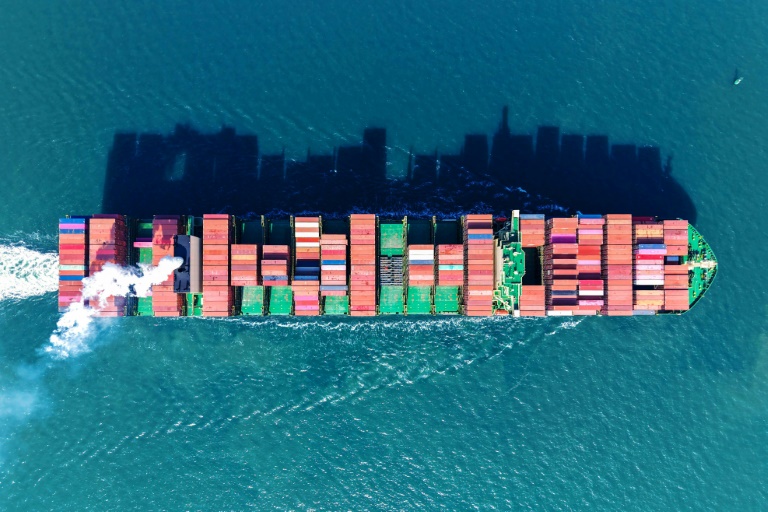

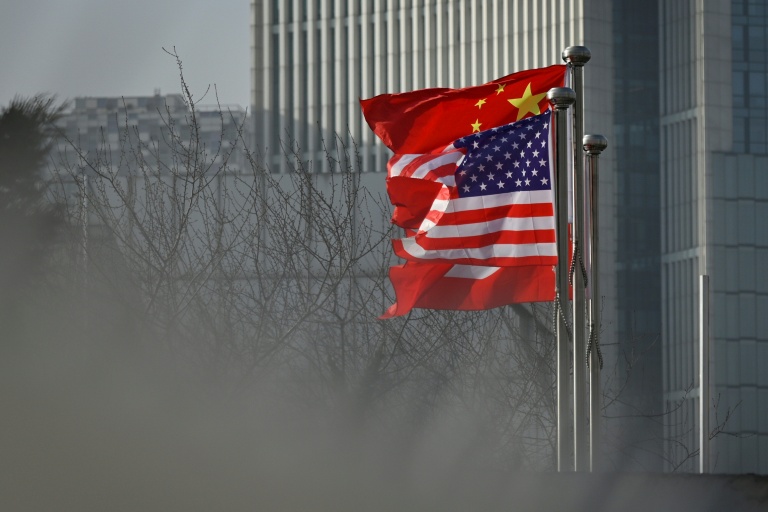

Hong Kong (AFP) – Asian markets tumbled on Tuesday after US President Donald Trump hiked tariffs on Chinese imports and warned that levies on Mexico and Canada could not be averted. Japan’s Nikkei and Hong Kong’s Hang Seng saw the biggest drop, falling more than two percent and 1.5 percent respectively. It comes after the White House said on Monday that Trump had signed an executive order to increase a previously imposed 10 percent tariff on China to 20 percent. Trump also stressed that Canada and Mexico would not avoid being hit with 25 percent levies, causing US stocks to fall sharply on Monday. The new levies came into effect soon after midnight.

Canada responded on Monday by putting 25 percent tariffs on $155 billion worth of American goods. Beijing also warned that it was “strongly dissatisfied” and would be taking countermeasures to safeguard its “rights and interests,” a commerce ministry spokesperson said in a statement. Fears that the retaliatory tariffs could escalate into a full-blown trade war drove markets down across Asia. Japanese automakers with Mexican factories in their supply chains suffered, with Nissan, Toyota, and Honda among the major losers, all down more than two percent.

Exchanges across Asia mirrored the downward trajectory, with Thailand, Australia, New Zealand, and Taiwan dropping around one percent. Equities also fell in the Philippines, Malaysia, and South Korea, where a second stock exchange named Nextrade was opened on Tuesday. “The spectre of a full-blown trade war is once again looming, threatening to choke global economic growth just as investors were starting to regain confidence,” said Stephen Innes of SPI Asset Management.

Investors are hoping China will announce a huge stimulus package at its key parliamentary meeting on Wednesday, the National People’s Congress, to stimulate the economy. “In the upcoming National People’s Congress, Chinese policymakers could provide more pro-growth measures including announcing a larger budget deficit target and maintaining a five percent growth target for this year,” said MUFG Bank’s Lloyd Chan. Trump expressed outrage on Monday over the weakening of certain currencies, accusing Beijing and Tokyo of using it as a trade strategy, although the Japanese government fiercely refuted the claim.

The oil market also saw sharp declines, with West Texas Intermediate crude falling to $68 per barrel, and Brent crude from the North Sea dropping to $71.06 per barrel at around 0200 GMT. Bitcoin’s price plunged nearly 10 percent on Monday as concerns of an escalating trade war pushed investors to seek safer investments. Bitcoin and similar digital assets had surged over the weekend after Trump suggested creating a national cryptocurrency reserve. “Everything is getting sold,” Forexlive manager Adam Button said. “There’s a de-risking that’s unfolding” among crypto investors, he said.

– Key figures around 0230 GMT –

Tokyo – Nikkei 225: DOWN 1.84 percent at 37,090.72 (break)

Hong Kong – Hang Seng Index: DOWN 1.3 percent at 22,706.40

Shanghai – Composite: DOWN 0.2 percent at 3,310.14

Euro/dollar: UP at 1.0485 from $1.0419 on Monday

Pound/dollar: UP at $1.2694 from $1.2612

Dollar/yen: DOWN 149.32 from 150.28 yen

Euro/pound: DOWN at 82.60 pence from 82.62 pence

West Texas Intermediate: DOWN 0.42 percent at $68.08 per barrel

Brent North Sea Crude: DOWN 0.66 percent at $71.15 per barrel

New York – Dow: DOWN 1.5 percent at 43,191.24 (close)

London – FTSE 100: UP 0.6 percent at 8,809.74 (close)

© 2024 AFP