Hong Kong (AFP) – Most Asian markets rose Monday, building on last week’s rally following the Federal Reserve’s bumper interest rate cut, with focus now on the release of the bank’s favoured inflation gauge later in the week. Traders greeted the first reduction in borrowing costs since 2020 by pushing the Dow and S&P 500 to record highs as they contemplated a soft landing for the world’s top economy.

While the Fed is expected to keep easing monetary policy, US investors took a breather Friday — though the Dow inched to another all-time high — with observers saying a pullback was expected after the latest run-up. Still, Asian dealers brushed off the tepid performance in New York on Friday, even after another round of data showed the Chinese economy remained weak. Youth unemployment in China hit 18.8 percent in August, its highest level this year, as leaders struggle to kickstart growth and face calls for more stimulus — particularly for the troubled property sector.

The report came after news earlier in the month pointed to a slowdown in retail sales and industrial production growth for August. “As the property market struggles and the unemployment rate creeps up, households are being cautious with their spending,” said Moody’s Analytics. “Government measures to stimulate domestic demand have yet to encourage households to spend.”

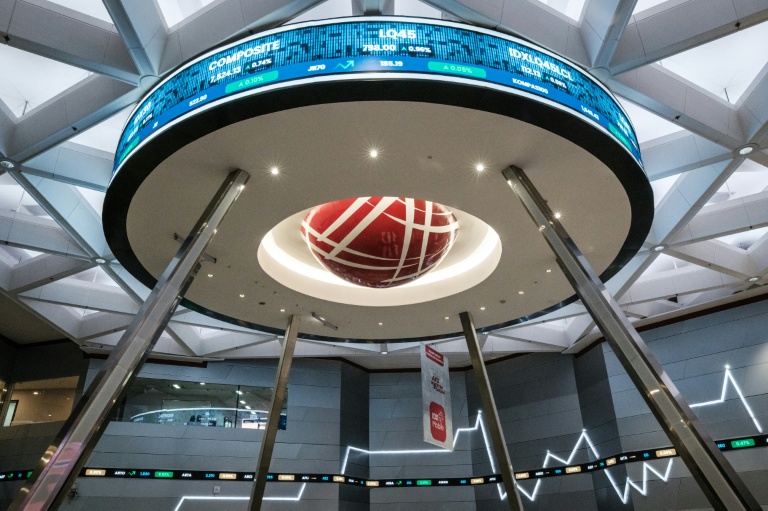

In early trade, Hong Kong, Shanghai, Seoul, Singapore, Taipei, and Manila rose, though Sydney, Jakarta, and Wellington dipped. Tokyo was closed for a holiday. Eyes are now on the release this week of the personal consumption expenditures index, the Fed’s preferred inflation metric, which could guide policymakers’ decision-making on the next rate move. Fed boss Jerome Powell signalled a tentative victory in the battle against inflation, noting that the risks of inflation escalating further have “diminished,” wrote IG analyst Tony Sycamore.

“The focus of monetary policy has now distinctly shifted towards supporting the labour market to ensure a smooth economic landing, evidenced by the substantial 50-basis-point cut.” Oil prices edged up on worries about an escalation of the conflict in the Middle East after Lebanon-based Hezbollah launched dozens of rockets at Israel, with both sides threatening to ramp up hostilities. The yen struggled to bounce back against the dollar after sinking Friday in reaction to the Bank of Japan’s decision not to hike interest rates for a third time this year and suggested it was not in a rush to tighten policy further.

And gold sat around record highs above $2,600 after the Fed rate cut, which makes the precious metal more attractive to traders, and on geopolitical concerns.

– Key figures around 0230 GMT –

Hong Kong – Hang Seng Index: UP 0.4 percent at 18,325.53

Shanghai – Composite: UP 0.2 percent at 2,743.11

Tokyo – Nikkei 225: Closed for a holiday

Pound/dollar: DOWN at $1.3312 from $1.3316 on Friday

Euro/dollar: DOWN at $1.1157 from $1.1160

Dollar/yen: UP at 144.37 yen from 144.02 yen

Euro/pound: UP at 83.82 pence from 83.80 pence

West Texas Intermediate: UP 0.4 at $71.28 per barrel

Brent North Sea Crude: UP 0.4 percent at $74.78 per barrel

New York – Dow: UP 0.1 percent at 42,063.36 (close)

London – FTSE 100: DOWN 1.2 percent at 8,229.99 (close)

© 2024 AFP