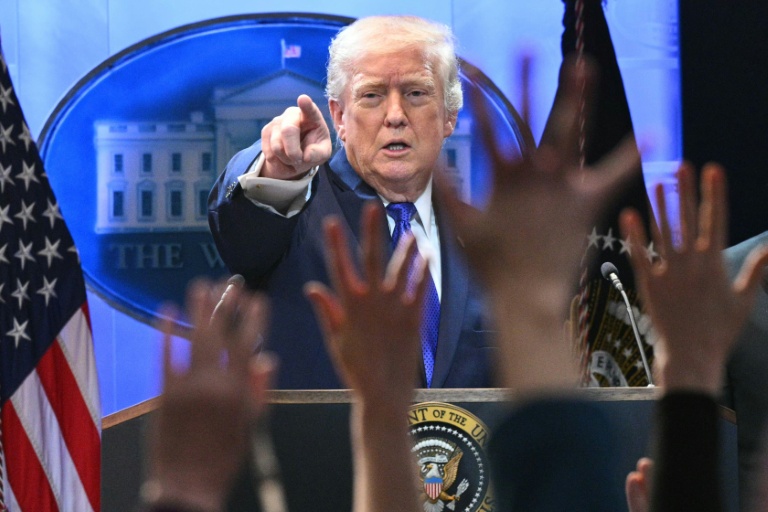

New York (AFP) – Shares in Europe largely dipped Monday while Wall Street treaded water, as Ukrainian President Volodymyr Zelensky and European leaders met with US President Donald Trump in Washington on ending the war with Russia. In New York, the broad-based S&P 500 and tech-heavy Nasdaq closed flat, while the blue-chip Dow edged down slightly. European indices also lost ground, except London’s FTSE which ticked up modestly.

Oil prices nudged higher as traders weighed the impact of the talks and what they could mean for sanctions-hit Russia, a major producer of crude oil. The Washington gathering is a follow-up to Trump’s summit last week with Russian President Vladimir Putin in Alaska, which failed to produce a ceasefire in the Ukraine war. It has been more than three years since Russia’s invasion.

Zelensky, under pressure from Trump to give up Crimea and abandon Ukraine’s NATO ambitions, said ahead of the gathering that Russia “should not be rewarded” for its war. He also said US security guarantees were “the most important” thing. “Friday’s US-Russia meeting turned out to be a non-event, although financial markets are trading as if there might still be a path — however uncertain — towards an eventual peace,” said Fawad Razaqzada, market analyst for trading platform FOREX.com.

Investors are also focused on a speech this week by US Federal Reserve chief Jerome Powell at the annual retreat of global central bankers in Jackson Hole, Wyoming. Markets hope Powell will provide more clues about Fed plans for interest rates when it meets next month, after data last week provided a mixed picture about inflation. Consumer inflation remained steady last month, but producer prices accelerated.

“The lack of progress at Friday’s Alaska summit, the upcoming Zelensky-Trump meeting in Washington, and the Jackson Hole Economic Symposium all remain potential catalysts for market swings,” said David Morrison, senior market analyst at Trade Nation. Traders will also be eyeing a series of US retailers’ financial results expected this week, for signs of how Trump’s sweeping tariffs are impacting businesses and consumers.

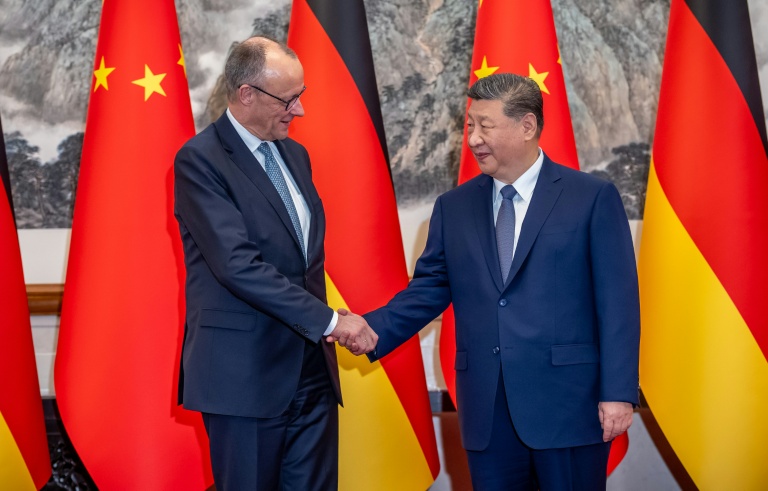

In Asia, Shanghai, Sydney, and Taipei were higher Monday, while Hong Kong, Seoul, and Jakarta fell back. Japan’s Nikkei ended up, posting a new record high and adding to gains on Friday after better-than-expected economic growth data.

– Key figures at around 2020 GMT –

New York – Dow: DOWN 0.1 percent at 44,911.82 points (close)

New York – S&P 500: FLAT at 6,449.15 (close)

New York – Nasdaq: FLAT at 21,629.77 (close)

London – FTSE 100: UP 0.2 percent at 9,157.74 (close)

Paris – CAC 40: DOWN 0.5 percent at 7,884.05 (close)

Frankfurt – DAX: DOWN 0.2 percent at 24,314.77 (close)

Tokyo – Nikkei 225: UP 0.8 percent at 43,714.31 (close)

Hong Kong – Hang Seng Index: DOWN 0.4 percent at 25,176.85 (close)

Shanghai – Composite: UP 0.9 percent at 3,728.03 (close)

Euro/dollar: DOWN at $1.1666 from $1.1704 on Friday

Pound/dollar: DOWN $1.3503 at from $1.3557

Dollar/yen: UP at 147.89 yen from 146.85 yen

Euro/pound: UP at 86.40 pence from 86.34 pence

Brent North Sea Crude: UP 1.1 percent at $66.60 per barrel

West Texas Intermediate: UP 1.0 percent at $63.42 per barrel

© 2024 AFP