Hong Kong (AFP) – Asian markets were mixed in holiday-thinned trade Friday as investors keep tabs on countries’ tariff talks with the White House, while Donald Trump’s remarks that he was reluctant to hike levies on Beijing even more provided a little support. Governments around the world are lining up to visit the US president’s team as they look to pare back eye-watering levies imposed by the United States for what he calls years of being “ripped off” and as he looks to reshore manufacturing.

While several officials have been in touch, Japanese negotiator Ryosei Akazawa’s trip this week was seen as a “canary in the mine” owing to the countries’ long-running relationship. He met Trump, Trade Representative Jamieson Greer and Treasury Secretary Scott Bessent on Wednesday without making any immediate progress, though a second round of talks is scheduled for the end of April. Trump had earlier hailed “big progress” in the negotiations.

Hopes most of the measures against US trading partners can be rowed back have soothed some market anxiety after the white-knuckle ride at the start of the month, though uncertainty caused by the president’s tendency to flip-flop is keeping investors on edge. Trump on Thursday offered a little optimism when he said he was reluctant to keep hiking rates on China as that could halt trade between the two economic superpowers, adding that Beijing had been reaching out to him. “I have a very good relationship with President Xi (Jinping), and I think it’s going to continue,” he said. “And I would say they have reached out a number of times.”

His remarks came after Bloomberg reported that China could be open to dialogue but wanted to see some measures beforehand, including reining in some cabinet members’ anti-Beijing comments. Still, Washington unveiled new port fees on Chinese built and operated ships Thursday as it looks to boost its domestic shipbuilding industry and curb China’s dominance in the sector. The move stems from a probe launched under Joe Biden’s administration but could further ratchet up tensions.

After a mixed lead from Wall Street, Asia fluctuated. Tokyo led the gains even as data showed Japanese inflation accelerated last month as rice prices more than doubled. Seoul and Taipei also rose while Shanghai dipped. Hong Kong, Sydney, Singapore, Mumbai, Jakarta, Wellington and Manila were closed for holidays.

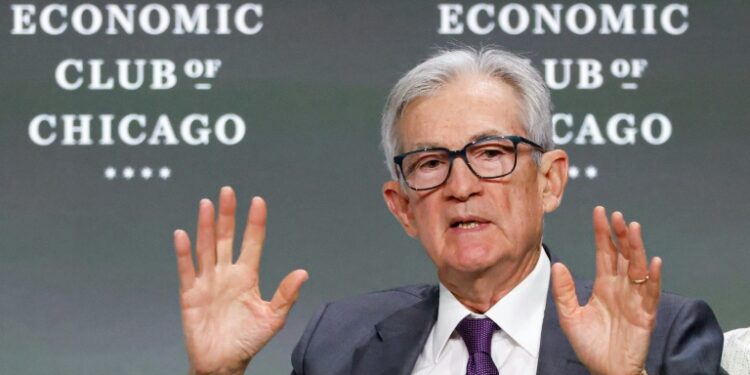

Investors are also eyeing developments at the Federal Reserve as Trump hit out at boss Jerome Powell, who warned the sweeping tariffs were “highly likely to generate at least a temporary rise in inflation.” The president slammed Powell for not lowering interest rates, as the ECB has done, and said his “termination cannot come fast enough.” Speaking to reporters at the White House, he said Powell would “leave if I ask him to,” adding “I’m not happy with him. I let him know it and if I want him out, he’ll be out of there real fast, believe me.” Earlier, in a post on Truth Social, he said his “termination…cannot come fast enough”.

Michael Hewson at MCH Market Insights pointed out that US inflation was far higher than the Fed’s two percent target and the tariff policy had created “significant ripples in the US economy, prompting a collapse in consumer confidence in the process.” “Trump is amping up the pressure on the Fed to cut rates quickly,” he wrote in a note. “Sadly, for Trump his very policies are the ones causing the Fed to pause, with Powell warning that the sheer size of the tariffs is complicating the central bank’s job.” The chaos being unleashed by the US administration is also giving business cause for concern.

– Key figures at 0230 GMT –

Tokyo – Nikkei 225: UP 0.6 percent at 34,583.29 (break)

Shanghai – Composite: DOWN 0.4 percent at 3,268.89

Hong Kong – Hang Seng Index: closed for a holiday

Euro/dollar: UP at $1.1371 from $1.1370 on Thursday

Pound/dollar: UP $1.3273 at $1.3268

Dollar/yen: DOWN at 142.35 yen from 142.39 yen

Euro/pound: DOWN at 85.66 pence from 85.67 pence

West Texas Intermediate: UP 3.5 percent at $64.68 per barrel

Brent North Sea Crude: UP 3.2 percent at $67.96 per barrel

New York – Dow: DOWN 1.3 percent at 39,142.23 (close)

London – FTSE 100: FLAT at 8,275.66 (close)

© 2024 AFP