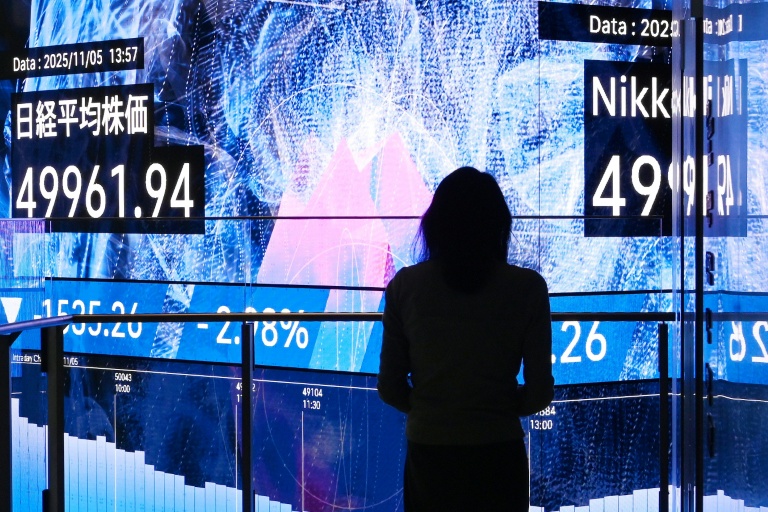

London (AFP) – Stock markets climbed Monday after conciliatory comments from US President Donald Trump at the weekend eased worries about China-US trade tensions. Tokyo stocks surged more than three percent to a record after Japan’s ruling party said it was set to sign a new coalition deal. The deal, signed on Monday, paves the way for Sanae Takaichi to become prime minister and raises hopes for an end to the country’s political turmoil.

Most stock markets started the week on the front foot as traders “responded to an apparent softening in rhetoric concerning the reigniting of the trade war between the US and China,” said David Morrison, senior market analyst at Trade Nation. Wall Street’s main indices opened higher, with the Nasdaq Composite rising 0.7 percent.

A global outage hit Amazon’s cloud services for several hours on Monday, affecting online services for the US tech giant and numerous other companies and organisations. Amazon’s share price, which had been down in pre-market trading, recovered to gain 0.5 percent at the opening bell.

In Europe, Frankfurt’s stock market rose more than one percent in afternoon trading. Even Paris pushed higher from early losses that were fuelled by BNP Paribas, whose share price tumbled more than seven percent after a US court late last week found it liable for atrocities committed in Sudan. Shares in BNP’s French rivals Credit Agricole and Societe Generale both recovered to stand 0.3 percent lower.

French bonds declined after S&P Global cut the country’s credit rating, citing risks that the government would fail to significantly reduce its deficit next year. The Paris stock exchange got a lift from Gucci-owner Kering, which rose 4.5 percent after it announced the $4.6-billion sale of its beauty products division to L’Oreal.

Hong Kong advanced more than two percent and Shanghai was also well up at close as data showed China’s economy grew in line with expectations in the third quarter, though at its slowest pace in a year. The data was released just hours before the start of a closely watched four-day meeting in Beijing with top Communist Party officials focused on long-term economic planning.

Sentiment was boosted as Washington and Beijing agreed on Saturday to hold another round of trade negotiations in the coming week to avoid another damaging tit-for-tat tariff battle. Trump, who recently threatened 100-percent tariffs in response to Chinese rare-earth export controls, told Fox Business last week that the higher tariffs were “not sustainable.”

“Catalysed by Trump’s remark…markets appear priced for a positive or at least less-bad outcome,” said Chris Weston, head of research at Pepperstone. “The market’s base case now seems to be that China will offer concessions on its rare-earth export controls, paving the way for the US to extend the current 30 percent ‘tariff truce’ by another 90 days beyond its 10 November deadline.”

Traders also took heart from a bounceback for US regional bank stocks Friday, which had been pummelled Thursday following disclosures from two mid-sized players of expected losses tied to problem loans.

**Key figures at around 1330 GMT:**

* New York – Dow: UP 0.4 percent at 46,392.91 points

* New York – S&P 500: UP 0.5 percent at 6,700.15

* New York – Nasdaq Composite: UP 0.7 percent at 22,844.82

* London – FTSE 100: UP 0.4 percent at 9,394.65

* Paris – CAC 40: UP 0.2 percent at 8,189.11

* Frankfurt – DAX: UP 1.6 percent at 24,214.44

* Tokyo – Nikkei 225: UP 3.4 percent at 49,185.50 (close)

* Hong Kong – Hang Seng Index: UP 2.4 percent at 25,858.83 (close)

* Shanghai – Composite: UP 0.6 percent at 3,863.89 (close)

**Exchange Rates:**

* Euro/dollar: DOWN at $1.1652 from $1.1670 on Friday

* Pound/dollar: DOWN at $1.3421 from $1.3433

* Dollar/yen: UP at 150.67 yen from 150.50 yen

* Euro/pound: DOWN at 86.85 percent from 86.88 pence

**Oil Prices:**

* West Texas Intermediate: DOWN 1.5 percent at $56.27 per barrel

* Brent North Sea Crude: DOWN 1.5 percent at $60.37 per barrel

burs-rl/jxb

© 2024 AFP