Hong Kong (AFP) – Investors fought back Friday after a tech-fuelled sell-off, taking heart from forecast-beating US growth data that indicated the economy was still in rude health, but did not dent hopes for an interest rate cut.

The positive performance came despite more losses on Wall Street, where the so-called “Magnificent Seven” heavyweights — which have been key to this year’s markets surge — suffered more selling as investors swapped out of them and into cheaper, small caps.

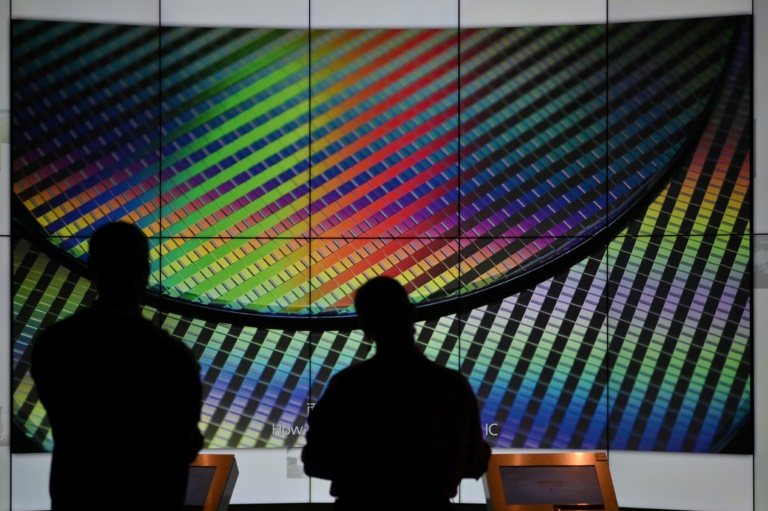

However, Taipei had a rough start as it reopened after being closed for two days by a typhoon, with chip giants including TSMC tanking as traders played catch-up with the recent rout, which was sparked by disappointing earnings from Tesla and Google-parent Alphabet.

Figures showing the US economy expanded far more than expected in the second quarter — and much quicker than the previous three months — provided a much-needed boost to sentiment and eased concerns that it was slowing a little too much for comfort.

The data was largely consumer-led, even while interest rates remain at two-decade highs and inflation is elevated.

However, the S&P 500 and Nasdaq both fell, with tech titans Nvidia, Microsoft, Amazon, Apple and Facebook owner Meta well in the red.

Attention now turns to personal consumption expenditure figures, which are due later in the day.

The data is the Federal Reserve’s preferred gauge of inflation and could give the central bank more room to cut borrowing costs.

A string of readings in recent months and dovish comments from Fed officials have seen bets on a September move soar, while some investors are also eyeing another one before January.

“The big picture is that the US economy has continued its gradual deceleration from last year, so there is no urgency for the Fed to start a new easing cycle as soon as next week,” said National Australia Bank’s Rodrigo Catril.

“But looking ahead there are several indicators that suggest further cooling should be expected.

“For instance, intentions surveys suggest a pullback in capital expenditure is coming while a decline in income alongside rising unemployment point to an (easing) in consumption ahead.”

Asian markets opened with big gains but some tailed off as the day wore on.

Hong Kong, Sydney, Singapore, Seoul, Manila, Mumbai, Bangkok and Jakarta rose along with London, Paris and Frankfurt.

Tokyo and Wellington edged down.

Taipei plunged more than three percent as traders returned from their imposed typhoon break, with chip makers leading the losses.

Market titan TSMC dived more than five percent, while ASE Technology plunged almost 10 percent, MediaTek more than two percent and Realtek more than one percent.

The selling followed a similar story for Asian tech firms on Thursday.

Now there are some worries that the eye-watering surge in the sector, which has been fanned by a frenzy to snap up artificial intelligence-linked firms, may have run its course and could be set for a pullback.

“Disappointing earnings reports from Tesla and Alphabet have overshadowed what was once an AI-fuelled euphoria,” said analyst Stephen Innes.

“As the investors continue to shimmy and rotate to the small-cap dance floor, the spotlight has turned, perhaps overly harshly, on once-celebrated tech stocks.”

In currency markets the dollar bounced back against the yen, having suffered some hefty selling in the two weeks since a suspected intervention by Japanese authorities to support their unit.

The greenback fell as low as 151.94 yen Thursday but clawed all the way back to 154.32 yen following the release of the US growth data.

Dealers are also eyeing Beijing, hoping for further measures to boost China’s stuttering economy after the central bank announced a surprise cut to medium-term interest rates Thursday, having lowered two other key rates three days earlier.

– Key figures around 0810 GMT –

Tokyo – Nikkei 225: DOWN 0.5 percent at 37,667.41 (close)

Hong Kong – Hang Seng Index: UP 0.1 percent at 17,021.31 (close)

Shanghai – Composite: UP 0.1 percent at 2,890.90 (close)

London – FTSE 100: UP 0.6 percent at 8,238.21

Dollar/yen: DOWN at 153.81 yen from 153.84 yen on Thursday

Euro/dollar: UP at $1.0850 from $1.0848

Pound/dollar: UP at $1.2864 from $1.2853

Euro/pound: DOWN at 84.34 pence at 84.38 pence

West Texas Intermediate: DOWN 0.1 percent at $78.20 per barrel

Brent North Sea Crude: DOWN 0.1 percent at $82.32 per barrel

New York – Dow: UP 0.2 percent at 39,935.07 (close)

© 2024 AFP