Hong Kong (AFP) – Asian stocks mostly rose Tuesday following the previous day’s stutter, as more weak data helped solidify US interest rate cut optimism and tempered nervousness over rising Japanese bond yields. Expectations that the Federal Reserve will lower borrowing costs have provided a boon to markets in the past few weeks and saw them recover early November’s losses that had been stoked by fears of a tech bubble.

Bets on the central bank easing monetary policy for a third successive meeting have been rising since a number of decision-makers said protecting jobs was a bigger concern for them than keeping a lid on elevated inflation. Those comments have been compounded by figures showing the economy — particularly the labour market — continues to soften while inflation appears to have stabilised for now. The latest round of data added to that narrative, with a survey of manufacturers by the Institute for Supply Management indicating that activity in the sector contracted for a ninth straight month.

After a mixed day to start the week, most of Asia battled to end with gains, while Europe opened on a negative note. Hong Kong, Sydney, Seoul, Singapore, Taipei, Manila, and Jakarta were all up, though Shanghai, Mumbai, and Bangkok dipped with London, Paris, and Frankfurt. Tokyo was flat after giving up early gains, following Monday’s losses that came on the back of comments from Bank of Japan boss Kazuo Ueda hinting at a possible interest rate hike this month. The remarks boosted the yen and provided a jolt to equities as the yield of Japanese two-year government bonds rose past one percent to their highest since 2008 during the global financial crisis.

The Japanese unit eased slightly Tuesday as an auction of 10-year bonds received healthy interest. Ueda’s hint also helped pin back Wall Street after last week’s Thanksgiving run-up and dented overall risk sentiment, pulling bitcoin back down. The comments “could mark a de-anchoring of the carry trade, in which traders borrow yen at low cost to invest in riskier assets,” wrote City Index senior market analyst Fiona Cincotta. “A higher rate in Japan could suck liquidity out of the markets. Tech stocks and crypto are particularly sensitive to even the smallest shifts in liquidity.”

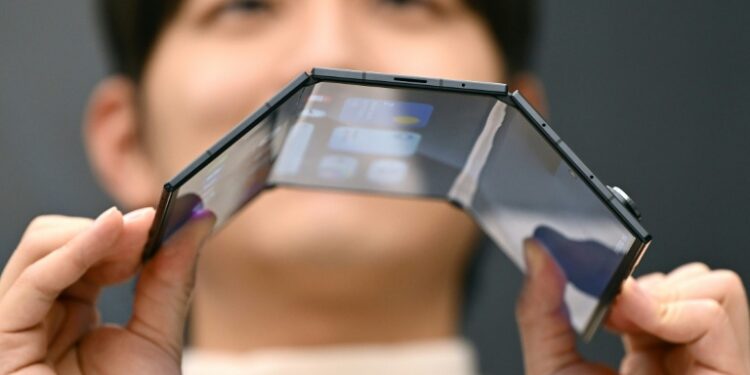

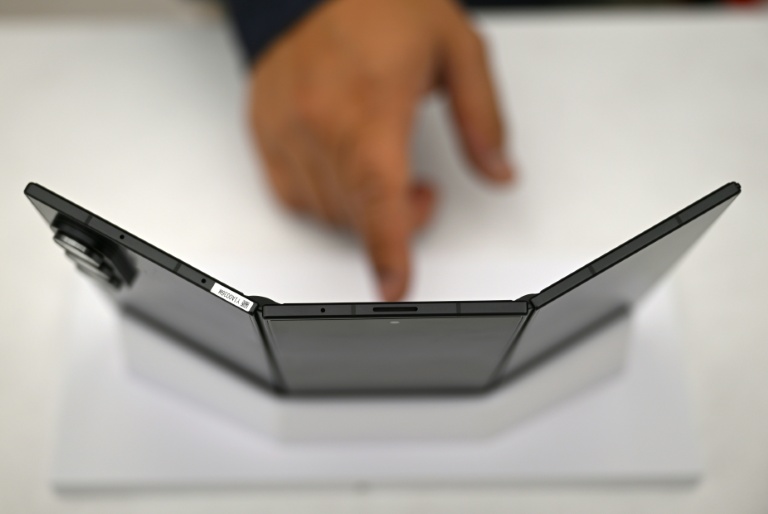

Still, National Australia Bank’s Rodrigo Catril said Ueda also mentioned the need “to confirm the momentum of initial moves toward next year’s annual spring labour-management wage negotiations.” He said that “implies that the December meeting may be too soon to have a good understanding of the wage momentum for next year.” South Korean tech titan Samsung Electronics surged more than two percent in Seoul as it launched its first triple-folding phone, even as the device’s more than $2,400 price tag places it out of reach for the average customer.

– Key figures at around 0815 GMT –

Tokyo – Nikkei 225: FLAT at 49,303.45 (close)

Hong Kong – Hang Seng Index: UP 0.2 percent at 26,095.05 (close)

Shanghai – Composite: DOWN 0.4 percent at 3,897.71 (close)

London – FTSE 100: DOWN 0.1 percent at 9,697.50

Dollar/yen: UP at 155.81 yen from 155.50 yen on Monday

Euro/dollar: UP at $1.1614 from $1.1608

Pound/dollar: UP at $1.3212 from $1.3211

Euro/pound: UP at 87.91 pence from 87.87 pence

West Texas Intermediate: UP 0.1 percent at $59.37 per barrel

Brent North Sea Crude: FLAT at $63.16 per barrel

New York – Dow: DOWN 0.9 percent at 47,289.33 (close)

© 2024 AFP