London (AFP) – The London stock market smashed another record peak Thursday after British mining titan Anglo American received a gargantuan $38.8-billion takeover bid from rival BHP, with sentiment also buoyed by earnings.

The British capital’s benchmark FTSE 100 index struck 8,102.14 points, reaching an all-time high for a third session running with Anglo American shares jumping 13 percent.

News of the colossal takeover offer, aimed at creating the world’s biggest copper miner, comes amid a separate bidding war for UK-listed music rights owner Hipgnosis Songs Fund.

Markets will switch focus later Thursday to earnings from US tech titans Alphabet and Microsoft.

“The FTSE 100 is having the time of its life as takeovers continue to power the market,” said Russ Mould, investment director at AJ Bell.

“BHP’s move on Anglo American has got investors excited at who else in the blue-chip UK stock index might be next for a bid.”

Susannah Streeter, head of money and markets at Hargreaves Lansdown, argued that UK stocks had been trading too low.

“The FTSE 100 may have raced to fresh highs this week — but it’s been a long time coming, and UK-listed companies are still considered to be undervalued.”

“Anglo American’s share price is down around 10 percent compared to a year ago, which is likely to have helped spark the offer,” Streeter added.

Well-received earnings sent share prices jumping for other British companies, including drugmaker AstraZeneca, lender Barclays and consumer goods firm Unilever.

– Eurozone stocks drop –

On the downside, eurozone indices fell partly with exporters hit by the stronger euro versus the dollar.

Sentiment was also subdued after a mixed Asian performance as investors fretted over US tech giant Meta’s warning that it will spend far more than expected this year.

That fuelled worries that the recent tech-led global rally may have gone too far, with traders turning cautious after the past three days’ sizeable gains.

Traders also kept an eye on Japan as the yen wallowed at a fresh three-decade low above 155 per dollar, a level many observers saw as likely to see authorities intervene in currency markets.

They were preparing for the release of key US inflation data Friday that could have a bearing on the Federal Reserve’s plans for cutting interest rates ahead of its meeting next week.

Stocks had mostly enjoyed broad gains earlier this week on optimism that earnings from some of the world’s biggest companies — particularly in the tech sector — would show that profits remained strong even amid stubbornly high inflation and elevated interest rates.

However, they lost a little momentum in New York on Wednesday.

Asia largely followed suit Thursday, with analysts suggesting Facebook parent Meta could be a key reason after it projected second-quarter sales that were below analyst expectations and increased its spending estimates.

– Key figures around 1020 GMT –

London – FTSE 100: UP 0.7 percent at 8,092.80 points

Paris – CAC 40: DOWN 0.6 percent at 8,043.25

Frankfurt – DAX: DOWN 0.6 percent at 17,984.30

EURO STOXX 50: DOWN 0.5 percent at 4,964.26

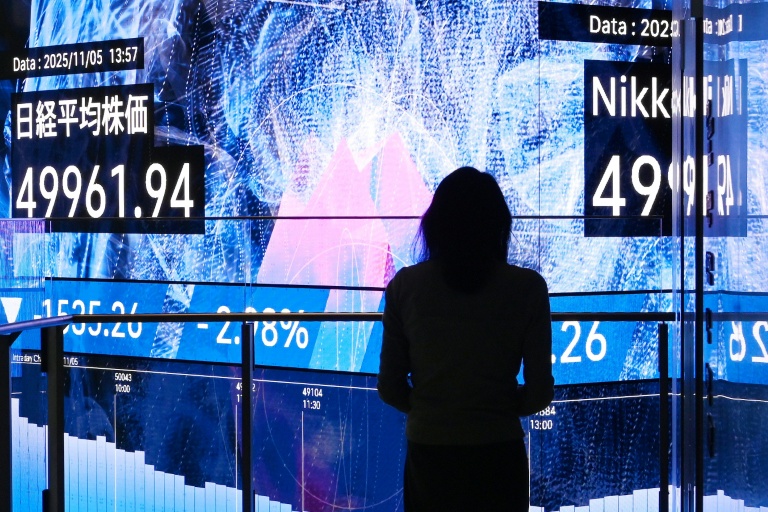

Tokyo – Nikkei 225: DOWN 2.2 percent at 37,628.48 (close)

Hong Kong – Hang Seng Index: UP 0.5 percent at 17,284.54 (close)

Shanghai – Composite: UP 0.3 percent at 3,052.90 (close)

New York – Dow: DOWN 0.1 percent at 38,460.92 (close)

Dollar/yen: UP at 155.62 yen from 155.31 yen on Wednesday

Euro/dollar: UP at $1.0729 from $1.0701

Pound/dollar: UP at $1.2509 from $1.2461

Euro/pound: DOWN at 85.75 pence from 85.85 pence

Brent North Sea Crude: DOWN 0.1 percent at $87.98 per barrel

West Texas Intermediate: DOWN 0.2 percent at $82.65 per barrel

burs-rfj/bcp/lth

© 2024 AFP