)

Tokyo – Nikkei 225: UP 0.6 percent at 39,901.19 (close)

Hong Kong – Hang Seng Index: DOWN 0.1 percent at 24,498.95 (close)

Shanghai – Composite: UP 0.4 percent at 3,516.83 (close)

Euro/dollar: DOWN at $1.1600 from $1.1641 on Wednesday

Pound/dollar: DOWN at $1.3415 from $1.3422

Dollar/yen: UP at 148.60 yen from 147.88 yen

Euro/pound: DOWN at 86.43 pence from 86.71 pence

Brent North Sea Crude: UP 1.5 percent at $69.52 per barrel

West Texas Intermediate: UP 1.8 percent at $67.54 per barrel

© 2024 AFP