London (AFP) – Most stock markets climbed Thursday even as US President Donald Trump’s new tariffs on dozens of countries took effect, with investors eyeing exemptions from his threatened 100-percent levy on semiconductors. Sentiment was also lifted by hopes of easing geopolitical tensions after the Kremlin said Trump and Russia’s leader Vladimir Putin were set to meet for talks in the coming days.

Wall Street’s main indices climbed as trading got underway, but the blue-chip Dow slipped into the red during morning trading and the S&P 500 was flat. Tech stocks were lifted by Trump’s pledge of chip-tariff exemptions for companies that invest heavily in the United States or commit to do so.

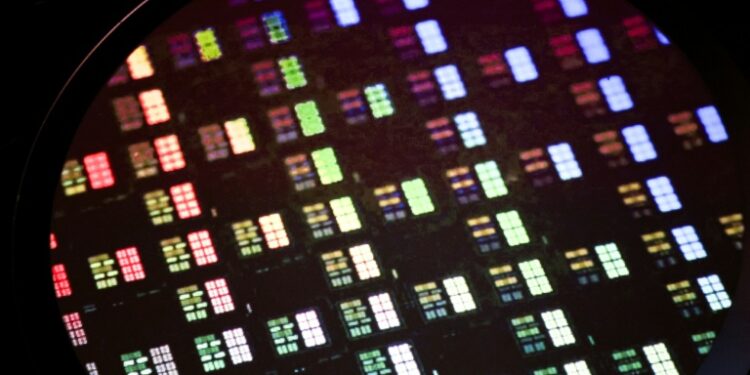

“Donald Trump’s latest tariff move was taken with a positive twist after the president confirmed a 100-percent levy on imported semiconductors, but threw a lifeline to firms like Apple, saying US-based manufacturers would be exempt,” said City Index and FOREX.com analyst Fawad Razaqzada. Shares in Apple climbed 2.9 percent, adding to a gain of more than five percent on Wednesday. Shares in AI chipmaker Nvidia rose 1.0 percent. Some Asian semiconductor firms also got a boost.

Taiwanese chip-making giant TSMC climbed five percent as Taipei said it would be exempt from Trump’s threatened levies on the sector. Seoul-listed Samsung, which is also pumping billions into the world’s number-one economy, rose more than two percent while South Korean rival SK Hynix was up more than one percent. Analysts said that while the chip tariff threat was steep, there was optimism the final level would be lower.

And the entry into force of new US tariffs on many of its key trading partners as part of Trump’s efforts to reshape the global economy did not spook investors. “Trump’s global web of tariffs is now in place, but the stock market appears largely unfazed,” said Jochen Stanzl, chief market analyst at CMC Markets.

Even Switzerland’s stock market rose 0.9 percent despite top officials failing to convince Washington not to impose a 39-percent tariff on Swiss goods. Stanzl added that buying was driven by “the potential for an interest rate cut by the Federal Reserve in just over a month and a possible meeting between Trump, (Ukraine leader Volodymyr) Zelensky, and Putin as early as next week.”

In Europe, London was a rare faller despite the Bank of England cutting interest rates as expected and raising its growth forecast for the British economy. The decision to cut was split and the BoE made clear that bringing down inflation is its main concern, putting in doubt further rate cuts in the immediate future and sending the pound higher.

Shares in chip maker Intel fell 3.3 percent after Trump demanded its new boss resign after a Republican Senator reportedly raised national security concerns over his links to firms in China. The price of bitcoin rose to near its record high on reports that Trump was about to sign an order that would allow US 401k pension savings accounts to use the cryptocurrency as an asset.

– Key figures at around 1530 GMT –

New York – Dow: DOWN 0.6 percent at 43,909.88 points

New York – S&P 500: FLAT at 6,340.70

New York – Nasdaq Composite: UP 0.4 percent at 21,262.39

London – FTSE 100: DOWN 0.7 percent at 9,100.77 (close)

Paris – CAC 40: UP 1.0 percent at 7,709.32 (close)

Frankfurt – DAX: UP 1.1 percent at 24,192.50 (close)

Tokyo – Nikkei 225: UP 0.7 percent at 41,059.15 (close)

Hong Kong – Hang Seng Index: UP 0.7 percent at 25,081.63 (close)

Shanghai – Composite: UP 0.2 percent at 3,639.67 (close)

Euro/dollar: DOWN at $1.1630 from $1.1659 on Wednesday

Pound/dollar: UP at $1.3413 from $1.3358

Dollar/yen: UP at 147.45 yen from 147.38 yen

Euro/pound: DOWN at 86.72 pence from 87.23 pence

Brent North Sea Crude: DOWN 0.3 percent at $66.68 per barrel

West Texas Intermediate: DOWN 0.3 percent at $64.13 per barrel

burs-rl/rlp

© 2024 AFP