Hong Kong (AFP) – Asian stocks advanced again Tuesday to extend another record day on Wall Street as traders locked in bets on a US interest rate cut this week, while they are also keenly eyeing flagged talks between Donald Trump and Xi Jinping.

While the outcome of the Federal Reserve’s policy decision Wednesday is considered a fait accompli, there is still a lot of discussion over its plans for future meetings and its so-called “dot plot” outlook for borrowing costs. Bank boss Jerome Powell’s post-meeting comments will also be pored over for an idea about decision-makers’ thinking as the US jobs market slows and inflation remains stubbornly above target.

“Jobless claims and unemployment are at their highest since 2021, and for the first time in four years, there are more job seekers than jobs,” said SPI Asset Management’s Stephen Innes. “That single ratio tells the Fed all it needs to know: rate cuts are back on the runway. Add the housing drag — mortgage payments nearly doubled from pre-Covid levels, affordability at record lows, rents soaring — and you get a feedback loop that eats into consumption, profits, hiring, and confidence,” Innes added.

Still, Neil Wilson at Saxo Markets said: “Assuming the Fed does cut… I’d still anticipate the Fed saying that the ‘extent and timing’ of further policy adjustments will be dependent on incoming data, and not on a preset course.” The meeting will take place with a Trump appointee as a new member of the bank’s board of governors and rate-setting Federal Open Market Committee. Stephen Miran, who chairs the White House Council of Economic Advisers, was cleared Monday by the Republican-majority Senate. His appointment comes as the president demands the Fed cut borrowing costs, and accusing Powell of being unfit for the job.

Tokyo rose as investors returned from a long weekend, while Seoul jumped more than one percent to chalk up another record high. Sydney, Taipei, Wellington, Manila, Mumbai, and Bangkok were also up, with Shanghai marginally higher and Hong Kong flat. There were losses in Singapore and Jakarta, while London, Paris, and Frankfurt struggled in the morning session. The broadly positive mood came after Wall Street’s S&P 500 and Nasdaq also hit records.

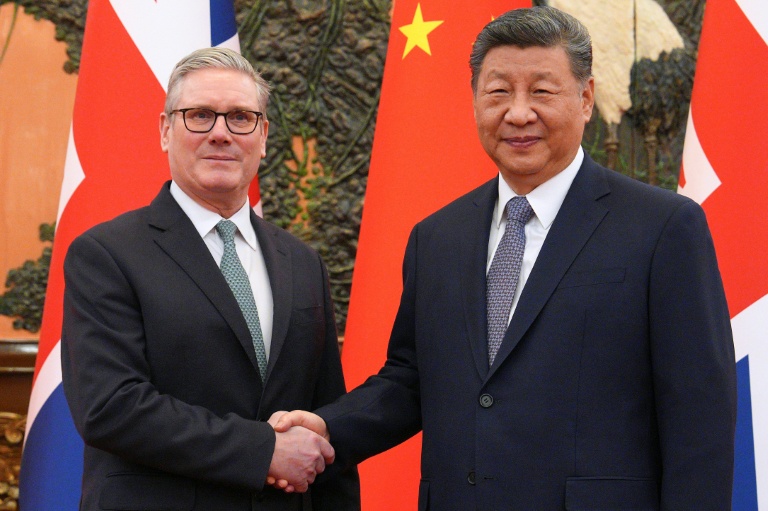

Expectations that US rates will be culled over the next few months and possibly into 2026 continued to weigh on the dollar against its peers and pushed up gold to a new all-time peak of above $3,689. Trump said on his Truth Social network Monday that he would speak to Chinese counterpart Xi at the end of the week, stoking hopes for a further easing of tensions between the world’s economic superpowers. The US president’s message came as Washington and Beijing reached a framework deal over their TikTok dispute, which the US side said will be finalized by the two leaders on Friday. The agreement came on the second day of high-level talks between the two sides in Madrid that included discussions on the countries’ trade dispute. Trump said on social media that the talks were going “VERY WELL.”

– Key figures at around 0810 GMT –

Tokyo – Nikkei 225: UP 0.3 percent at 44,902.27 (close)

Hong Kong – Hang Seng Index: FLAT at 26,438.51 (close)

Shanghai – Composite: FLAT at 3,861.87 (close)

London – FTSE 100: DOWN 0.2 percent at 9,256.33

Euro/dollar: UP at $1.1797 from $1.1768 on Monday

Pound/dollar: UP at $1.3631 from $1.3609

Dollar/yen: DOWN at 146.87 yen from 147.38 yen

Euro/pound: UP at 86.54 pence from 86.47 pence

West Texas Intermediate: DOWN 0.4 percent at $63.03 per barrel

Brent North Sea Crude: DOWN 0.5 percent at $67.13 per barrel

New York – Dow: UP 0.1 percent at 45,883.45 (close)

© 2024 AFP