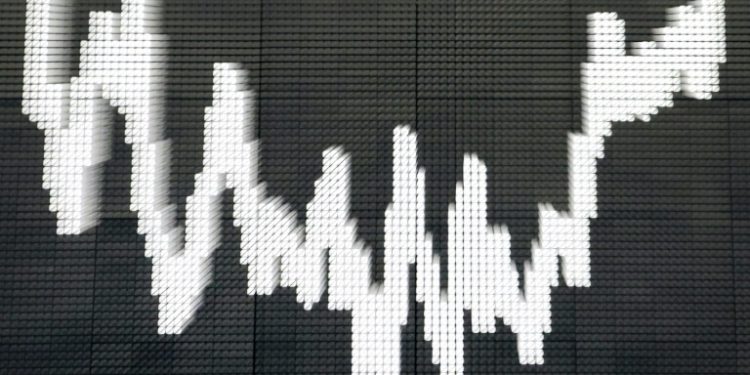

Hong Kong (AFP) – Asian markets retreated Wednesday as traders took a breather from a global rally that has been fuelled by expectations the Federal Reserve will cut interest rates next month. With few sparks to drive buying, markets took their cue from Wall Street, where the main indexes slipped after an eight-day advance, with focus on a speech Friday by central bank boss Jerome Powell at the Jackson Hole symposium in Wyoming.

After a hefty retreat at the start of the month—caused by a weak US jobs report that fanned recession fears—investors have rediscovered their buying mojo, with speculation rife that the Fed will begin easing monetary policy at its September meeting. Data showing inflation easing, retail sales remaining healthy, and the jobs market softening—but not too quickly—have reinforced a long-running view that bank officials are on course to guide the economy to a soft landing and avert a recession.

With bets now baked into a reduction, speculation is now focused on how many cuts are in the pipeline and how big they will be, with some suggesting as much as 100 basis points before the end of the year. Its forecast rate cut would come as central banks around the world begin easing after years of battling soaring inflation. Sweden on Tuesday announced its second cut this year, while New Zealand last week moved for the first time since early 2020. The Bank of England and European Central Bank have also moved and are eyeing more cuts before January.

All three main indexes on Wall Street dipped, having come within distance of their record highs. And the losses filtered through to Asia. Hong Kong led losers as tech firms took a hit, with e-commerce titan JD.com tumbling more than 11 percent at one point after a Bloomberg report said US retail behemoth Walmart planned to unload $3.7 billion of shares in the firm at a discount. Alibaba and Netease were among others in retreat. Tokyo, Shanghai, Mumbai, Singapore, and Taipei also slipped, though Manila, Bangkok, Seoul, and Jakarta eked out gains. London edged higher while Paris and Frankfurt were also up.

While analysts are optimistic about the outlook for equities, Stefan Angrick at Moody’s Analytics warned, “anything that changes the interest rate outlook could trigger new market hiccups.” This includes political factors such as the US election and the conditions in the Middle East, but also negative data surprises. Any data that delays rate cuts in the US or hikes in Japan could lead to large swings in currencies, equities, and bonds. The risk of large swings is particularly pronounced in Japan given the Bank of Japan’s fuzzy messaging. This will keep trading jumpy.

On currency markets, the dollar edged up but remained largely pinned down by rate cut expectations, with the yen helped by talk of another Bank of Japan hike. The turmoil on markets in early August was partly caused by the BoJ’s surprise lift, which came soon after the Fed indicated it was set to cut—that caused a huge unwind of the so-called carry trade in which dealers use the cheap yen to buy higher-yielding assets.

“While most central banks are expected to reduce their policy rates by mid-2025, the BoJ is anticipated to pursue a modest increase,” said ACY Securities’ Luca Santos. “This divergence in policy trajectories suggests a limited likelihood of a significant resurgence in yen carry trades.” Gold held above $2,520, having broken to a record high above $2,530 Tuesday on Fed rate cut bets that would make the metal more attractive to investors.

– Key figures around 0710 GMT –

Tokyo – Nikkei 225: DOWN 0.3 percent at 37,951.80 (close)

Hong Kong – Hang Seng Index: DOWN 1.0 percent at 17,334.12

Shanghai – Composite: DOWN 0.4 percent at 2,856.58 (close)

London – FTSE 100: UP 0.1 percent at 8,281.68

Dollar/yen: UP at 145.87 yen from 145.20 yen on Tuesday

Euro/dollar: DOWN at $1.1118 from $1.1129

Pound/dollar: DOWN at $1.3020 from $1.3034

Euro/pound: UP at 85.39 pence from 85.38 pence

West Texas Intermediate: FLAT at $73.15 per barrel

Brent North Sea Crude: FLAT at $77.21 per barrel

New York – Dow: DOWN 0.2 percent at 40,834.97 (close)

© 2024 AFP