Hong Kong (AFP) – Asian shares mostly rose on Thursday ahead of the release of crucial inflation data later in the day that will help chart the Fed’s rate cut timeline.

Investors are awaiting the release of the US Personal Consumption Expenditures (PCE) price index, the Federal Reserve’s most-watched inflation indicator, which is expected to influence the central bank’s policy decisions.

Expectations for cuts to US interest rates have shifted to later this year because recent inflation data has come in hot and Fed policymakers have taken a wait-and-see attitude, calling for more time and data showing that inflation is moving towards their two percent goal.

Analysts say the PCE figures, and other US economic indicators coming Thursday, will likely influence market sentiment.

“The recent data is ‘noise’ and should be ignored outside of its impact for very short-term market movements,” Chris Zaccarelli, chief investment officer for Independent Advisor Alliance, told Bloomberg.

“We are more interested in the PCE data,” he said.

The world’s biggest economy will also report consumer and jobless figures.

“Given its status as a real-time gauge of the jobs market, the initial jobless claims release can sway investor perceptions and contribute to market volatility,” Stephen Innes, of SPI Asset Management, said in a note.

Wall Street’s main indices retreated on Wednesday, although losses on both the Dow and S&P 500 were modest.

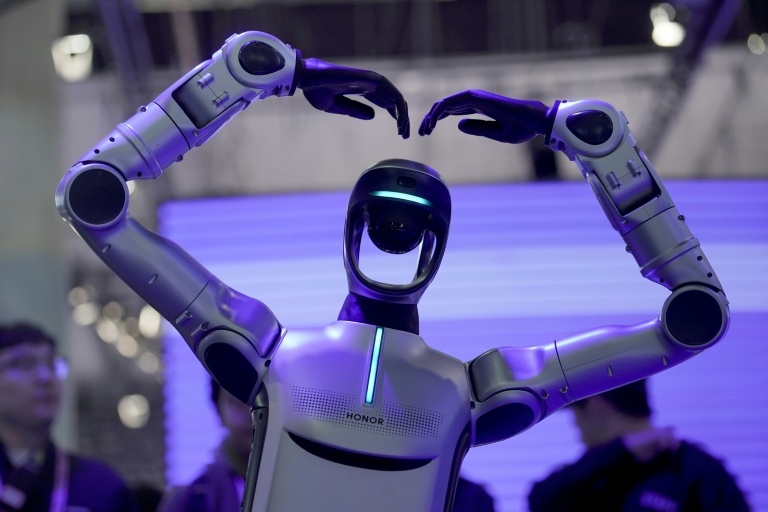

“Stocks buoyed by A.I.euphoria encountered challenges in the final days of February as inflation concerns resurfaced, prompting investors to reckon with the prospect of higher interest rates likely to endure for an extended period,” Innes said.

“Indeed, investors have been in a state of cautious contemplation as they grapple with the shifting dynamics in interest rates, which have transformed from favourable trade winds to subtly challenging headwinds.”

New York Fed boss John Williams said Wednesday the central bank has “a ways to go” in its inflation fight, according to Bloomberg.

Eurozone inflation figures are due Friday.

Cryptocurrency bitcoin rose above $63,000 on Thursday thanks to feverish demand, edging in on its November 2021 peak.

Bitcoin has been buoyed by US moves towards creating exchange-traded funds (ETFs) to track the price of the world’s most popular cryptocurrency, which would expand its potential investor pool by allowing the public to place bets without directly purchasing the digital unit.

Tokyo stocks closed lower, with the Japanese market lacking “clues for buying stocks after falls in US shares”, Matsui Securities said.

Hong Kong finished down, while Shanghai gained 1.9 percent and the Shenzhen Composite Index on China’s second exchange added 3.4 percent.

Traders are awaiting next week’s meeting of the National People’s Congress with hopes Beijing will offer more economic support.

Seoul, Wellington, Bangkok and Jakarta were lower, while Sydney, Taipei, Singapore, Manila and Kuala Lumpur were up.

London, Frankfurt and Paris all opened higher.

– Key figures around 0810 GMT –

Tokyo – Nikkei 225: DOWN 0.1 percent at 39,166.19 (close)

Hong Kong – Hang Seng Index: DOWN 0.2 percent at 16,511.44 (close)

Shanghai – Composite: UP 1.9 percent at 3,015.17 (close)

London – FTSE 100: UP 0.2 percent at 7,637.68

Euro/dollar: UP at $1.0845 from $1.0840 on Wednesday

Dollar/yen: DOWN at 149.65 yen from 150.70 yen

Pound/dollar: UP at $1.2666 from $1.2661

Euro/pound: UP at 85.62 pence from 85.60 pence

Brent North Sea Crude: DOWN 0.6 percent at $83.20 per barrel

West Texas Intermediate: DOWN 0.4 percent at $78.24 per barrel

New York – Dow: DOWN 0.1 percent at 38,949.02 (close)

© 2024 AFP